Saudi Arabia Biometrics Market (2018-2024) | Size, Analysis, Industry, Companies, Revenue, Share, Outlook, Trends, Growth, Value & Forecast

Market Forecast By Technology (Fingerprint, Facial, Iris, Hand/Palm, Multimodal, Voice, Vein, and Other Biometrics), By Applications (Time & Attendance, Access control, and Record-Keeping), By Verticals (Government & Transportation, Healthcare & Hospitality, Commercial Office, Industry & Manufacturing, Retail & Logistics, Education Institutions and Banking & Financial Institutions), By Regions (Eastern, Western, Central and Southern) and Competitive Landscape

| Product Code: ETC000493 | Publication Date: Jan 2022 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 130 | No. of Figures: 74 | No. of Tables: 12 | |

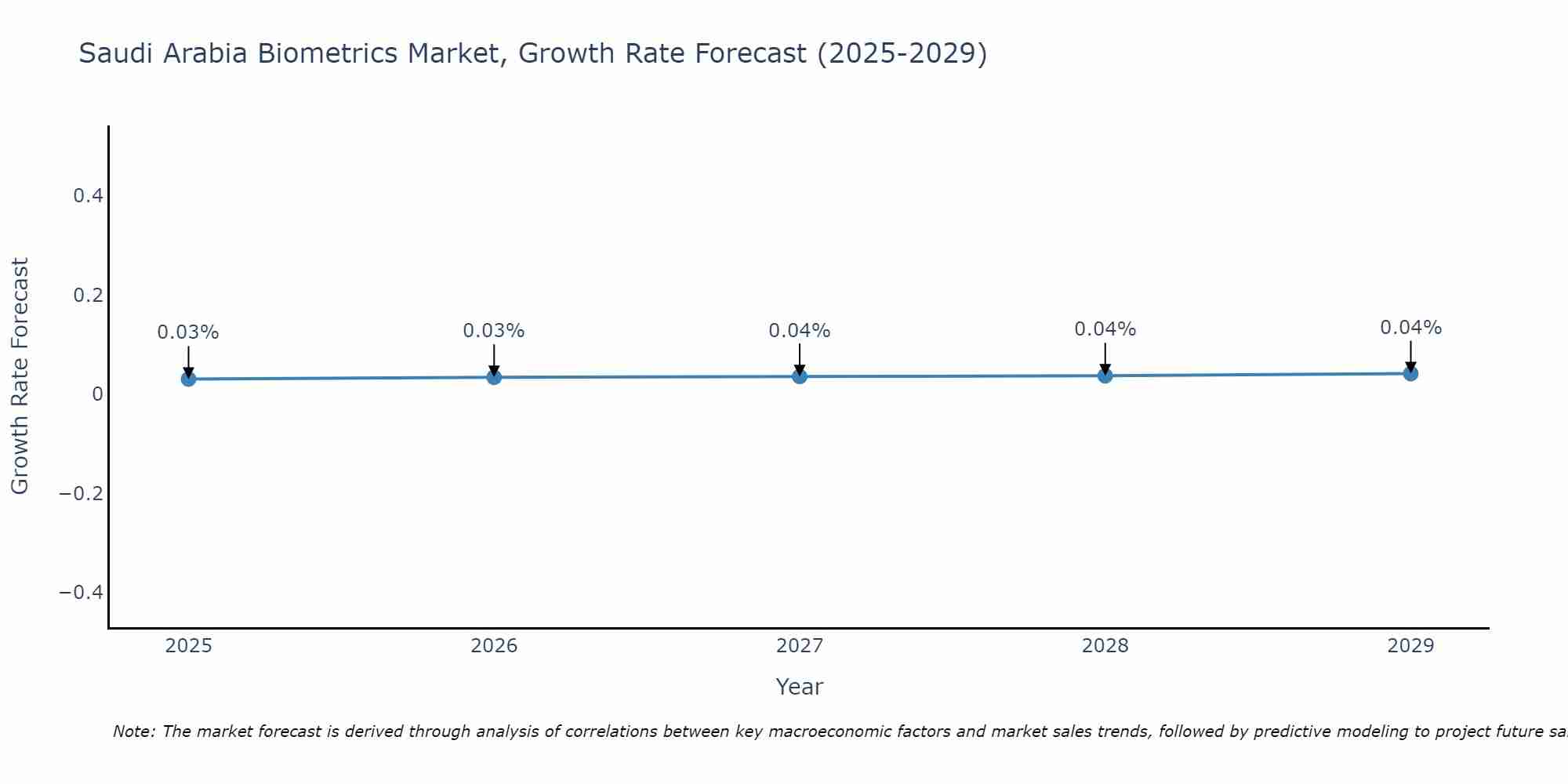

Saudi Arabia Biometrics Market Size Growth Rate

The Saudi Arabia Biometrics Market is likely to experience consistent growth rate gains over the period 2025 to 2029. From 0.03% in 2025, the growth rate steadily ascends to 0.04% in 2029.

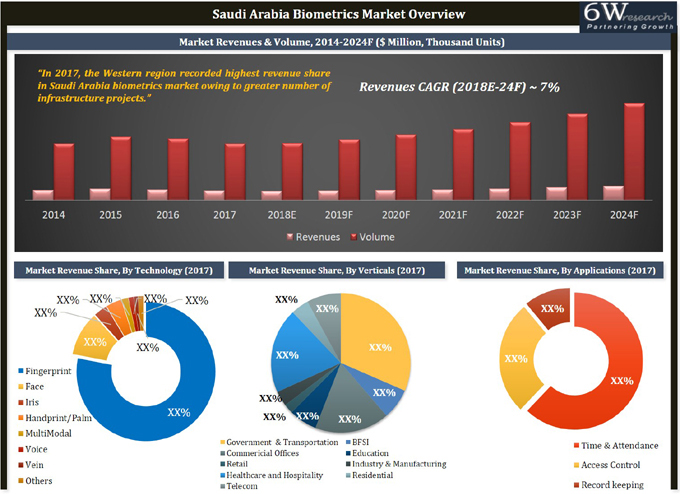

Saudi Arabia biometrics market recorded a downfall in demand during 2014-16, particularly due to deteriorating economic conditions on account of a decline in oil prices, resulting in a drop in government spending towards the biometrics solutions in the country. However, the market is anticipated to bounce back with the recovery of oil prices post 2017. Additionally, growing security concerns and increasing crime rate in the Saudi Arabia region are expected to further contribute to the Saudi Arabia Biometrics Market Revenue.

According to 6Wresearch, Saudi Arabia biometrics market is projected to cross $52.9 million by 2024. Projected growth in the construction market, upcoming projects on hotels & shopping malls, coupled with increasing inflow of FDI in the construction and retail sectors are expected to emerge as the key driving factors for the Saudi Arabia Biometrics market growth. In terms of technology, the fingerprint recognition segment accounted for a majority of the market revenue share, owing to the availability of supporting infrastructure and increasing installation in the government & transportation vertical.

Amongst all verticals, government & transportation acquired the highest revenue share in the Saudi Arabia Biometrics Market Share in 2017. Over the next six years, hospitality & healthcare, and education verticals are anticipated to record the highest growth on account of an increasing number of hotels, and higher penetration of biometrics attendance solutions in educational institutions.

In the Saudi Arabia region, the Central region recorded a major share in biometrics system revenues on the back of increasing infrastructure development activities, especially in the commercial vertical. Additionally, during the forecast period, the Central region is expected to lead the market owing to the rapid development of IT parks and SEZs (Special Economic Zones) in Riyadh.

The report thoroughly covers the Arabia biometrics market by types, technology, applications, verticals, and regions. The report provides an unbiased and detailed analysis of the ongoing trends, opportunities/ high growth areas, market drivers, which would help stakeholders to device and align market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Market Size & Forecast of Global Biometrics Revenues & Volume until 2024

• Market Size & Forecast of Saudi Arabia Biometrics Revenues & Volume Market until 2024

• Market Size & Forecast of Saudi Arabia Fingerprint Biometrics Revenues & Volume Market until 2024

• Market Size & Forecast of Saudi Arabia Face Recognition Biometrics Revenues & Volume Market until 2024

• Market Size & Forecast of Saudi Arabia Iris Biometrics Revenues & Volume Market until 2024

• Market Size & Forecast of Saudi Arabia Hand/Palm Print Biometrics Revenues & Volume Market until 2024

• Market Size & Forecast of Saudi Arabia Multimodal Biometrics Revenues & Volume Market until 2024

• Market Size & Forecast of Saudi Arabia Voice Biometrics Revenues & Volume Market until 2024

• Market Size & Forecast of Saudi Arabia Vein Biometrics Revenues & Volume Market until 2024

• Historical data and Forecast of Saudi Arabia Biometrics Market, By Verticals

• Historical data and Forecast of Saudi Arabia Biometrics Market, By Regions

• Historical data and Forecast of Saudi Arabia Biometrics Market, By Technology

• Market Drivers and Restraints, Market Trends and Industry Life Cycle

• Value Chain Analysis and Porter's Five Forces Analysis

• Competitive Landscape (Player's Revenue Share and Competitive Benchmarking)

• Company Profiles and Key Strategic Pointers

Markets Covered

The report provides a detailed analysis of the following market segments:

• By Technologies:

o Fingerprint

o Facial

o Iris

o Hand/Palm

o Multimodal

o Voice

o Vein

o Other Biometrics

• By Applications:

o Time & Attendance

o Access control

o Record Keeping

• By Verticals:

o Government & Transportation

o Healthcare & Hospitality

o Commercial Office

o Industry & Manufacturing

o Retail & Logistics

o Education Institutions

o Banking & Financial Institutions

• By Regions:

o Eastern

o Western

o Central

o Southern

Frequently Asked Questions About the Market Study (FAQs):

1. Executive Summary

2. Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumptions

3. Global Biometrics Market Overview

3.1 Global Biometrics Market Revenues (2014-2024F)

3.2 Global Biometrics Market Revenue Share - By Region

4. Saudi Arabia Biometrics Market Overview

4.1 Saudi Arabia Biometrics Market Revenues (2015-2024F)

4.2 Saudi Arabia Biometrics Market Volume (2015-2024F)

4.3 Saudi Arabia Biometrics Market, Industry Life Cycle

4.4 Saudi Arabia Biometrics Market, Opportunity Matrix

4.5 Saudi Arabia Biometrics Market, Porters Five Forces

4.6 Saudi Arabia Biometrics Market Revenue Share, By Verticals

4.7 Saudi Arabia Biometrics Market Revenue Share, By Types

4.8 Saudi Arabia Biometrics Market Revenue Share, By Regions

5. Saudi Arabia Biometrics Market Dynamics

5.1 Impact Analysis

5.2 Market Drivers

5.3 Market Restraints

6. Saudi Arabia Biometrics Market Trends

7. Saudi Arabia Biometrics Market Overview, By Applications

7.1 Saudi Arabia Biometrics Market Revenues, By Time & Attendance (2014-2024F)

7.2 Saudi Arabia Biometrics Market Revenues, By Access Control (2014-2024F)

7.3 Saudi Arabia Biometrics Market Revenues, By Record-Keeping (2014-2024F)

8. Saudi Arabia Fingerprint Recognition Market Overview

8.1 Saudi Arabia Fingerprint Biometrics Market Revenues & Volume (2014-2024F)

8.2 Saudi Arabia Fingerprint Biometrics Market Revenue Share (2017 & 2024F)

8.3 Saudi Arabia Fingerprint Biometrics Market Price Trend (2014-2024F)

9. Saudi Arabia Facial Recognition Market Overview

9.1 Saudi Arabia Facial Recognition Market Revenues & Volume (2014-2024F)

9.2 Saudi Arabia Facial Recognition Market Revenue Share (2017 & 2024F)

9.3 Saudi Arabia Facial Recognition Market Price Trend (2014-2024F)

10. Saudi Arabia IRIS Recognition Market Overview

10.1 Saudi Arabia IRIS Recognition Market Revenues & Volume (2014-2024F)

10.2 Saudi Arabia IRIS Recognition Market Revenue Share (2017 & 2024F)

10.3 Saudi Arabia IRIS Recognition Market Price Trend (2014-2024F)

11. Saudi Arabia Hand/Palm Recognition Market Overview

11.1 Saudi Arabia Hand/Palm Recognition Market Revenues & Volume (2014-2024F)

11.2 Saudi Arabia Hand/Palm Recognition Market Revenue Share (2017 & 2024F)

11.3 Saudi Arabia Hand/Palm Recognition Market Price Trend (2014-2024F)

12. Saudi Arabia Multimodal Recognition Market Overview

12.1 Saudi Arabia Multimodal Biometrics Market Revenues & Volume (2014-2024F)

12.2 Saudi Arabia Multimodal Biometrics Market Revenue Share (2017 & 2024F)

12.3 Saudi Arabia Multimodal Biometrics Market Price Trend (2014-2024F)

13. Saudi Arabia Voice Recognition Market Overview

13.1 Saudi Arabia Voice Recognition Market Revenues & Volume (2014-2024F)

13.2 Saudi Arabia Voice Recognition Market Revenue Share (2017 & 2024F)

13.3 Saudi Arabia Voice Recognition Market Price Trend (2014-2024F)

14. Saudi Arabia Vein Recognition Market Overview

14.1 Saudi Arabia Vein Recognition Market Revenues & Volume (2014-2024F)

14.2 Saudi Arabia Vein Recognition Market Revenue Share (2017 & 2024F)

14.3 Saudi Arabia Vein Recognition Market Price Trend (2014-2024F)

15. Saudi Arabia Other Biometrics Recognition Market Overview

15.1 Saudi Arabia Other Biometrics Recognition Market Revenues & Volume (2014-2024F)

15.2 Saudi Arabia Other Biometrics Recognition Market Revenue Share (2017 & 2024F)

16. Saudi Arabia Biometrics Market Overview, By Verticals

16.1 Saudi Arabia Biometrics Market Revenues, By BFSI (2014-2024F)

16.2 Saudi Arabia Biometrics Market Revenues, By Government & Transportation (2014-2024F)

16.3 Saudi Arabia Biometrics Market Revenues, By Retail (2014-2024F)

16.4 Saudi Arabia Biometrics Market Revenues, By Commercial Offices (2014-2024F)

16.5 Saudi Arabia Biometrics Market Revenues, By Industrial & Manufacturing (2014-2024F)

16.6 Saudi Arabia Biometrics Market Revenues, By Residential (2014-2024F)

16.7 Saudi Arabia Biometrics Market Revenues, By Hospitality & Healthcare (2014-2024F)

16.8 Saudi Arabia Biometrics Market Revenues, By Telecommunications (2014-2024F)

17. Saudi Arabia Biometrics Market Overview, By Regions

17.1 Saudi Arabia Central and Southern Region Biometrics Market Revenues (2014-2024F)

17.2 Saudi Arabia Western and Eastern Region Biometrics Market Revenues (2014-2024F)

18. Competitive Landscape

18.1 Saudi Arabia Biometrics Market Players Revenues Share (2017)

18.2 Competitive Benchmarking, By Operating Parameters

19. Company Profiles

19.1 3M

19.2 Assa Abloy

19.3 M2SYS Inc.

19.4 NEC Corporation

19.5 Suprema Inc.

19.6 Precise Biometrics

19.7 Aware LLC

19.8 Morpho SA

19.9 ZK Technology

20. Key Strategic Pointers

21. Disclaimer

List of Figures

1. Evolution of Biometrics System (1858-2011)

2. Global Biometrics Market Revenues, 2014E-2024F ($ Billion)

3. Top Five Countries Biometrics Market Revenue Share ( 2017)

4. Global Biometrics Market Revenue Share, By Regions (2017)

5. Saudi Arabia Biometrics Market Revenues, 2014-2024F ($ Million)

6. Saudi Biometrics Market Volume, 2015-2024F (Thousand Units)

7. Saudi Arabia Biometrics Market Revenue Share, By Verticals (2017 & 2024F)

8. Saudi Arabia Biometrics Market Revenue Share, By Technology (2017 & 2024F)

9. Saudi Arabia Biometrics Market Revenue Share, By Regions (2017 & 2024F)

10. Saudi Arabia Vein Biometrics Market Revenues, $ Millions (2014-2024F)

11. Smartphone Sales, Million Units , KSA (2014-2024F)

12. Saudi Arabia Biometrics Market Revenues, By Time & Attendance Application (2014-2024F )

13. Saudi Arabia Biometrics Market Revenues, By Access Control Application (2014-2024F )

14. Saudi Arabia Biometrics Market Revenue, By Record Keeping Application (2014-2024F )

15. Saudi Arabia Fingerprint Biometrics Market Revenues, 2014-2024F ($ Million)

16. Saudi Arabia Fingerprint Biometrics Market Volume, 2014-2024F (Thousand Units)

17. Saudi Fingerprint Biometrics Market Revenue Share (2017)

18. Saudi Fingerprint Biometrics Market Revenue Share (2024F)

19. Saudi Arabia Fingerprint Biometrics Price Trend, 2014-2024F ($ Per Unit)

20. Saudi Arabia Facial Recognition Market Revenues, 2014-2024F ($ Million)

21. Saudi Arabia Face Recognition Market Volume, 2014-2024F (Thousand Units)

22. Saudi Facial Recognition Biometrics Market Revenue Share (2017)

23. Saudi Facial Recognition Biometrics Market Revenue Share (2024F)

24. Saudi Arabia Facial Recognition Price Trend, 2014-2024F ($ Per Unit)

25. Saudi Arabia Iris Recognition Market Revenues, 2014-2024F ($ Million)

26. Saudi Arabia Iris Biometrics Market Volume, 2014-2024F (Thousand Units)

27. Saudi Iris Recognition Biometrics Market Revenue Share (2017)

28. Saudi Iris Biometrics Recognition Market Revenue Share (2024F)

29. Saudi Arabia Iris Recognition Price Trend, 2014-2024F ($ Per Unit)

20. Saudi Arabia Hand/Palm Recognition Market Revenues, 2014-2024F ($ Million)

31. Saudi Arabia Hand/Palm Recognition Market Volume, 2014-2024F (Thousand Units)

32. Saudi Hand/Palm Biometrics Market Revenue Share (2017)

33. Saudi Hand/Palm Biometrics Market Revenue Share (2024F)

34. Saudi Arabia Hand/Palm Recognition Price Trend, 2014-2024F ($ Per Unit)

35. Saudi Arabia Multi Modal Biometrics Market Revenues, 2014-2024F ($ Million)

36. Saudi Arabia Multi Modal Biometrics Market Volume, 2014-2024F (Thousand Units)

37. Saudi Multi Modal Biometrics Market Revenue Share (2017)

38. Saudi Fingerprint Multi Modal Market Revenue Share (2024F)

39. Saudi Arabia Multi Modal Biometrics Price Trend, 2014-2024F ($ Per Unit)

40. Saudi Arabia Voice Recognition Market Revenues, 2014-2024F ($ Million)

41. Saudi Arabia Voice Recognition Market Volume, 2014-2024F (Thousand Units)

42. Saudi Arabia Voice Recognition Biometrics Market Revenue Share (2017)

43. Saudi Arabia Voice Recognition Biometrics Market Revenue Share (2024F)

44. Saudi Arabia Voice Recognition Price Trend, 2014-2024F ($ Per Unit)

45. Saudi Arabia Vein Recognition Market Revenues, 2014-2024F ($ Million)

46. Saudi Arabia Vein Recognition Market Volume, 2014-2024F (Thousand Units)

47. Saudi Arabia Vein Biometrics Market Revenue Share (2017)

48. Saudi Arabia Vein Biometrics Market Revenue Share (2024F)

49. Saudi Arabia Vein Recognition Price Trend, 2014-2024F ($ Per Unit)

50. Saudi Arabia Other Biometric Recognition Market Revenues, 2014-2024F ($ Million)

51. Saudi Arabia Other Biometrics Recognition Market Volume, 2014-2024F (Thousand Units)

52. Saudi Others Biometrics Market Revenue Share (2017)

53. Saudi Others Biometrics Market Revenue Share (2024F)

54. Saudi Arabia BFSI Biometrics Market Revenues, 2014-2024F ($ Million)

55. Saudi Arabia Bank ATMs Per 100 Thousand People (2014-2018E)

56. No of Bank Branches Per 100 Thousand People in Saudi Arabia (2011-2017)

57. Saudi Arabia BFSI Biometrics Market Revenues, 2014-2024F ($ Million)

58. Saudi Arabia Government & Transportation Biometrics Market Revenues, 2014-2024F ($ Million)

59. Saudi Arabia Retail Biometrics Market Revenues, 2014-2024F ($ Million)

60. Saudi Arabia Retail Coverage, 2015-2019F (Million sq. m)

61. Saudi Arabia Commercial Offices Biometrics Market Revenues, 2014-2024F ($ Million)

62. Saudi Arabia Commercial Offices Unit 2014-2019F (Million sq. m)

63. Saudi Arabia Industrial Biometrics Market Revenues, 2014-2024F ($ Million)

64. Saudi Arabia Residential Biometrics Market Revenues, 2014-2024F ($ Million)

65. Saudi Arabia Residential Unit 2014-2019F (Thousand Units)

66. Saudi Arabia Hospitality & Healthcare Biometrics Market Revenues, 2014-2024F ($ Million)

67. Saudi Arabia Number of Hotel Rooms 2013-2018F (Per Thousand Keys)

68. Saudi Arabia Educational Institutions Biometrics Market Revenues, 2014-2024F ($ Million)

69. Saudi Arabia Central Region Biometrics Market Revenues, 2014-2024F ($ Million)

70. Saudi Arabia Southern Region Biometrics Market Revenues, 2015-2024F ($ Million)

71. Saudi Arabia Western Region Biometrics Market Revenues, 2014-2024F ($ Million)

72. Saudi Arabia Eastern Region Biometrics Market Revenues, 2014-2024F ($ Million)

73. Saudi Arabia Biometrics Market Revenue, By Companies, 2017 ($ Million)

74. Saudi Arabia Biometrics Market Revenue Share, By Companies (2017)

List of Tables

1. Saudi Arabia Construction Industry Revenues (2017-2024F)

2. Comparison of Biometrics Accuracy (By Technology)

3. Saudi Arabia Transportation Sector Key Construction Projects (2017)

4. Saudi Arabia Commercial Offices Sector Major Construction Projects (2017)

5. Saudi Arabia Residential Sector Major Construction Projects (2017)

6. Saudi Arabia Hospitality & Healthcare Sector Major Construction Projects (2017)

7. 3M Co. Financial Statement, 2014-17 ($ Million)

8. M2SYS Technology LLC Notable Projects (2012-15)

9. Suprema Inc. Financial Statement, 2014-17 ($ Million)

10. Precise Biometrics AB Financial Statement, 2014-16 ($ Million)

11. Aware Inc. Financial Statement, 2014-2016 ($ Million)

12. Safran Sa Financial Statement, 2014-2017 ($ Billion)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero