Saudi Arabia Diesel Genset Market (2021-2027) | Size, Share, Outlook, Growth, Analysis, Value, Industry, Trends, Revenue, Segmentation & COVID-19 IMPACT

Market Forecast By KVA Rating (5-75 KVA, 75.1 KVA-375 KVA, 375.1 KVA-750 KVA, 750.1 KVA-1000 KVA And Above 1000 KVA), By Applications (Residential, Commercial, Industrial, Transportation & Public Infrastructure), By Regions (Northern, Southern) and Competitive Landscape

| Product Code: ETC054923 | Publication Date: May 2021 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 101 | No. of Figures: 31 | No. of Tables: 12 | |

Saudia Arabia Diesel Genset Market | Country-Wise Share and Competition Analysis

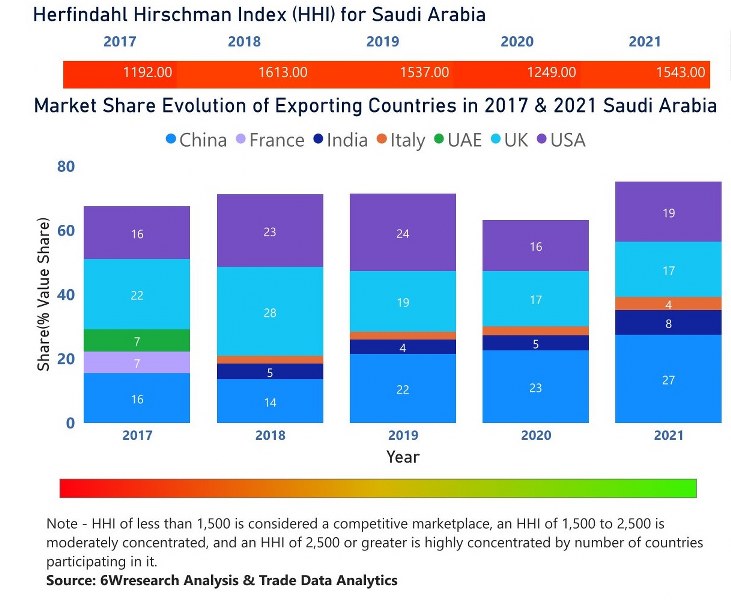

In the year 2021, China was the largest exporter in terms of value, followed by the USA. It has registered a decline of -16.19% over the previous year. While the USA registered a decline of -18.45% as compared to the previous year. In the year 2017, the UK was the largest exporter followed by the USA. In terms of Herfindahl Index, which measures the competitiveness of countries exporting, Saudi Arabia has a Herfindahl index of 1192 in 2017 which signifies high competitiveness also in 2021 it registered a Herfindahl index of 1543 which signifies moderately concentrated in the market.

![Saudi Arabia Brazil Diesel Genset Market | Country-Wise Share and Competition Analysis]() Saudi Arabia Diesel Genset Market - Export Market Opportunities

Saudi Arabia Diesel Genset Market - Export Market Opportunities![Saudi Arabia Diesel Genset Market - Export Market Opportunities]()

Topics Covered In the Saudi Arabia Diesel Genset (Generator) Market

Saudi Arabia Diesel Genset Market report comprehensively covers the diesel Genset market by kVA ratings, applications, and regions. The report provides an unbiased and detailed analysis of the diesel Genset market ongoing trends, opportunities, high growth areas, market drivers, and market share by companies which would help the stakeholders to devise and align their market strategies to the current and future market dynamics.

Latest Development (2023) of the Saudi Arabia Diesel Genset (Generator) Market

Saudi Arabia Diesel Genset (Generator) Market is witnessing significant growth in recent years. Diesel generators have emerged as an important power source in the commercial and residential domain and due to this, the demand for electricity has increased. The remote area and the construction sites are witnessing a major demand for electricity. There is an increase in focus on technological advancement to reduce the carbon footprint and improve the efficiency of the machines. The need for sustainable energy sources is the latest trend that is shaping the market. The manufacturers are also focusing on providing customized based solutions to cater to the needs of different industries. There is a requirement for the different types of gensets by different industries. There are various key players in the market who are trying to stay competitive in the market by investing heavily in the research and development domain. The future of the market is bright as the companies are developing new technologies.

Saudi Arabia Diesel Genset Market Synopsis

Saudi Arabia Diesel Genset Market is anticipated to witness notable growth during the forecast period. The outburst of coronavirus in has adversely affected the diesel genset market in 2020 as the Saudi Arabian government imposed a nationwide lockdown has led to the closure of all construction operations and disrupted the demand and supply of diesel genset systems. The majority of the demand for diesel gensets in Saudi Arabia could be witnessed in verticals such as commercial, industrial, and transportation. The growing electricity demand supported by the government’s aim to diversify the economy from oil to non-oil sectors along with the rising number of upcoming infrastructure projects such as the Neom City, the Red Sea Project, Amaala, GCC Railway Project, Waterfront Infrastructure Facilities Project - Phase II, and Medina Metro Project are the key factors, which would drive the market for diesel gensets in Saudi Arabia in the coming years.

The outburst of coronavirus has adversely impacted the country’s Diesel Generator market in 2020 as the government-imposed nationwide lockdown has led to the closure of all construction operations and disrupted the demand and supply of diesel gensets. However, the market is expected to recover post the pandemic.

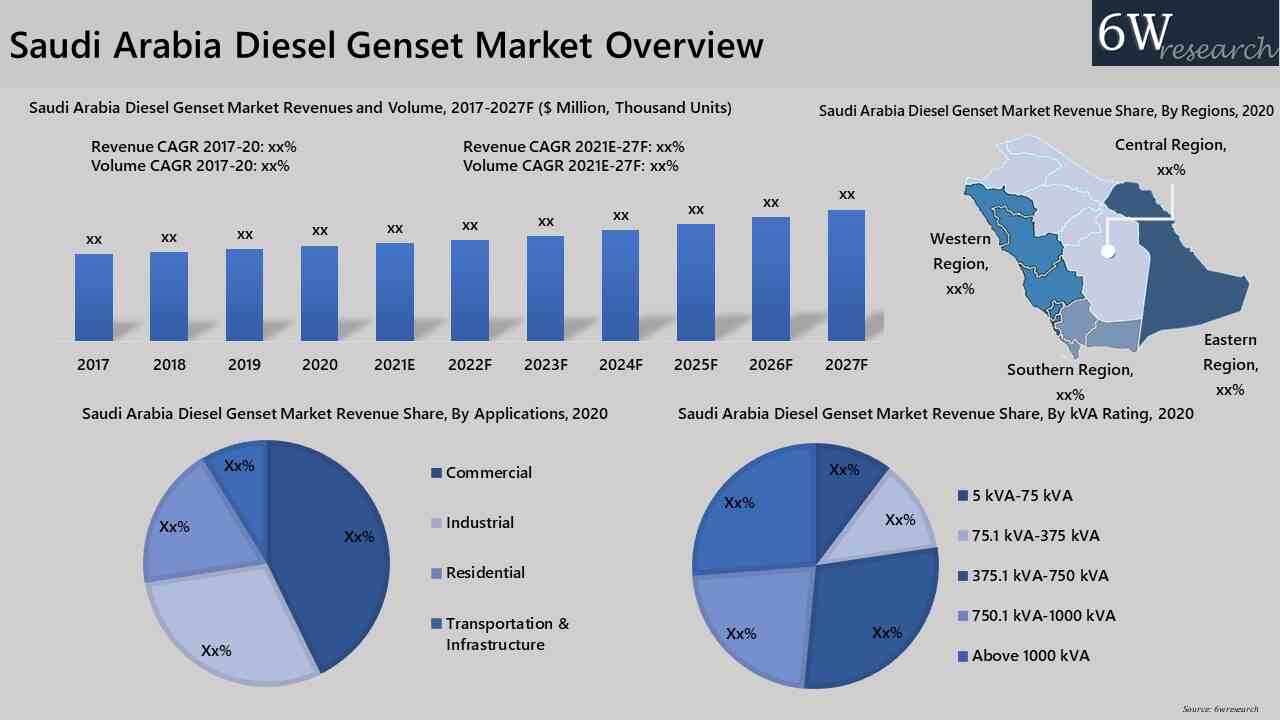

According to 6Wresearch, Saudi Arabia Diesel Genset Market size is projected to grow at a CAGR of 3.1% during 2021-27. Attributed to the presence of a robust industrial sector in Saudi Arabia along with a rapidly growing automotive sector, the diesel gen-sets market in the country accounted for a major share in the market. However, the market is projected to exhibit highest growth rate on account of flourishing construction and industrial segments providing immense opportunities for the diesel gensets demand in the country during the forecast period. Further, the Saudi Arabia Vision 2030 and the National Transformation Programme 2020 are a few of the government initiatives, which aim at developing and strengthening public service sectors such as healthcare, education, infrastructure, and tourism, creating a huge demand for power backup equipment for the developmental activities, leading to a surge in demand for Diesel Genset Market in Saudi Arabia.

Market Analysis by kVA Rating

In terms of kVA ratings, 375.1kVA - 750kVA diesel gensets have emerged as a major shareholder in the Generator Market in 2020, owing to their major deployment as power backup systems in the industrial and logistics sector. Moreover, Saudi Arabia National Development and Logistics Program is expected to attract a huge amount of investment of around $500 billion by 2030 in manufacturing, logistics, and industrial sectors, thereby driving the demand for diesel genset in the coming years and leading to an increase in the growth of DG Market.

Market Analysis by Application

According to Ravi Bhandari, Research Head, 6Wresearch, the industrial sector has emerged as a major market shareholder in terms of revenue in Genset Market in 2020, and the same trend is anticipated to persist over the coming years. The segment is also expected to witness the highest revenues and volume growth in the forthcoming period owing to factors such as the government's focus on industrial development, including implementation of the required infrastructure, construction of Jubail and Yanbu industrial cities as well as other industrial cities in various regions of the country.

COVID-19 Impact on Saudi Arabia Diesel Genset (Generator) Market

The pandemic disturbed the global economy, including the Saudi Arabia Diesel Genset Industry. There was the implementation of the lockdown and the restriction measures and this led to close down of businesses or forced the businesses to function at a reduced capacity. The construction industry is the major consumer of diesel gensets and it was heavily impacted by the pandemic as there was delay in the projects and disruptions in the supply chain. There was less requirement for power backup as more people started working from home. There were still opportunities for growth in the market due to expansion in the healthcare industry. The need for reliable sources increased during critical times as healthcare needed to upgrade its instruments and infrastructure.

Saudi Arabia Diesel Genset (Generator) Market: Key Players

These are the key players in the market who are producing different kinds of Gensets (Generators) to cater to the needs of the consumers.

- Caterpillar Inc.

- Cummins Inc.

- Kohler Co.

- Atlas Copco AB

- Wärtsilä Corporation

- Generac Power Systems, Inc.

- Himoinsa S.L.

- Yanmar Holdings Co., Ltd.

- Mitsubishi Heavy Industries, Ltd.

- AKSA Power Generation

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia Diesel Genset Market Overview

- Saudi Arabia Diesel Genset Market Outlook

- Saudi Arabia Diesel Genset Market Forecast

- Historical Data of Saudi Arabia Diesel Genset Market Revenues and Volume for the Period 2017-2020

- Market Size & Forecast of Saudi Arabia Diesel Genset Market Revenues and Volume until 2027

- Historical Data of Saudi Arabia Diesel Genset Market Revenues and Volume, By kVA Ratings for the Period 2017-2020.

- Market Size & Forecast of Saudi Arabia Diesel Genset Market Revenues and Volume, By kVA Ratings until 2027

- Historical Data of Saudi Arabia Diesel Genset Market Revenues, By Applications for the Period 2017-2020.

- Market Size & Forecast of Saudi Arabia Diesel Genset Market Revenues, By Applications until 2027

- Historical Data of Saudi Arabia Diesel Genset Market Revenues, By Regions for the Period 2017-2020.

- Market Size & Forecast of Saudi Arabia Diesel Genset Market Revenues, By Regions until 2027

- Saudi Arabia Diesel Genset Market Drivers and Restraints

- Saudi Arabia Diesel Genset Market Trends

- Saudi Arabia Diesel Genset Market Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Saudi Arabia Diesel Genset Market Revenues Share, By Players

- Saudi Arabia Diesel Genset Market Overview on Competitive Benchmarking

- Key Strategic Recommendations

Market Scope and Segmentation

Thereport provides a detailed analysis of the following market segments:

By KVA Rating

- 5-75 KVA

- 75.1 KVA-375 KVA

- 375.1 KVA-750 KVA

- 750.1 KVA-1000 KVA

- Above 1000 KVA

By Applications

- Residential

- Commercial

- Industrial

- Transportation & Public Infrastructure

By Regions

- Northern

- Southern

Saudi Arabia Diesel Genset Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of The Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Saudi Arabia Diesel Genset Market Overview |

| 3.1. Saudi Arabia Diesel Genset Market Revenues & Volume, 2017-2027F |

| 3.2. Saudi Arabia Diesel Genset Market Revenues & Volume Shares, By Countries 2020 & 2027F |

| 3.2.1 Saudi Arabia Diesel Genset Market Revenues & Volume, By Countries 2017-2027F |

| 4. Saudi Arabia Diesel Genset Market Overview |

| 4.1. Saudi Arabia Diesel Genset Market Revenues & Volume, 2017-2027F |

| 4.2. Saudi Arabia Diesel Genset Market - Industry Life Cycle, 2020 |

| 4.3. Saudi Arabia Diesel Genset Market - Porter’s Five Forces |

| 4.4. Saudi Arabia Diesel Genset Market Revenues Share, By Regions, 2020 & 2027F |

| 5. Saudi Arabia Diesel Genset Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.2.1 Increasing demand for reliable backup power solutions in Saudi Arabia |

| 5.2.2 Growth in construction and infrastructure development projects in the region |

| 5.2.3 Expansion of industrial sector driving the need for continuous power supply |

| 5.3. Market Restraints |

| 5.3.1 Fluctuating fuel prices impacting the operational costs of diesel gensets |

| 5.3.2 Stringent emission regulations leading to higher compliance costs |

| 5.3.3 Competition from alternative power generation technologies like solar and wind energy |

| 6. Saudi Arabia Diesel Genset Market Trends |

| 7. Saudi Arabia Diesel Genset Market Overview, By kVA Ratings |

| 7.1. Saudi Arabia Diesel Genset Market Revenues Share, By kVA Ratings, 2020 & 2027F |

| 7.2. Saudi Arabia Diesel Genset Market Volume Share, By kVA Ratings, 2020 & 2027F |

| 7.3. Saudi Arabia Diesel Genset Market Revenues & Volume, By kVA Ratings, 2017-2027F |

| 7.3.1. Saudi Arabia Up to 75 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F |

| 7.3.2. Saudi Arabia 75.1-375 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F |

| 7.3.3. Saudi Arabia 375.1-750 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F |

| 7.3.4. Saudi Arabia 750.1-1000 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F |

| 7.3.5. Saudi Arabia Above 1000 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F |

| 8. Saudi Arabia Diesel Genset Market Overview, By Applications |

| 8.1. Saudi Arabia Diesel Genset Market Revenues Share, By Applications, 2020 & 2027F |

| 8.1.1. Saudi Arabia Diesel Genset Market Revenues, By Commercial Application, 2017-2027F |

| 8.1.2. Saudi Arabia Diesel Genset Market Revenues, By Industrial Application, 2017-2027F |

| 8.1.3. Saudi Arabia Diesel Genset Market Revenues, By Residential Application, 2017-2027F |

| 8.1.4. Saudi Arabia Diesel Genset Market Revenues, By Transportation & Infrastructure Application, 2017-2027F |

| 9. Saudi Arabia Diesel Genset Market Overview, By Regions |

| 9.1. Saudi Arabia Diesel Genset Market Revenues, By Eastern Region, 2017-2027F |

| 9.2. Saudi Arabia Diesel Genset Market Revenues, By Western Region, 2017-2027F |

| 9.3. Saudi Arabia Diesel Genset Market Revenues, By Central Region, 2017-2027F |

| 9.4. Saudi Arabia Diesel Genset Market Revenues, By Southern Region, 2017-2027F |

| 10. Saudi Arabia Diesel Genset Market – Key Performance Indicators |

| 10.1 Average utilization rate of diesel gensets in Saudi Arabia |

| 10.2 Number of new construction permits issued in the region |

| 10.3 Percentage of industrial sector growth in Saudi Arabia |

| 11. Saudi Arabia Diesel Genset Market Import Statistics |

| 11.1. Saudi Arabia Up to 75 kVA Diesel Gensets Import, By Country, 2019 |

| 11.2. Saudi Arabia 75.1 - 375 kVA Diesel Gensets Import, By Country, 2019 |

| 11.3. Saudi Arabia Above 375 kVA Diesel Gensets Import, By Country, 2019 |

| 12. Saudi Arabia Diesel Genset Market Opportunity Assessment |

| 12.1. Saudi Arabia Diesel Genset Market Opportunity Assessment, By kVA Ratings, 2027F |

| 12.2. Saudi Arabia Diesel Genset Market Opportunity Assessment, By Applications, 2027F |

| 13. Saudi Arabia Diesel Genset Market Competitive Landscape |

| 13.1. Saudi Arabia Diesel Genset Market Competitive Benchmarking, By Technical Parameters |

| 13.2. Saudi Arabia Diesel Genset Market Competitive Benchmarking, By Operating Parameters |

| 13.3. Saudi Arabia Diesel Genset Market Revenues Share, By Company, 2020 |

| 14. Company Profiles |

| 14.1. Atlas Copco Industrial Equipment Co. |

| 14.2. Caterpillar Inc. |

| 14.3. Cummins Inc. |

| 14.4. Aksa Power Generation |

| 14.5. Alkhorayef Group |

| 14.6. Kirloskar Oil Engines Limited |

| 14.7. Saudi Diesel Equipment Co. Ltd. |

| 14.8. Yanmar Holdings Co. Ltd. |

| 14.9. Kohler Co. |

| 14.10. MTU Onsite Energy Corporation |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

| List of Figures |

| 1. Middle East and Africa Diesel Genset Market Revenues and Volume, 2017-2027F ($ Billion, Thousand Units) |

| 2. Middle East and Africa Diesel Genset Market Revenues Share, By Countries, 2020 & 2027F |

| 3. Middle East and Africa Diesel Genset Market Volume Share, By Countries, 2020 & 2027F |

| 4. Saudi Arabia Diesel Genset Market Revenues and Volume, 2017-2027F ($ Million, Thousand Units) |

| 5. Saudi Arabia Diesel Genset Market Revenue Share, By Regions, 2020 & 2027F |

| 6. Saudi Arabia Office Supply Space, Q2 2020-2022F (Million Sq.mt. GLA) |

| 7. Saudi Arabia Retail Supply Stock, Q2 2020-2022F (Million Sq. mt. GLA) |

| 8. Saudi Arabia Residential Supply Stock, Q2 2020-2022F (Million Units) |

| 9. Saudi Arabia Power Generation Capacity (GW) |

| 10. GHG Emissions Per Capita (2019) in Metric Tons |

| 11. Saudi Arabia Energy-Related CO2 Emissions Share, 2020 |

| 12. Saudi Arabia Diesel Genset Market Revenues Share, By kVA Ratings, 2020 & 2027F |

| 13. Saudi Arabia Diesel Genset Market Volume Share, By kVA Ratings, 2020 & 2027F |

| 14. Saudi Arabia Up to 75 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| 15. Saudi Arabia 75.1- 375 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| 16. Saudi Arabia 375.1- 750 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| 17. Saudi Arabia 750.1-1000 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| 18. Saudi Arabia Above 1000 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| 19. Saudi Arabia Diesel Genset Market Revenues Share, By Applications, 2020 & 2027F |

| 20. Saudi Arabia Diesel Genset Market Revenues, By Eastern Region, 2017–2027F ($ Million) |

| 21. Saudi Arabia Diesel Genset Market Revenues, By Western Region, 2017–2027F ($ Million) |

| 22. Saudi Arabia Diesel Genset Market Revenues, By Central Region, 2017–2027F ($ Million) |

| 23. Saudi Arabia Diesel Genset Market Revenues, By Southern Region, 2017–2027F ($ Million) |

| 24. Saudi Arabia Upcoming First Class and Luxury Hotel Projects (No. of Projects) |

| 25. Saudi Arabia Distribution of Hospitality Projects, 2021-23 |

| 26. Saudi Arabia Up to 75 kVA Diesel Genset Import, By Country, 2019 ($ Thousand) |

| 27. Saudi Arabia 75.1 - 375 kVA Diesel Gensets Import, By Country, 2019 ($ Thousand) |

| 28. Saudi Arabia Above 375 kVA Diesel Gensets Import, By Country, 2019 ($ Thousand) |

| 29. Saudi Arabia Diesel Genset Market Opportunity Assessment, By kVA Ratings, 2027F |

| 30. Saudi Arabia Diesel Genset Market Opportunity Assessment, By Applications, 2027F |

| 31. Saudi Arabia Diesel Genset Market Revenue Share, By Companies, 2020 |

| List of Tables |

| 1. Saudi Arabia Genset Market Revenues, By Countries, 2017-2027F ($ Million) |

| 2. Saudi Arabia Diesel Genset Market Volume, By Countries, 2017-2027F (Thousand Units) |

| 3. Saudi Arabia Ongoing Major Economic City Projects, 2006-37 |

| 4. Saudi Arabia Diesel Genset Market Revenues, By Commercial Application, 2017–2027F ($ Million) |

| 5. Saudi Arabia Ongoing Major Mega Projects |

| 6. Saudi Arabia Ongoing Major Medical Complex Projects |

| 7. Saudi Arabia Ongoing Major Transportation Projects |

| 8. Saudi Arabia Ongoing Major Skyscraper Projects |

| 9. Saudi Arabia Ongoing Major Industrial Projects |

| 10. Saudi Arabia Petrochemical Projects |

| 11. Saudi Arabia List of Major Infrastructure Projects |

| 12. Saudi Arabia Ongoing Hospitality Projects, |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero