Saudi Arabia Electric Motor Market (2025-2031) | Trends, Share, Forecast, Industry, Value, Segmentation, Analysis, Size, Growth, Outlook

Market Forecast By Types (AC Electric Motor And DC Electric Motor), By Power Output (Fractional Horsepower And Integral Horsepower), By Voltage (Low Voltage, Medium Voltage And High Voltage), By Application (Pumps, Fans, Compressors, Conveyors And Others (Centrifuges, Extruders And Winches)), By End-User (Industrial Machinery, HVAC Equipment, Automobile, Consumer Appliances, Aerospace & Transportation, Power Generation And Others Commercial Application (Agriculture And Mining)) And Competitive Landscape

| Product Code: ETC002409 | Publication Date: Dec 2023 | Updated Date: Oct 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Saudi Arabia Electric Motor Market Growth Rate

According to 6Wresearch internal database and industry insights, the Saudi Arabia Electric Motor Market is predicted to expand at a compound annual growth rate (CAGR) of 9.1% during the forecast period 2025-2031.

Saudi Arabia Electric Motor Market Highlights

| Report Name | Saudi Arabia Electric Motor Market |

| Forecast Period | 2025-2031 |

| CAGR | 9.1% |

| Growing Sector | Oil & Gas and Automobile |

Topics Covered in the Saudi Arabia Electric Motor Market Report

The Saudi Arabia Electric Motor Market report thoroughly covers the market by motor type, power output, voltage, application, end-user, and speed. The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia Electric Motor Market Synopsis

Saudi Arabia Electric Motor Market is experiencing exceptional growth throughout the years. As motors are main components which are used across pumps, compressors, fans, and conveyors, their demand spans multiple industries such as oil & gas, petrochemicals, HVAC, and automobiles. The growth of this market is pushed forward by majorly industrial diversification programs under Saudi Vision 2030, increasing demand for automation in oil & gas, and rising adoption of electric vehicles.

Evaluation of Growth Drivers in the Saudi Arabia Electric Motor Market

Below mentioned some major drivers and their impacts on the market dynamics:

| Driver | Primary Segments Affected | Why it Matters (Evidence) |

| Oil & Gas Industry Modernization | AC & Integral Horsepower Motors | Saudi Arabia’s oil & gas sector uses thousands of pumps, compressors, and drilling equipment requiring durable AC motors, sustaining long-term demand. |

| Industrial Diversification & Automation | AC Motors & Medium Voltage Motors | Vision 2030 is pushing industrial automation in steel, cement, and petrochemicals, thereby boosting electric motor consumption. |

| Rise of EV Adoption | AC & DC Motors | Growing EV is driving demand for specialized high-torque AC motors and efficient DC motors in automotive applications. |

| Expansion of HVAC Systems | Hermetic Motors & AC Motors | Massive construction projects including smart cities (like NEOM) are fuelling demand for high-efficiency HVAC motors. |

| Renewable Energy Projects | AC Motors | Wind and solar power projects require motors for tracking, pumping, and grid integration, driving adoption in the utilities sector. |

Saudi Arabia Electric Motor Market Size is predicted to expand at a steady CAGR of 9.1% during the forecast period 2025-2031. There are numbers of major drivers which are contributing in the expansion of the market which include the rapid industrial expansion, strong investments in oil & gas, and rising infrastructure development under Vision 2030. Also, government initiatives are promoting renewable energy and energy-efficient technologies which are boosting demand for advanced motor solutions across power generation and utilities. Further, the adoption of smart automation is growing in manufacturing, HVAC systems, and water treatment strengthens market growth.

Evaluation of Restraints in the Saudi Arabia Electric Motor Market

Below mentioned some major restraints and their influence on the market dynamics:

| Restraint | Primary Segments Affected | What this Means (Evidence) |

| High Cost of Premium Motors | Industrial & Automotive | Energy-efficient motors cost significantly more, limiting adoption among SMEs and cost-sensitive industries. |

| Import Dependency | All Segments | Heavy reliance on imported motors creates supply chain risks and reduces competitiveness of local manufacturers. |

| Harsh Climate Conditions | HVAC & Oilfield Equipment | The harsh climate of desert demand advanced cooling systems in motors, increasing maintenance costs. |

| Limited Local Manufacturing Base | Industrial Machinery & Automotive | The major dependence on foreign suppliers slows domestic adoption of cutting-edge motor technologies. |

| Shortage of Skilled Workforce | Ultrahigh-Speed Motors | The lack of specialized knowledge needed for advanced motors is lacking, slowing aerospace and EV motor deployment. |

Saudi Arabia Electric Motor Market Challenges

Saudi Arabia Electric Motor Market deals with the numbers of the challenges such as fluctuating raw material prices of copper and rare earth metals, dependency on imports for advanced motor designs, and high energy consumption in older motor installations. These obstacles are creating hurdles in the supply chain and manufacturing process. On the other side, harsh desert climates require additional protective features in motors, raising lifecycle costs. Further, integration of AI-based predictive maintenance remains limited among smaller industries due to high costs and lack of technical expertise.

Saudi Arabia Electric Motor Market Trends

Some emerging trends noticed in the market which include:

- Adoption of EV & Hybrid Vehicles: The demand for AC and DC motors designed for electric cars and commercial fleets is rising.

- Smart HVAC Systems: Widespread installation of noise-free, energy-efficient hermetic motors in commercial complexes, airports, and residential towers.

- Industrial Automation Surge: Motors increasingly embedded in conveyor systems, robotic arms, and automated drilling units.

- Renewable Energy Integration: Motors are integrated with solar trackers and wind turbines to optimize energy generation.

- Miniaturization in Consumer Appliances: Compact high-performance motors gaining demand in household appliances and small electronics.

Investment Opportunities in the Saudi Arabia Electric Motor Industry

There are some worthwhile opportunities in the Saudi Arabia Electric Motor Industry:

- EV-Specific Motor Development – The demand for electric mobility is rising in passenger cars and trucks which opens opportunities for specialized motor manufacturing.

- Oilfield Motor Solutions – Use of heavy-duty AC motors for pumps, compressors, and drilling rigs present long-term opportunities.

- Smart City HVAC Systems – The demand for hermetic motors is increasing in mega-projects like NEOM and Red Sea Global.

- Industrial Robotics – Automation in steel, cement, and petrochemical industries fuelling opportunities for medium-voltage AC motors.

- Renewable Energy Expansion – Gradually, the need for motors is growing in solar, wind, and hybrid energy systems across Saudi Arabia.

Top 5 Leading Players in the Saudi Arabia Electric Motor Market

Here is comprehensive list of top companies in the Saudi Arabia Electric Motor Market:

1. Siemens Saudi Arabia

| Company Name | Siemens Saudi Arabia |

| Established Year | 1954 |

| Headquarters | Riyadh, Saudi Arabia |

| Official Website | Click Here |

This is a leading supplier of motors across Saudi industries, focusing on industrial automation, utilities, and renewable energy.

2. WEG Industries

| Company Name | WEG Industries |

| Established Year | 1961 |

| Headquarters | Jaragua do Sul, Brazil |

| Official Website | Click Here |

This company supplies motors across oil & gas, water treatment, and construction industries in Saudi Arabia, focusing on high-efficiency motors and customized automation solutions.

3. ABB Saudi Arabia

| Company Name | ABB Saudi Arabia |

| Established Year | 1988 (regional presence) |

| Headquarters | Riyadh, Saudi Arabia |

| Official Website | Click Here |

This is a major motor supplier for Saudi industries, especially in oil & gas, HVAC, and renewable sectors, also emphasizes the smart, energy-efficient, and digitally enabled motor solutions.

4. TECO Middle East

| Company Name | TECO Middle East |

| Established Year | 1956 |

| Headquarters | Taipei, Taiwan |

| Official Website | Click Here |

This company provides industrial and HVAC motors in Saudi Arabia, with a focus on medium- and high-voltage solutions for oil & gas and power generation applications.

5. Nidec Corporation

| Company Name | Nidec Corporation |

| Established Year | 1973 |

| Headquarters | Kyoto, Japan (regional hub in Saudi Arabia) |

| Official Website | Click Here |

This company supplies compact and high-efficiency motors for automotive, consumer appliances, and industrial machinery in the Saudi market.

Government Regulations Introduced in the Saudi Arabia Electric Motor Market

According to Saudi Arabian Government Data, the Saudi Arabia Electric Motor Market is supported by the government with the enforcement of regulation through Metrology and Quality Organization (SASO) who has implemented Minimum Energy Performance Standards (MEPS) aligned with IEC guidelines and mandating the use of high-efficiency motors. One of the top policies introduced in this market is the Saudi Energy Efficiency Program (SEEP), to encourage the adoption of energy-efficient technologies across all industries. SEEP provides companies with free energy audits, helps them develop customized action plans, and provides partial grants to cover the costs of implementing energy-efficient technologies. Further, Vision 2030 emphasizes energy conservation and diversification, pushing industries to upgrade to IE2 and IE3 class motors.

Future Insights of the Saudi Arabia Electric Motor Market

The future of Saudi Arabia Electric Motor Market Growth is expected to rise with major factors such as growing EV adoption, automation in oil & gas, and renewable energy investments. Some mega-projects such as NEOM, Red Sea Global, and Qiddiya will raise the demand in large volumes of motors for HVAC, conveyors, and industrial machinery. Further, there are high-efficiency AC motors, EV-specific motors, and medium-voltage solutions which will attract strong investment, while local manufacturing and skill development will play critical roles in future competitiveness.

Market Segmentation Analysis

AC motors to Dominate the Market -By Types

According to Parth, Senior Research Analyst, 6Wresearch, motors are set to dominate the market due to their extensive use in industrial machinery, HVAC, and oil & gas applications. Owing to their efficiency, durability, and adaptability in pumps, compressors, and conveyors, this is a leading choice compared to DC motors, which are largely confined to EVs and niche robotics.

Integral horsepower to Dominate the Market -By Power Output

Integral horsepower motors are set to lead the market as they are critical in heavy-duty operations across oil & gas, steel, and petrochemicals. Fractional horsepower motors are growing in consumer appliances and electronics but remain secondary to integral horsepower demand.

Medium voltage to Dominate the Market -By Voltage

Medium voltage motors are predicted to lead the market due to their significant application in oil & gas pumping, compressors, and industrial automation systems. High-voltage motors find adoption in power generation, while low-voltage motors are mainly used in consumer appliances.

Pumps to Dominate the Market -By Application

Pumps are set to capture the largest Saudi Arabia Electric Motor Market Share as they are critical in oil extraction, desalination plants, and water infrastructure projects. Compressors and conveyors are growing segments in petrochemical industries, while fans are widely used in HVAC.

Industrial Machinery to Dominate the Market -By End-User

Industrial machinery dominates the end-user segment, as oil & gas, petrochemicals, and steel industries are heavily dependent on electric motors. HVAC is expanding rapidly with mega infrastructure projects, while the automobile sector is witnessing growing EV-related motor adoption.

Key Attractiveness of the Reports

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia Electric Motor Market Outlook

- Market Size of Saudi Arabia Electric Motor Market, 2024

- Forecast of Saudi Arabia Electric Motor Market, 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Revenues & Volume for the Period 2021 - 2031

- Saudi Arabia Electric Motor Market Trend Evolution

- Saudi Arabia Electric Motor Market Drivers and Challenges

- Saudi Arabia Electric Motor Price Trends

- Saudi Arabia Electric Motor Porter's Five Forces

- Saudi Arabia Electric Motor Industry Life Cycle

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Motor Type for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Alternate Current (AC) Motor for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Direct Current (DC) Motor for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Hermetic Motor for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Voltage Range for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By 9 V & Below for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By 10-20 V for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By 21-60 V for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By 60 V & Above for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Industrial machinery for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Motor vehicles for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Heating, ventilating, and cooling (HVAC) equipment for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Aerospace & transportation for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Household appliances for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Other for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Speed (RPM) for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Low-Speed Electric Motors (Less Than 1,000 RPM) for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Medium-Speed Electric Motors (1,001-25,000 RPM) for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By High-Speed Electric Motors (25,001-75,000 RPM) for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia Electric Motor Market Revenues & Volume By Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM) for the Period 2021 - 2031

- Saudi Arabia Electric Motor Import Export Trade Statistics

- Market Opportunity Assessment By Motor Type

- Market Opportunity Assessment By Voltage Range

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Speed (RPM)

- Saudi Arabia Electric Motor Top Companies Market Share

- Saudi Arabia Electric Motor Competitive Benchmarking By Technical and Operational Parameters

- Saudi Arabia Electric Motor Company Profiles

- Saudi Arabia Electric Motor Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Motor Type

- Alternate Current (AC) Motor

- Direct Current (DC) Motor

- Hermetic Motor

By Voltage Range

- 9 V & Below

- 10-20 V

- 21-60 V

- 60 V & Above

By Application

- Industrial Machinery

- Motor Vehicles

- Heating

- Ventilating

- And Cooling (HVAC) Equipment

- Aerospace & Transportation

- Household Appliances

- Other

By Speed (RPM)

- Low-Speed Electric Motors (Less Than 1,000 RPM)

- Medium-Speed Electric Motors (1,001-25,000 RPM)

- High-Speed Electric Motors (25,001-75,000 RPM)

- Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM)

Saudi Arabia Electric Motor Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of The Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Saudi Arabia Electric Motor Market Overview |

| 3.1. Saudi Arabia Country Indicators |

| 3.2. Saudi Arabia Electric Motor Market Revenues, 2021-2031F |

| 3.3. Saudi Arabia Electric Motor Market Revenue Share, By Voltage, 2021 & 2031F |

| 3.4. Saudi Arabia Electric Motor Market Revenue Share, By Types, 2021 & 2031F |

| 3.5. Saudi Arabia Electric Motor Market Revenue Share, By Applications, 2021 & 2031F |

| 3.6. Saudi Arabia Electric Motor Market Revenue Share, By End-Users, 2021 & 2031F |

| 3.7. Saudi Arabia Electric Motor Market - Industry Life Cycle |

| 3.8. Saudi Arabia Electric Motor Market - Porter’s Five Forces |

| 4. Saudi Arabia Electric Motor Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Government initiatives promoting energy efficiency and sustainability |

| 4.2.2 Growing industrial sector driving demand for electric motors |

| 4.2.3 Increasing investments in infrastructure development |

| 4.3. Market Restraints |

| 4.3.1 Volatility in raw material prices affecting manufacturing costs |

| 4.3.2 Intense competition from global and local electric motor manufacturers |

| 4.3.3 Technological advancements leading to rapid product obsolescence |

| 5. Saudi Arabia Electric Motor Market Trends |

| 6. Saudi Arabia Electric Motor Market Overview, By Voltage |

| 6.1. Saudi Arabia Low Voltage Electric Motor Market Revenues, 2021-2031F |

| 6.2. Saudi Arabia Medium Voltage Electric Motor Market Revenues, 2021-2031F |

| 6.3. Saudi Arabia High Voltage Electric Motor Market Revenues, 2021-2031F |

| 7. Saudi Arabia Electric Motor Market Overview, By Types |

| 7.1. Saudi Arabia Electric Motor Market Revenues, By AC Type, 2021-2031F |

| 7.2. Saudi Arabia Electric Motor Market Revenues, By DC Type, 2021-2031F |

| 8. Saudi Arabia Electric Motor Market Overview, By Applications |

| 8.1. Saudi Arabia Electric Motor Market Revenues, By Pump Application, 2021-2031F |

| 8.2. Saudi Arabia Electric Motor Market Revenues, By Fan Application, 2021-2031F |

| 8.3. Saudi Arabia Electric Motor Market Revenues, By Conveyor Application, 2021-2031F |

| 8.4. Saudi Arabia Electric Motor Market Revenues, By Compressors Application, 2021-2031F |

| 8.5. Saudi Arabia Electric Motor Market Revenues, By Other Applications, 2021-2031F |

| 9. Saudi Arabia Electric Motor Market Overview, By End-Users |

| 9.1. Saudi Arabia Electric Motor Market Revenues, By Industrial Processing, 2021-2031F |

| 9.2. Saudi Arabia Electric Motor Market Revenues, By Commercial HVAC, 2021-2031F |

| 9.3. Saudi Arabia Electric Motor Market Revenues, By Automotive, 2021-2031F |

| 9.4. Saudi Arabia Electric Motor Market Revenues, By Consumer Appliances, 2021-2031F |

| 9.5. Saudi Arabia Electric Motor Market Revenues, By Power Generation, 2021-2031F |

| 9.6. Saudi Arabia Electric Motor Market Revenues, By Others, 2021-2031F |

| 10. Saudi Arabia Electric Motor Market - Key Performance Indicators |

| 10.1 Energy efficiency improvements in electric motor technologies |

| 10.2 Adoption rate of electric motors in key industries |

| 10.3 Investments in research and development for electric motor innovation |

| 10.4 Availability and adoption of renewable energy sources in Saudi Arabia |

| 10.5 Regulatory compliance and standards adherence in electric motor manufacturing |

| 11. Saudi Arabia Electric Motor Market - Opportunity Assessment |

| 11.1. Saudi Arabia Electric Motor Market Opportunity Assessment, By Types, 2031F |

| 11.2. Saudi Arabia Electric Motor Market Opportunity Assessment, By Applications, 2031F |

| 12. Saudi Arabia Electric Motor Market Competitive Landscape |

| 12.1. Saudi Arabia Electric Motor Market Revenue Share, By Companies, 2024 |

| 12.2. Saudi Arabia Electric Motor Market Competitive Benchmarking, By Operating & Technical Parameters |

| 13. Company Profiles |

| 14. Key Recommendations |

| 15. Disclaimer |

Market Forecast By Types (AC Electric Motor And DC Electric Motor), By Power Output (Fractional Horsepower And Integral Horsepower), By Voltage (Low Voltage, Medium Voltage And High Voltage), By Application (Pumps, Fans, Compressors, Conveyors And Others (Centrifuges, Extruders And Winches)), By End-User (Industrial Machinery, HVAC Equipment, Automobile, Consumer Appliances, Aerospace & Transportation, Power Generation And Others Commercial Application (Agriculture And Mining)) And Competitive Landscape

| Product Code: ETC002409 | Publication Date: Apr 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Saudi Arabia Electric Motor Market | Country-Wise Share and Competition Analysis

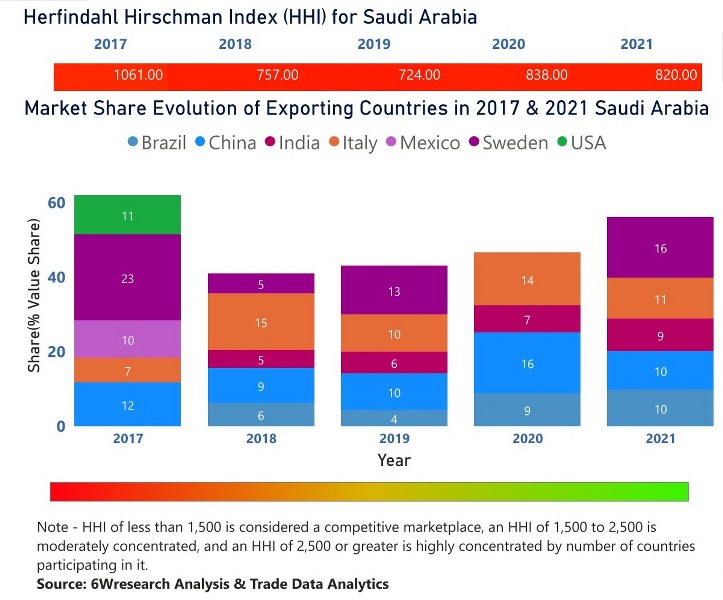

In the year 2021, Sweden was the largest exporter in terms of value, followed by Italy. It has registered a growth of 150133.78% over the previous year. While Italy registered a growth of 10.67% as compare to the previous year. In the year 2017 Sweden was the largest exporter followed by China. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Saudi Arabia has the Herfindahl index of 1061 in 2017 which signifies high competitiveness also in 2021 it registered a Herfindahl index of 820 which signifies high competitiveness in the market.

Saudi Arabia Electric Motor Market - Export Market Opportunities

Latest 2023 Developments of Saudi Arabia Electric Motor Market

Saudi Arabia Electric Motor Market has accomplished significant developments, reflecting the nation’s commitment to sustainable energy solutions. The rising implementation of energy-efficient motors which support in saving electricity as well as reduce carbon emission is the major development of the market. The country has been investing in renewable energy, especially solar power and this trend also drives the demand for these motors that are used in solar panels as well as other renewable energy systems. Rise of advanced electric motor technologies which incorporate smart sensors and control systems in order to optimize performance and minimize downtime is another significant market development.

Topics Covered in Saudi Arabia Electric Motor Market Report

Saudi Arabia Electric Motor Market report thoroughly covers the market by types, power output, voltage, applications, and end-user. The market report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia Electric Motor Market is projected to grow over the coming year. Saudi Arabia Electric Motor Market report is a part of our periodical regional publication Middle East Electric Motor Market Outlook report. 6W tracks electric motor market for over 60 countries with individual country-wise market opportunity assessment and publishes with the report titled Global Electric Motor Market outlook report annually.

Saudi Arabia Electric Motor Market Synopsis

Saudi Arabia Electric Motor Market is projected to grow over the coming year owing to the growing implementations and sales of electric vehicles, and reduced operation costs as well as the growing demand for the products that are energy-efficient.

According to 6wresearch, the Saudi Arabia Electric Motor Market size is expected to grow during 2020-2026. The market is driven by the growing automotive industry and developing infrastructure coupled with increasing investment in the industrial sector. Increasing demand for energy-efficient products, increasing adoption and sales of electric vehicles, and reduction in operating costs are the key factors boosting the growth of the electric motor market in Saudi Arabia. The government in the country is pushing towards renewable energy sources and sustainable development. The nation has set ambitious purposes in order to decrease its reliance on gas and oil, which leads to investments in wind farms, solar power plants, as well as other green technologies. The growth of automation in many sectors also contribute to the market growth. Automation needs efficient and reliable motors in order to run machinery with accuracy and precision. These drivers are leading to the Saudi Arabia Electric Motor Market Growth.

COVID-19 Impact on Saudi Arabia Electric Motor Market

The pandemic has made it extremely difficult for the market to operate smoothly in the country since there was a strong decrease in demand for these electric motors during the pandemic. The outbreak of the coronavirus resulted in disruption of electric motors owing to the reduction in manufacturing output and industrial activities. A number of manufacturers confronted significant challenges and disruptions related to supply chain management, raw material procurement, and workforce availability during the peak. These factors definitely led to a rise in costs of production, which affected consumer prices. The market started to recover with gradual eased up over time and reopening of businesses.

Key Players in Saudi Arabia Electric Motor Industry

Some significant players that have been stimulating the market growth are:

- ABB Ltd.

- WEG Industries SA

- Siemens AG

- Toshiba International Corporation

- Emerson Electric Co.

- Nidec Corporation

- Regal Beloit Corporation

Market by Power Output

Based on power output, the fractional horsepower segment is expected to lead the electric motor market revenue share in Saudi Arabia owing to surging deployment of motors from industries coupled with increasing investment during the forecast period. Furthermore, in Saudi Arabia, the market is expected to register a decline in the economic growth over the first quarter of 2020, on account of the coronavirus pandemic which has a worse impact on worldwide business. However, the market in Saudi Arabia is expected to recover with healthy growth in the economy during the second half of 2020-2026.

Market by End-User

According to Nikhil, Senior Research Manager, 6Wresearch, the power generation and industrial machinery segments are dominating the electric motor market revenue share in Saudi Arabia on account of surging power utility in the automotive industry, growing demand for energy-efficient systems in the manufacturing and construction industry.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2029.

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Reports

- Saudi Arabia Electric Motor Market Overview

- Saudi Arabia Electric Motor Market Outlook

- Saudi Arabia Electric Motor Market Forecast

- Historical Data of Saudi Arabia Electric Motor Market Revenues and Volumes, for the Period 2016-2019.

- Market Size & Forecast of Saudi Arabia Electric Motor Market Revenues and Volumes, until 2026.

- Historical Data of Saudi Arabia Electric Motor Market Revenues and Volumes, by type, for the Period 2016-2019.

- Market Size & Forecast of Saudi Arabia Electric Motor Market Revenues and Volumes, by type, until 2026.

- Historical Data of Saudi Arabia Electric Motor Market Revenues and Volumes, by power output, for the Period 2016-2019.

- Market Size & Forecast of Saudi Arabia Electric Motor Market Revenues and Volumes, by power output, until 2026.

- Historical Data of Saudi Arabia Electric Motor Market Revenues and Volumes, by voltage, for the Period 2016-2019.

- Market Size & Forecast of Saudi Arabia Electric Motor Market Revenues and Volumes, by voltage, until 2026.

- Historical Data of Saudi Arabia Electric Motor Market Revenues and Volumes, by end-user, for the Period 2016-2019.

- Market Size & Forecast of Saudi Arabia Electric Motor Market Revenues and Volumes, by end-user, until 2026.

- Historical Data of Saudi Arabia Electric Motor Market Revenues and Volumes, by application, for the Period 2016-2019.

- Market Size & Forecast of Saudi Arabia Electric Motor Market Revenues and Volumes, by application, until 2026.

- Market Drivers and Restraints

- Saudi Arabia Electric Motor Market Price Trends

- Saudi Arabia Electric Motor Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Saudi Arabia Electric Motor Market Share, By Players

- Saudi Arabia Electric Motor Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Types

- AC Electric Motor

- DC Electric Motor

By Power Output

- Integral Horsepower

- Fractional Horsepower

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

By Applications

- Pumps

- Fans

- Compressors

- Conveyors

- Others (Centrifuges, Extruders and Winches)

By End-User

- Industrial Machinery

- HVAC Equipment

- Automobile

- Consumer Appliances

- Aerospace & Transportation

- Power generation

- Other Commercial Application (Agriculture and Mining)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero