Thailand LED Lighting Market (2020-2026) | Size, Share, Revenue, Analysis, Forecast, Growth, Value, industry, Outlook & & COVID-19 IMPACT

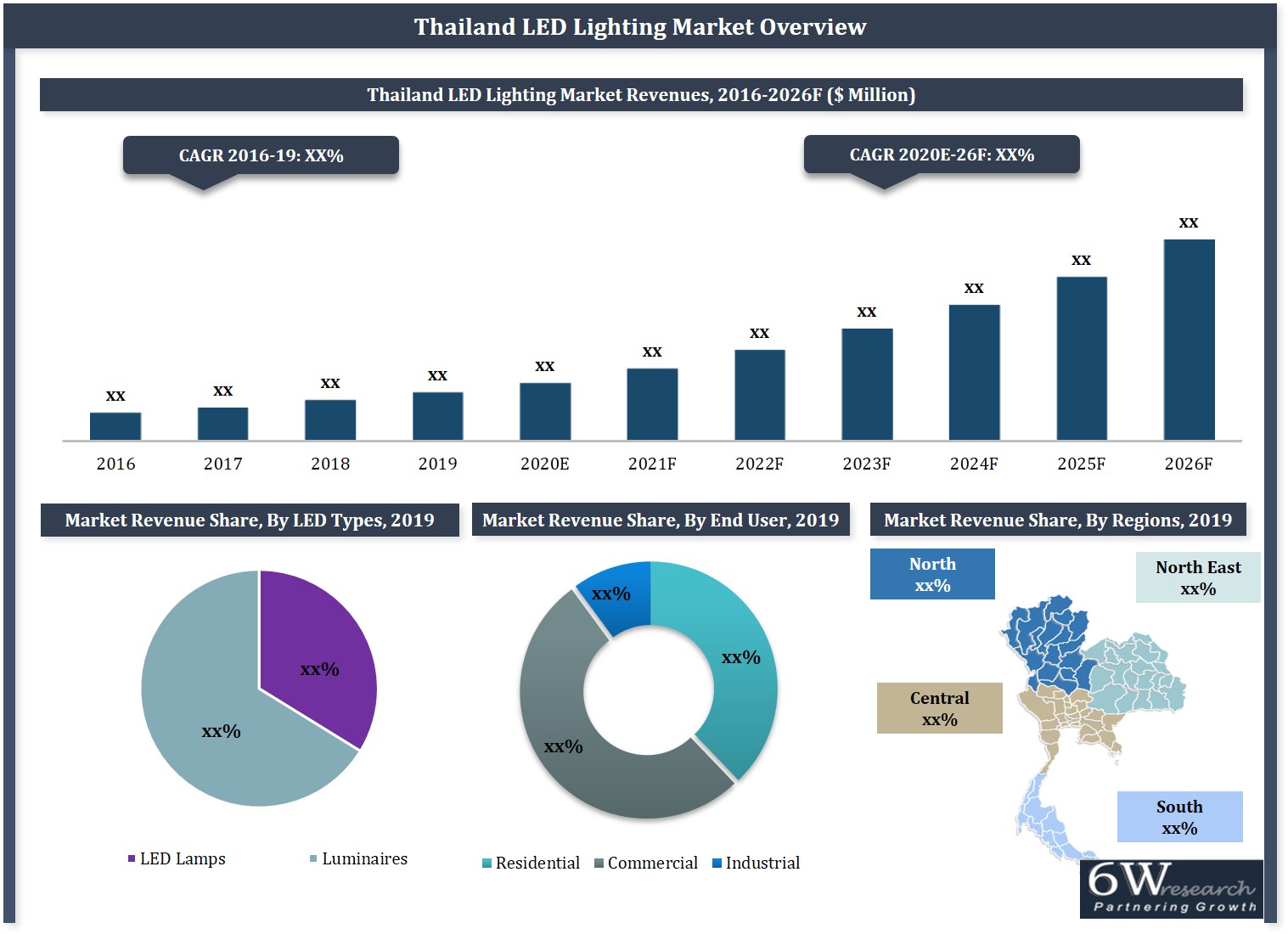

Market Forecast By Types (LED Lamps (Self-Ballasted LED Lamps, Down Lighters LED and Street Lights LED), LED Luminaires (Indoor Luminaires and Outdoor Luminaires)), By End-Users (Outdoor Lighting and Indoor Lighting), By Applications (Commercial, Residential and Industrial), By Regions (Northern, Central, North Eastern and Southern) and Competitive Landscape.

| Product Code: ETC001633 | Publication Date: Feb 2023 | Updated Date: Feb 2026 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 89 | No. of Figures: 34 | |

Thailand Led Lighting Market: Import Trend Analysis

In the Thailand LED lighting market, the import trend experienced a significant decline with a Compound Annual Growth Rate (CAGR) of -85.09% from 2020 to 2024. This sharp decrease suggests a substantial shift in demand dynamics or market stability, impacting trade performance within the sector.

Thailand LED Lighting Market report thoroughly covers the Thailand LED lighting market by types, applications, end-users, and regions including Northern, North Eastern, Southern and Central regions. The report provides an unbiased and detailed analysis of the ongoing trends, opportunities/ high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Latest 2023 Development of The Thailand LED Market

Thailand LED Market has been witnessing growth over the years significant. The growth is primarily driven by a growing focus on sustainability and increasing demand for energy-efficient lighting solutions. In addition, rising awareness about the benefits of LED lighting is another major factor that proliferates industry expansion. The market has confronted various developments which are contributing to its growth of this market. For instance, favourable initiatives by the Thai government to promote the use of LED lighting, including tax incentives for manufacturers and subsidies for consumers who have shifted towards to LED lights. The expansion of manufacturing facilities by LED lighting manufacturers engrossed by the country's favourable investment climate and skilled workforce.

Companies in Thailand are investing in the development of smart LED lighting solutions, which offer a range of features such as energy monitoring, remote control, and automation. Many companies in the Thailand LED Lighting Industry are prioritizing sustainability in their operations, including the use of environmentally friendly materials in the manufacturing of LED lights. The demand for LED lighting solutions from the commercial sector, including malls, hotels, and office buildings has been growing rapidly in Thailand.

Thailand LED Lighting Market Synopsis

Thailand LED Lighting Market is anticipated to register robust growth projections during the forecast period 2020-26F on the back of an increase in construction activities across the country coupled with technically superior equipment and advanced construction methods in the country. Owing to rising investments in the promotion of efficient lighting in the country, backed by a rising focus towards the implementation of sound measures, standards, and regulations in the construction industry, the LED lighting market in Thailand is expected to witness a proliferation in the coming timeframe and is expected to steer up with a positive growth phase in the next five to ten years. Rising demand for higher energy generation, backed by the acceleration of the oil & gas sector along with the adoption of light towers as efficient backup options are anticipated to drive significant demand projections for LED lighting during the projected period 2020-26F. Additionally, the profitability of LED lighting for illumination in inaccessible locations is anticipated to contribute significantly towards the adoption of LED lighting and would further benefit the growth of the Thailand LED Lighting market in the coming years. The market has seen a substantial decline owing to the massive outbreak of COVID-19 as construction was halted to combat the spread of the virus.

According to 6Wresearch, Thailand LED Lighting Market size is projected to grow at a CAGR of 22.9% during 2020-2026. Consumer demand for light-emitting diodes in Thailand is driven by lower prices, fewer maintenance requirements, better durability, and enhanced energy efficiency as compared to other forms of lighting. Additionally, rapid urbanization, government initiatives to conserve energy, as well as increasing investment by multinational players in Thailand’s LED market on account of the global political situation and trade tensions between major global powers are likely to positively impact the growth of the LED lighting market during the forecast period.

Market Analysis By Applications

On the basis of applications, Outdoor applications of LEDs are anticipated to gain traction during the forecast period on account of the development of smart cities and government measures to replace street lights with LED Lamps. The market for LEDs is also likely to be burgeoned by smart lighting solutions which facilitate functions such as timer setting and motion-detecting across commercial and residential spaces.

Key Attractiveness of The Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Historical Data of Thailand Lighting Market Revenues for the Period 2016-2019.

- Market Size & Forecast of Thailand Lighting Market Revenues, Until 2026.

- Historical Data of Thailand LED Lighting Market Revenues for the Period 2016-2019.

- Market Size & Forecast of Thailand LED Lighting Market Revenues, Until 2026.

- Historical Data of Thailand LED Lighting Market Revenues by Types for the Period 2016-2019.

- Market Size & Forecast of Thailand LED Lighting Market Revenues by Types, Until 2026.

- Historical Data of Thailand LED Lighting Market Revenues By Applications for the Period 2016-2019.

- Market Size & Forecast of Thailand LED Lighting Market Revenues by Applications, Until 2026.

- Historical Data of Thailand LED Lighting Market Revenues by End-user for the Period 2016-2019.

- Market Size & Forecast of Thailand LED Lighting Market Revenues by End-user, Until 2026.

- Historical Data of Thailand LED Lighting Market Revenues by Regions for the Period 2016-2019.

- Market Size & Forecast of Thailand LED Lighting Market Revenues by Regions, Until 2026.

- Market Drivers and Restraints.

- Market Trends and Developments.

- Market Share by Players and Competitive Landscape.

- Company Profiles.

- Key Strategic Recommendations.

Market Scope and Segmentation

The report provides a detailed analysis of the following Market segments:

By Types

- LED Lamps

- Self- Ballasted LED lamps

- Down Lighters LED

- Street Lights LED

- LED Luminaires

- Indoor Luminaires

- Outdoor Luminaires

By Applications

- Outdoor Lighting

- Indoor Lighting

By End Users

- Commercial

- Residential

- Industrial

By Regions

- Northern

- Southern

- Central

- North Eastern

Thailand LED Lighting Market: FAQs

| TABLE OF CONTENTS |

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Methodology Adopted and Key Data Points |

| 2.5. Assumptions |

| 3. Thailand Lighting Market Overview |

| 3.1. Thailand Lighting Market Revenues, 2016-2026F |

| 4. Thailand LED Lighting Market Overview |

| 4.1. Thailand Country Indicators |

| 4.2. Thailand LED Lighting Market Revenues, 2016-2026F |

| 4.3. Thailand LED Market - Value Chain |

| 4.4. Thailand LED Lighting Market - Industry Life Cycle |

| 4.5. Thailand LED Lighting Market - Porter’s Five Forces Model |

| 4.6. Thailand LED Lighting Market Revenue Share, By Types, 2019 & 2026F |

| 4.7. Thailand LED Lighting Market Revenue Share, By Applications, 2019 & 2026F |

| 4.8. Thailand LED Lighting Market Revenue Share, By End User, 2019 & 2026F |

| 4.9. Thailand LED Lighting Market Revenue Share, By Regions, 2019 & 2026F |

| 5. Thailand LED Lighting Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.3. Market Restraints |

| 6. Thailand LED Lighting Market Trends |

| 7. Thailand LED Lamps Market Overview |

| 7.1. Thailand LED Lamps Market Revenues, 2016-2026F |

| 7.1.1. Thailand Self Ballasted LED Lighting Market Revenues, 2016–2026F |

| 7.1.2. Thailand Down Lighters LED Lighting Market Revenues, 2016-2026F |

| 7.1.3. Thailand Street Light LED Lighting Market Revenues, 2016-2026F |

| 8. Thailand LED Luminaire Lighting Market Overview |

| 8.1. Thailand Luminaire Lighting Market Revenues, 2016-2026F |

| 8.1.1. Thailand Indoor Luminaire Lighting Market Revenues, 2016-2026F |

| 8.1.2. Thailand Outdoor Luminaire Lighting Market Revenues, 2016-2026F |

| 9. Thailand LED Lighting Market Overview, By Applications |

| 9.1. Thailand LED Lighting Market Revenues, By Outdoor Applications, 2016-2026F |

| 9.2. Thailand LED Lighting Market Revenues, By Indoor Applications, 2016-2026F |

| 10. Thailand LED Lighting Market Overview, By End Users |

| 10.1. Thailand LED Lighting Market Revenues, By Residential End Users, 2016-2026F |

| 10.2. Thailand LED Lighting Market Revenues, By Commercial End Users, 2016-2026F |

| 10.3. Thailand LED Lighting Market Revenues, By Industrial End Users, 2016-2026F |

| 11. Thailand LED Lighting Market Overview, By Regions |

| 11.1. Thailand LED Lighting Market Revenues, By Regions, 2016-2026F |

| 12. Thailand LED Lighting Market - Key Performance Indicators |

| 12.1. Thailand Government Spending Outlook |

| 12.2. Thailand Commercial Sector Overview |

| 12.3. Thailand Industrial Sector Overview |

| 12.4. Thailand Residential Sector Overview |

| 13. Thailand LED Lighting Market Opportunity Assessment |

| 13.1. Thailand LED Lighting Market Opportunity Assessment, By Regions, 2026F |

| 14. Competitive Landscape |

| 14.1. Thailand LED Lighting Market Revenue Ranking, By Company, 2019 |

| 15. Company Profile |

| 15.1. Thai Stanley Electric Public Company Limited |

| 15.2. Signify Holding |

| 15.3. Racer Electric (Thailand) Co. Ltd. |

| 15.4. Lighting & Equipment Public Company Limited |

| 15.5. Eve Lighting Co Ltd |

| 15.6. Tp Halo Techno-energy Co, Ltd |

| 15.7. Delta Electronics (Thailand) Public Company Limited |

| 15.8.Lamptan Company Limited |

| 15.9. Osram (Thailand) co ltd |

| 15.10. OPPLE Lighting Co., Ltd |

| 16. Key Strategic Recommendation |

| 17. Disclaimer |

| LIST OF FIGURES |

| 1. Thailand Lighting Market Revenues, 2016-2026F ($ Billion) |

| 2. Thailand LED Lighting Market Revenues, 2016-2026F ($ Million) |

| 3. Thailand LED Lighting Market - Value Chain |

| 4. Thailand LED Lighting Market - Industry Life Cycle |

| 5. Thailand LED Lighting Market Revenue Share, By Types, 2019 & 2026F |

| 6. Thailand LED Lighting Market Revenue Share, By Applications, 2019 & 2026F |

| 7. Thailand LED Lighting Market Revenue Share, By End User, 2019 & 2026F |

| 8. Thailand LED Lighting Market Revenue Share, By Regions, 2019 & 2026F |

| 9. Thailand LED Lamps Lighting Market Revenues, 2016-2026F ($ Million) |

| 10. Thailand Self-Ballasted LED Lighting Market Revenues, 2016-2026F ($ Million) |

| 11. Thailand Down Lighters LED Lighting Market Revenues, 2016-2026F ($ Million) |

| 12. Thailand Street Light LED Lighting Market Revenues, 2016-2026F ($ Million) |

| 13. Thailand LED Luminaires Lighting Market Revenues, 2016-2026F ($ Million) |

| 14. Thailand Indoor Luminaires LED Lighting Market Revenues, 2016-2026F ($ Million) |

| 15. Thailand Outdoor Luminaires LED Lighting Market Revenues, 2016-2026F ($ Million) |

| 16. Thailand Outdoor LED Lighting Market Revenues, 2016-2026F ($ Million) |

| 17. Thailand Indoor LED Lighting Market Revenues, 2016-2026F ($ Million) |

| 18. Thailand LED Lighting Market Revenues, By Residential Users, 2016-2026F ($ Million) |

| 19. Thailand LED Lighting Market Revenues, By Commercial Users, 2016-2026F ($ Million) |

| 20. Thailand LED Lighting Market Revenues, By Industrial Users, 2016-2026F ($ Million) |

| 21. Thailand LED Lighting Market Revenues, By Regions, 2016-2026F ($ Million) |

| 22. Thailand Actual Government Spending Vs Actual Government Revenues, 2015-2024F (BHT Trillion) |

| 23. Existing Supply by Location, Q4 2019 |

| 24. Bangkok Office New Supply (2018-2022F (Sq M)) |

| 25. Retail Supply by Type as of Q3 2019 |

| 26. Occupancy Rate by Type as of Q4 2019 |

| 27. Nation-wise Tourist Arrival Highlights (Q3 2019 ) |

| 28. Total Upscale Hotel Supply by Grade (H1 2019) |

| 29. Thailand’s International Tourist Arrivals (2015-2022F) |

| 30. Thailand YoY (%) Industrial Production, 2017-2021F |

| 31. Bangkok Condominium Supply, 2016 (Q1) – 2019 (Q4), (Units) |

| 32. Thailand LED Lighting Market Opportunity Assessment, By Regions, 2026F |

| 33. Thailand LED Lighting Market Revenue Ranking, By Company, 2018 |

| 34. Thailand LED Lighting Market – Ansoff Matrix |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero