Thailand Botulinum Toxin Market (2025-2031) | Analysis, Growth, Outlook, Competitive Landscape, Industry, Forecast, Trends, Value, Segmentation, Share, Companies

Market Forecast By Product Type (Type A, Type B), By Application (Aesthetic, Therapeutic), By End User (Hospitals, Dermatology & Aesthetic Clinics, Others (Rehabilitation Centers, Research Institutes, Etc.)) And Competitive Landscape

| Product Code: ETC9680003 | Publication Date: Sep 2024 | Updated Date: Aug 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 65 | No. of Figures: 18 | No. of Tables: 4 |

Thailand Botulinum Toxin Market Size & Growth Rate

Thailand Botulinum Toxin Market Report thoroughly covers the market By Product Type, By Application and By end user. Thailand Botulinum Toxin Market Outlook report provides an unbiased and detailed analysis of the ongoing Thailand Botulinum Toxin Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Thailand Botulinum Toxin Market Synopsis

Thailand's Botulinum Toxin market is witnessing significant growth, primarily driven by booming medical tourism and the rising demand for medical aesthetics. The country attracts over 25 million international visitors annually, offers cost savings compared to Western nations while maintaining high standards of safety and quality. Thailand ranks 4th in Asia (after South Korea, Japan, and China) in medical aesthetic tourism revenue, according to Siam Commercial Bank. The Thailand Medical Hub Board projects that the medical aesthetics market would grow more by 2027. Supporting this expansion, Thailand has a well-established network for aesthetic clinics.

According to 6Wresearch, Thailand Botulinum Toxin Market revenue is projected to grow at a CAGR of 6.4% during 2025-2031. Thailand’s healthcare and cosmetic industries are poised for substantial growth, driven by increasing demand and strategic investments. The healthcare sector is on a strong growth trajectory, with total spending projected to surpass USD 32 billion by 2026, driven by a 7.35% CAGR from 2023 to 2026. A major contributor to this expansion is the booming medical tourism industry, which has been growing at an 11.6% CAGR from 2019 to 2027 and is expected to reach USD 9.9 billion by 2027. Under the 20-Year National Strategy (2018–2037), Yuthasak anticipates millions medical tourists will contribute 200 billion baht to Thailand’s economy by 2037. Meanwhile, Thailand’s cosmetic industry is also experiencing rapid expansion, with projected growth of 9.5%–10% in 2024 and up to 11% in 2025. By 2030, the market is expected to exceed USD 10 billion, maintaining a steady annual growth rate of 5.0% since 2022.

Market Segmentation By Product Type

In 2031, Type A is expected to witness the highest growth, primarily due to its widespread use in reducing facial wrinkles and fine lines. This surge is attributed to increasing beauty consciousness and the growing preference for minimally invasive treatments. Additionally, Type A is utilized in treating various medical conditions such as chronic migraines, muscle spasticity, and overactive bladder.

Market Segmentation By Application

In 2031, the Aesthetic Application segment is expected to experience the highest growth, driven by the increasing focus on youthful appearance and cosmetic enhancements, which is fueling demand for botulinum toxin procedures. Additionally, Thailand's status as a hub for medical tourism, with a growing influx of international clients seeking affordable, high-quality aesthetic treatments, is further boosting market expansion.

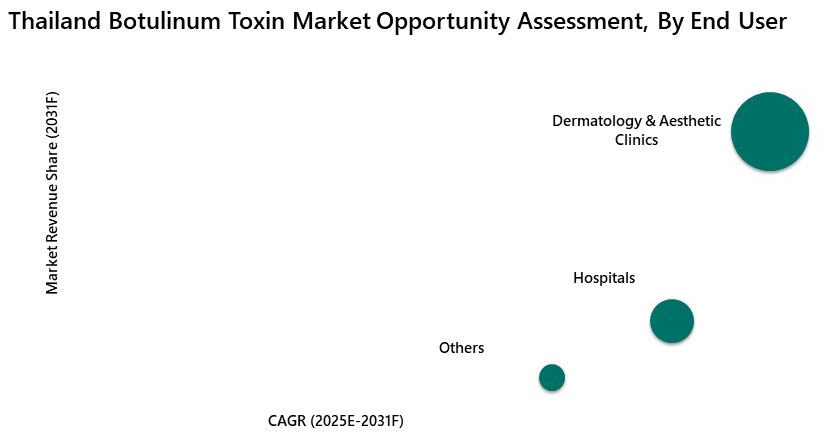

Market Segmentation By End User

In 2031, the Dermatology & Aesthetic Clinics segment is expected to grow at a faster rate, as these clinics offer specialized and personalized treatments tailored to individual needs, setting them apart from general hospitals. Moreover, there is a growing trend among individuals seeking non-invasive and minimally invasive aesthetic treatments, such as botulinum toxin injections, to enhance their appearance.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- Thailand Botulinum Toxin Market Overview

- Thailand Botulinum Toxin MarketOutlook

- Thailand Botulinum Toxin Market Forecast

- Historical Data and Forecast ofThailand Botulinum Toxin MarketRevenues and Revenue Share, for the Period 2021-2031F

- Industry Life Cycle

- Porter’s Five Force Analysis

- Thailand Botulinum Toxin Market Drivers and Restraints

- Thailand Botulinum Toxin Market Trends and Evolution

- MarketRevenues and Revenue Share, By Product Type

- MarketRevenues and Revenue Share, By Application

- MarketRevenues and Revenue Share, By End User

- Key Performance Indicators

- Opportunity Assessment, By Product Type

- Opportunity Assessment, By Application

- Opportunity Assessment, By End User

- Revenue Ranking, By Companies

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Product Type

- Type A

- Type B

By Application

- Aesthetic Applications

- Therapeutic Applications

By End User

- Hospitals

- Dermatology & Aesthetic Clinics

- Others (Rehabilitation Centers, Research Institutes, Etc.)

Thailand Botulinum Toxin Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Key Highlights of the Report |

| 2.2. Report Description |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Thailand Botulinum Toxin Market Overview |

| 3.1. Thailand Botulinum Toxin Market Revenues and Revenue Share, 2021-2031F |

| 3.2. Thailand Botulinum Toxin Market Industry Life Cycle |

| 3.3. Thailand Botulinum Toxin Market Porter's Five Forces |

| 4. Thailand Botulinum Toxin Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Increasing demand for minimally invasive cosmetic procedures in Thailand |

| 4.2.2 Growing awareness about the benefits of botulinum toxin treatments |

| 4.2.3 Rising disposable income levels in the population |

| 4.3. Market Restraints |

| 4.3.1 Stringent regulations and approval processes for botulinum toxin products |

| 4.3.2 Potential side effects and risks associated with botulinum toxin treatments |

| 4.3.3 Competition from alternative cosmetic treatments in the market |

| 5. Thailand Botulinum Toxin Market Trends And Evolution |

| 6. Thailand Botulinum Toxin Market Overview, By Product Type |

| 6.1. Thailand Botulinum Toxin Market Revenue Share, By Product Type, 2024 & 2031F |

| 6.1.1. Thailand Botulinum Toxin Market Revenues, By Type A, 2021-2031F |

| 6.1.2. Thailand Botulinum Toxin Market Revenues, By Type B, 2021-2031F |

| 7. Thailand Botulinum Toxin Market Overview, By Application |

| 7.1. Thailand Botulinum Toxin Market Revenue Share, By Application, 2024 & 2031F |

| 7.1.1. Thailand Botulinum Toxin Market Revenues, By Aesthetic Applications, 2021-2031F |

| 7.1.2. Thailand Botulinum Toxin Market Revenues, By Therapeutic Applications, 2021-2031F |

| 8. Thailand Botulinum Toxin Market Overview, By End User |

| 8.1. Thailand Botulinum Toxin Market Revenue Share, By End User, 2024 & 2031F |

| 8.1.1. Thailand Botulinum Toxin Market Revenues, By Hospitals, 2021-2031F |

| 8.1.2. Thailand Botulinum Toxin Market Revenues, By Dermatology & Aesthetic Clinics, 2021-2031F |

| 8.1.3. Thailand Botulinum Toxin Market Revenues, By Others, 2021-2031F |

| 9. Thailand Botulinum Toxin Market Key Performance Indicator |

| 10. Thailand Botulinum Toxin Market Opportunity Assessment |

| 10.1. Thailand Botulinum Toxin Market Opportunity Assessment, By Product Type, 2031F |

| 10.2. Thailand Botulinum Toxin Market Opportunity Assessment, By Application, 2031F |

| 10.3. Thailand Botulinum Toxin Market Opportunity Assessment, By End User, 2031F |

| 11. Thailand Botulinum Toxin Market Competitive Landscape |

| 11.1 Thailand Botulinum Toxin Market Revenue Ranking, By Top 3 Companies, 2024 |

| 11.2 Thailand Botulinum Toxin Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 12.1 Merz Pharma GmbH & Co. |

| 12.2 Medy-Tox, Inc. |

| 12.3 Hugel inc |

| 12.4 Galderma |

| 12.5 AbbVie Inc (Allergan plc) |

| 12.6 Ipsen Pharma |

| 12.7 Daewoong Pharmaceutical |

| 12.8 Evolus Inc |

| 12.9 BNC Korea |

| 12.10 Supernus Pharmaceuticals, Inc. |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| list of figures |

| 1. Thailand Botulinum Toxin Market Revenues, 2021-2031F (Million USD) |

| 2. Thailand's : International patients in Thailand 2021-2024, (Million USD) |

| 3. Thailand Medical Tourism Market Size, USD Million, 2022-2026F |

| 4. Thailand Total Number Of Procedures, By Type, 2023 (%) |

| 5. Thailand Medical Aesthetic Market Size, 2020 & 2027 (Billion USD) |

| 6. Thailand Botulinum Toxin Market , By Product Type, 2024 & 2031F |

| 7. Thailand Botulinum Toxin Market Revenue Share, By Application, 2024 & 2031F |

| 8. Thailand Botulinum Toxin Market Revenue Share, By End User, 2024 & 2031F |

| 9. Thailand Common Procedures, 2023 (%) |

| 10. Thailand Injectables Procedures, 2023 |

| 11. Thailand Facial Rejuvenation Procedures (2023) |

| 12. Thailand Spending Healthcare Market, 2022-2026F ($ Billion) |

| 13. Thailand’s Healthcare Facilities, 2023 |

| 14. Thailand's 60+ Population Projection (2020-2050) |

| 15. Thailand Botulinum Toxin Market Opportunity Assessment, By Product Type, 2031F (USD Million) |

| 16. Thailand Botulinum Toxin Market Opportunity Assessment, By Application, 2031F (USD Million) |

| 17. Thailand Botulinum Toxin Market Opportunity Assessment, By End User, 2031F (USD Million) |

| 18. Thailand Botulinum Toxin Market, Revenue Ranking, 2024 |

| list of tables |

| 1. Thailand Botulinum Toxin Market Revenue, By Product Type, 2021-2031F (USD Million) |

| 2. Thailand Botulinum Toxin Market Revenue, By Application, 2021-2031F (USD Million) |

| 3. Thailand Botulinum Toxin Market Revenue, By End User, 2021-2031F (USD Million) |

| 4. Thailand Skin Clinics 2023 |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero