Turkey Home and Office Furniture Market (2022-2028) | Trends, Value, Revenue, Outlook, Forecast, Size, Analysis, Growth, Industry, Share, Segmentation & COVID-19 IMPACT

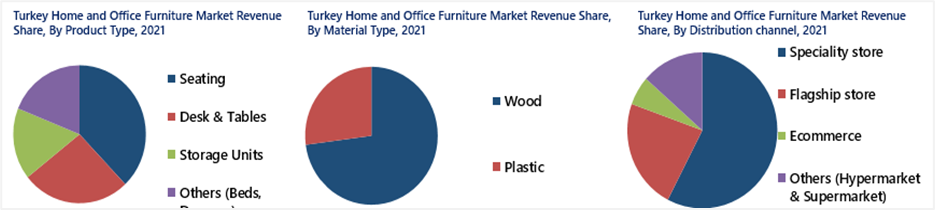

Market Forecast By Material Type (Wood, Plastic), By Product Type (Seating, Table and Desks, Storage Units, Others (Bed, Dressers)), By Distribution Channel (Online, Offline), By Regions (Central, Eastern, Western) and Competitive landscape

| Product Code: ETC4377972 | Publication Date: Jan 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 89 | No. of Figures: 17 | No. of Tables: 10 | |

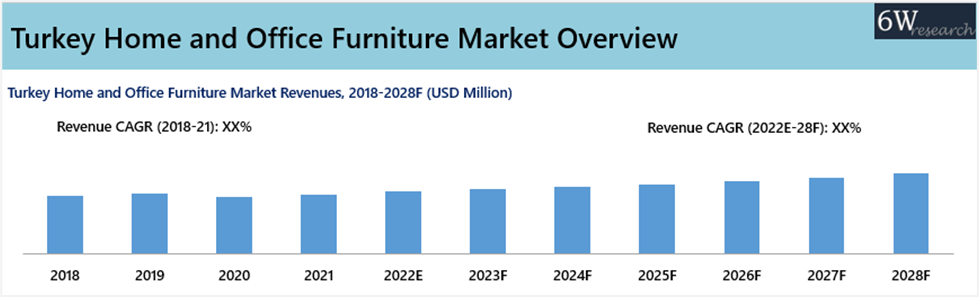

Turkey Home and Office Furniture Market Size & Growth Rate

The Turkey Home and Office Furniture Market is projected to grow at a CAGR of 4.3% during 2022–2028, driven by urbanization, construction projects, and rising demand from the residential and commercial sectors, despite challenges from inflation and economic conditions.

Turkey Home And Office Furniture Market report comprehensively covers the market by Material, by Product, by Distribution Channel, by Regions. Turkey Home and Office Furniture market report provides an unbiased and detailed analysis of the on-going trends, opportunities/high growth areas, market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Turkey Home and Office Furniture Market Synopsis

Turkey Home and Office Furniture market witnessed a significant growth in recent years owing to growing urbanization and construction sector which include development of residential and commercial sector. Furthermore, Turkish Citizenship Programme 1,07,000 properties with a total capital of 54 billion USD has been owned by foreigners during the period of 2020-2021 drive the demand for furniture in the residential sector and various industries. However, Home and Office Furniture market witnessed contraction, in revenues, during 2020 on the account of fall in revenues from the commercial sector, manufacturing and halting of several projects on account of nationwide lockdowns owing to the spread of COVID-19. Further the market is expected a slow growth owing to the on-going economic crises in turkey with rising inflation with 40% due to which prices of raw material or final product would increases.

According to 6wresearch, the Turkey Home and Office Furniture Market revenue size is projected to grow at a CAGR of 4.3% from 2022E-28F. The market would register a slow growth on account of tight financial conditions, high inflation, and exchange rate volatility in Turkey are one of the major reasons which leads to rise in prices of Home and office furniture. However, with upcoming construction project along with rising investment to US$400,000 through turkey citizenship program, would further boost the demand of home and office furniture market.

Market by Product Types

Based on product type, seating segment acquired the highest revenue share in Turkey owing to the larger deployment in domains such as residential, commercial offices, etc as this is the most essential and basic furniture needed in a home or office. Further, the demand would boost up in the coming years on account of several projects such as new office projects are under construction such as Mahall bomonti izmir, cyber–Ankara B Blok and increasing foreign direct investments in housing sector would further augment the demand for seating product type in the forecast period.

Market by Material Type

Based on Material type, wood segment acquired the highest revenue share in Turkey as it is commonly used in all type furniture, such as seating, desk, sofas, beds etc and also with rising demand of sustainable products and with upcoming residential projects would boost the demand of wood furniture in the coming years.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2018 to 2028.

- Base Year: 2021

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Turkey Home and Office Furniture Market Overview

- Turkey Home and Office Furniture Market Outlook

- Turkey Home and Office Furniture Market Forecast

- Turkey Home and Office Furniture Market Ranking, By Companies

- Historical Data and Forecast of Turkey Home and Office Furniture Market Revenues, for the Period 2018-2028F

- Historical Data and Forecast of Turkey Home and Office Furniture Market Revenues, By Material Type, for the Period 2018-2028F

- Historical Data and Forecast of Turkey Home and Office Furniture Market Revenues, By Product Type, for the Period 2018-2028F

- Historical Data and Forecast of Turkey Home and Office Furniture Market Revenues, By Distribution Channel, for the Period 2018-2028F

- Historical Data and Forecast of Turkey Home and Office Furniture Market Revenues, By Regions, for the Period 2018-2028F

- Turkey Home and Office Furniture Market Drivers and Restraints

- Turkey Home and Office Furniture Market Trends

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Market Player’s Revenue Ranking

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Material Type

- Wood

- Plastic

By Product Type

- Seating

- Table and Desks

- Storage Units

- Others (Bed, Dressers)

By Distribution Channel

- Online

- Offline

By Regions

- Central

- Eastern

- Western

Turkey Home and Office Furniture Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Turkey Home & Office Furniture Market Overview |

| 3.1 Turkey Home & Office Furniture Market Overview & revenues (2018-2028F) |

| 3.2 Turkey Home & Office Furniture Market Total Addressable Market & Total Production (2021 and 2022E) |

| 3.3 Turkey Home & Office Furniture Market – Industry Life Cycle |

| 3.4 Turkey Home & Office Furniture Market – SWOT Analysis |

| 4. Impact Analysis of Covid-19 on Turkey Home & Office Furniture Market |

| 5.Turkey Home & Office Furniture Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.2.1 Increasing urbanization and population growth in Turkey leading to a higher demand for home and office furniture. |

| 5.2.2 Growing disposable income levels and changing consumer preferences towards more sophisticated and modern furniture designs. |

| 5.2.3 Expansion of e-commerce platforms providing a convenient way for consumers to purchase furniture online. |

| 5.3 Market Restraints |

| 5.3.1 Economic fluctuations and uncertainties impacting consumer spending on non-essential items like furniture. |

| 5.3.2 Rising raw material costs affecting the overall production and pricing of home and office furniture. |

| 5.3.3 Intense competition among furniture manufacturers and retailers leading to pricing pressures and margin erosion. |

| 6. Turkey Home & Office Furniture Market Trends & Evolution |

| 7. Turkey Home & Office Furniture Market Overview, By Material Type |

| 7.1.Turkey Home & Office Furniture Market Revenues, By Wood, 2018-2028F |

| 7.2. Turkey Home & Office Furniture Market Revenues, By Plastic, 2018-2028F |

| 8. Turkey Home & Office Furniture Market Overview, By Product Type |

| 8.1.Turkey Home & Office Furniture Market Revenues, By Seating, 2018-2028F |

| 8.2. Turkey Home & Office Furniture Market Revenues, By Desk & Tables, 2018-2028F |

| 8.3.Turkey Home & Office Furniture Market Revenues, By Storage Units, 2018-2028F |

| 8.4. Turkey Home & Office Furniture Market Revenues, By Other, 2018-2028F |

| 9. Turkey Home & Office Furniture Market Overview, By Distribution Channel |

| 9.1.Turkey Home & Office Furniture Market Revenues, By Speciality Stores, 2018-2028F |

| 9.2. Turkey Home & Office Furniture Market Revenues, By Flagship Stores, 2018-2028F |

| 9.3.Turkey Home & Office Furniture Market Revenues, By E-commerce , 2018-2028F |

| 9.4. Turkey Home & Office Furniture Market Revenues, By Other, 2018-2028F |

| 10. Turkey Home & Office Furniture Market Overview, By Distribution Channel |

| 10.1.Turkey Home & Office Furniture Market Revenues, By Western, 2018-2028F |

| 10.2. Turkey Home & Office Furniture Market Revenues, By Central, 2018-2028F |

| 10.3.Turkey Home & Office Furniture Market Revenues, By Eastern , 2018-2028F |

| 11. Turkey Home & Office Furniture Market - Key Performance Indicators |

| 12. Turkey Home & Office Furniture Market - Government Initiatives and Regulations |

| 12.1 Turkey Home and Office Furniture Market Government Initiatives and Regulation |

| 13. Turkey Home & Office Furniture Market - Export Statistics |

| 13.1 Key Countries Adopting Turkey Furniture & Export Statistics |

| 13.1 Potential Export Market (2022E) |

| 14. Turkey Home & Office Furniture Market - Manufacturing Analysis |

| 14.1 Turkey Home and Office Furniture Manufacturing Analysis- Assumptions |

| 14.2 Turkey Home and Office Furniture Market- Fixed Expenditure |

| 14.3 Turkey Home and Office Furniture Market- Working Capital |

| 14.4 Turkey Home and Office Furniture Market- Production Cost |

| 14.5 Turkey Home and Office Furniture Market- Production Cost & Break-Even Analysis |

| 14.6 Key Raw Material Suppliers and Product Distributors/Retailers Names to Partnership |

| 15. Turkey Home & Office Furniture Market - Opportunity Assessment |

| 15.1 Turkey Home & Office Furniture Market Opportunity Assessment, By Material Type (2028F) |

| 15.2 Turkey Home & Office Furniture Market Opportunity Assessment, By Product Type (2028F) |

| 15.3 Turkey Home & Office Furniture Market Opportunity Assessment, By Distribution Channel (2028F) |

| 15.4 Turkey Home & Office Furniture Market Opportunity Assessment, By Regions (2028F) |

| 16. Turkey Home & Office Furniture Market - Competitive Landscape |

| 16.1 Turkey Home & Office Furniture Market Revenue Share, By Top 3/5 Companies (2021) |

| 16.2 Turkey Home & Office Furniture Market Companies Competitive Benchmarking by Several Parameters |

| 17. Company Profiles (Top 10) |

| 17.1 Istikbal Furniture Inc. |

| 17.2 IKEA |

| 17.3 Bellona |

| 17.4 Vivense Home and Living |

| 17.5 Casa Furniture |

| 17.6 Lazzoni Furniture |

| 17.7 Fuga Mobilya |

| 17.8 Koleksiyon |

| 17.9 Burotime |

| 17.10 Enza Homes |

| 18. Key Strategic Recommendations |

| 19. Disclaimer |

| List of Figures |

| 1. Turkey Home and Office Furniture Market Revenues, 2018-2028F ($ Million) |

| 2. Istanbul Cumulative Supply Of Grade A Office Space In Gross Leasable Area, 2018- 2020 (Million Sq M) |

| 3. Turkey Rise in Urbanization 2018 – 2030F |

| 4. Turkey per capita Income, 2020 – 2021 (in US$) |

| 5. Turkey Home and Office Furniture Market Revenue Share, By Material Type, 2021 & 2028F |

| 6. Turkey Home and Office Furniture Market Revenue Share, By Product Type, 2021 & 2028F |

| 7. Turkey Home and Office Furniture Market Revenue Share, By Distribution Channel, 2021 & 2028F |

| 8. Turkey Home and Office Furniture Market Revenue Share, By Regions, 2021 & 2028F |

| 9. Turkey Real Estate Sales, 2021 – 2022E (Thousand Units) |

| 10. Top 5 Countries whose citizen bought homes in Turkey, 2021 (Units) |

| 11. Infrastructure Investment current trends & need in Turkey, 2015-40F ($ Billion) |

| 12. Construction permits Use of Building share, Quarter II, 2022 |

| 13. Turkey Home and Office Furniture Market Opportunity Assessment, By Material Type, 2028F |

| 14. Turkey Home and Office Furniture Market Opportunity Assessment, By Product Type, 2028F |

| 15. Turkey Home and Office Furniture Market Opportunity Assessment, By Distribution Channel, 2028F |

| 16. Turkey Home and Office Furniture Market Opportunity Assessment, By Regions, 2028F |

| 17. Turkey Home and Office Furniture Market Revenue Ranking, By Companies, 2021 |

| List of Tables |

| 1. Turkey Upcoming Office Projects, 2022 -2023 |

| 2. Turkey Home and Office Furniture Market Revenue Share, By Material Type, 2018-2028F ($ Million) |

| 3. Turkey Home and Office Furniture Market Revenues, By Product Type, 2018-2028F ($ Million) |

| 4. Turkey Home and Office Furniture Market Revenues, By Distribution Channel, 2018-2028F ($ Million) |

| 5. Turkey Home and Office Furniture Market Revenues, By Regions, 2018-2028F ($ Million) |

| 6. Key Countries Adopted Turkey Home and Office Furniture Products, 2021, (USD Million) |

| 7. Potential Countries to Export, in Home and Office Furniture Market, 2022 |

| 8. Key raw material suppliers in Turkey |

| 9. Distributor and Retailer of Furniture products in Turkey |

| 10. Upcoming Home and Office Skyscrapers in Istanbul |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero