United Arab Emirates (UAE) Air Conditioner (AC) Market (2023-2029) | Outlook, Share, Analysis, Trends, Industry, Value, COVID-19 IMPACT, Growth, Forecast, Companies, Size & Revenue

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others) And Competitive Landscape

| Product Code: ETC090099 | Publication Date: Oct 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Topics Covered in the UAE Air Conditioner Market Report

The UAE Air Conditioner Market report thoroughly covers the market by type and by application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Latest (2024) Development of the United Arab Emirates (UAE) Air Conditioner (AC) Market

United Arab Emirates (UAE) Air Conditioner (AC) Market is poised for major advancements. A surge in urban development projects, coupled with the ongoing expansion of smart cities, is driving the demand for both residential and commercial air conditioning solutions. Innovations in energy-efficient technologies are at the forefront, with manufacturers focusing on eco-friendly refrigerants and smart AC systems that integrate seamlessly with home automation networks.

Additionally, governmental regulations aimed at reducing carbon footprints are encouraging the adoption of greener technologies, thus reshaping the market landscape. The UAE's commitment to sustainability is fostering a competitive market environment which is attracting global players and fostering local innovation.

UAE Air Conditioner Market Synopsis

UAE Air Conditioner Market has accomplished major success and is projected to attain more in the coming years on the back of the extreme climate conditions, faster urbanization and construction, technological advancements, rising income levels, as well as rising population and tourism industry. The market is also going through certain challenges that can hamper its growth to a certain extent in the near future.

According to 6Wresearch, the UAE Air Conditioner Market size is expected to grow at a significant CAGR of 4.6% during the forecast period 2023-2029. The United Arab Emirates is experiencing extremely hot as well as arid climates and this factor drives a high demand for air conditioning systems since they are crucial for maintaining comfortable indoor temperatures. The country has witnessed faster urbanization as well as a surge in construction activities such as commercial, residential, and industrial projects. This is leading to a high demand for air conditioning systems in the development of new buildings. The country’s growing population and tourism sector have resulted in a higher surge for housing, hospitality, as well as commercial spaces, all of which need well-organized air conditioning systems. The industry is influenced by constant innovations, which is leading to the development of more energy-efficient as well as eco-friendly systems. Consumers in the market are increasingly opting for, smart, modern and energy-efficient air conditioners. The country’s government has implemented many initiatives in order to promote energy efficiency as well as sustainability, including regulations and incentives. These factors will influence the UAE Air Conditioner Market Growth.

Air conditioners are significant consumers of electricity, and high energy consumption may lead to increased utility bills, this is a major concern in the UAE, where energy costs are an essential consideration for both consumers and businesses. The environmental impact of the air conditioning systems, particularly in terms of refrigerants used, is a rising concern. The rising surge for air conditioners is highly seasonal, with peak demand occurring during the summer months and this can lead to obstacles in production planning and inventory management for manufacturers and retailers.

UAE Air Conditioner Industry: Leading Players

One of the significant players in the UAE air conditioner market is Daikin, a subsidiary of the Japanese multinational Daikin Industries. The player has earned a major market share in the country, offering a wide range of air conditioning products and advanced technology. Gree Electric Appliances Inc. is another leading Chinese manufacturer of air conditioning products. Gree is well-known for its reliable and innovative brand, and it offers a variety of air conditioning solutions. Carrier Corporation, a subsidiary of United Technologies Corporation, is a leading player in the nation. This key player has a long history of offering HVAC solutions and has a significant presence in the United Arab Emirates market.

Air Conditioner Market in UAE: Government Regulations

The air conditioner market in the United Arab Emirates (UAE), which is an essential part of the Middle East Air Conditioner Market is subject to many government regulations aimed at ensuring energy efficiency, consumer safety, and environmental sustainability. These regulations play an essential role in shaping the industry as well as influencing the types of air conditioning systems available in the industry. The government in the country has introduced energy efficiency standards and labels for air conditioning units and these standards need manufacturers to produce and import energy-efficient products. In Dubai, the government has implemented regulations linked to green building standards and these government regulations often need the installation of energy-efficient air conditioning systems. The UAE government has implemented regulations for the use of refrigerants in air conditioning systems. A number of regulations concern phasing out the use of ozone-depleting substances and transitioning to more environmentally friendly refrigerants.

Market Segmentation by Type

According to Dhaval, Research Manager, 6Wresearch, the centralized air conditioner segment dominated this industry. The segment which will grow in the coming years is the ducted air conditioners since they will grow more in demand.

Market Segmentation by Application

On the basis of application, the commercial sector is projected to attain growth and it is due to the many initiatives taken by the government of the country to strengthen the country's infrastructure with rising construction projects such as corporate offices, shopping malls, and educational institutions.

Key Attractiveness of the Report:

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- UAE Air Conditioner Market Outlook

- Market Size of UAE Air Conditioner Market, 2022

- Forecast of UAE Air Conditioner Market, 2029

- Historical Data and Forecast of UAE Air Conditioner Revenues & Volume for the Period 2019-2029

- UAE Air Conditioner Market Trend Evolution

- UAE Air Conditioner Market Drivers and Challenges

- UAE Air Conditioner Price Trends

- UAE Air Conditioner Porter's Five Forces

- UAE Air Conditioner Industry Life Cycle

- Historical Data and Forecast of UAE Air Conditioner Market Revenues & Volume by Type for the Period 2019-2029

- Historical Data and Forecast of UAE Air Conditioner Market Revenues & Volume by Room Air Conditioner for the Period 2019-2029

- Historical Data and Forecast of UAE Air Conditioner Market Revenues & Volume by Ducted Air Conditioner for the Period 2019-2029

- Historical Data and Forecast of UAE Air Conditioner Market Revenues & Volume by Ductless Air Conditioner for the Period 2019-2029

- Historical Data and Forecast of UAE Air Conditioner Market Revenues & Volume by Centralized Air Conditioner for the Period 2019-2029

- Historical Data and Forecast of UAE Air Conditioner Market Revenues & Volume by Application for the Period 2019-2029

- Historical Data and Forecast of UAE Air Conditioner Market Revenues & Volume by Residential for the Period 2019-2029

- Historical Data and Forecast of UAE Air Conditioner Market Revenues & Volume by Healthcare for the Period 2019-2029

- Historical Data and Forecast of UAE Air Conditioner Market Revenues & Volume by Commercial & Retail for the Period 2019-2029

- Historical Data and Forecast of UAE Air Conditioner Market Revenues & Volume by Transportation & Infrastructure for the Period 2019-2029

- Historical Data and Forecast of UAE Air Conditioner Market Revenues & Volume by Hospitality for the Period 2019-2029

- Historical Data and Forecast of UAE Air Conditioner Market Revenues & Volume by Others for the Period 2019-2029

- UAE Air Conditioner Import Export Trade Statistics

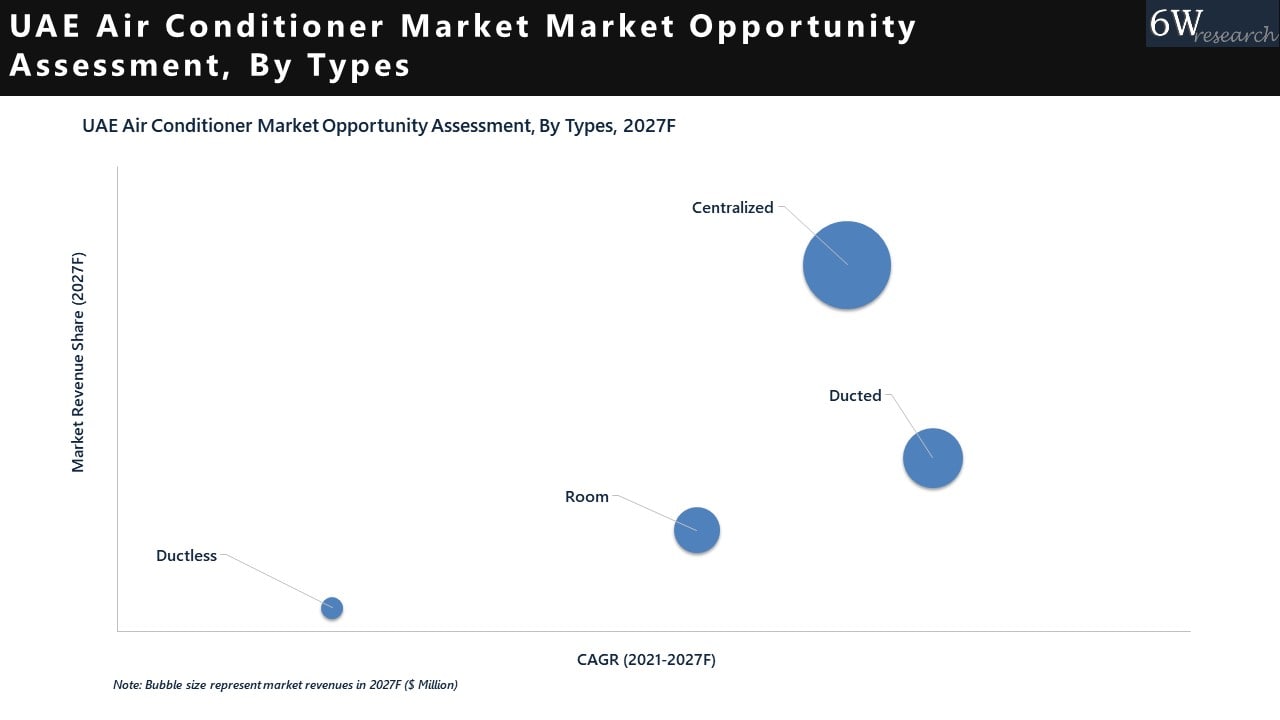

- Market Opportunity Assessment by Type

- Market Opportunity Assessment by Application

- UAE Air Conditioner Top Companies Market Share

- UAE Air Conditioner Competitive Benchmarking by Technical and Operational Parameters

- UAE Air Conditioner Company Profiles

- UAE Air Conditioner Key Strategic Recommendations

Market Covered

By Type

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Application

- Residential

- Healthcare

- Commercial & Retail

- Transportation & Infrastructure

- Hospitality

- Others

United Arab Emirates (UAE) Air Conditioner (AC) Market (2023-2029): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 United Arab Emirates (UAE) Air Conditioner Market Overview |

| 3.1 United Arab Emirates (UAE) Country Macro Economic Indicators |

| 3.2 United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume, 2022 & 2029F |

| 3.3 United Arab Emirates (UAE) Air Conditioner Market - Industry Life Cycle |

| 3.4 United Arab Emirates (UAE) Air Conditioner Market - Porter's Five Forces |

| 3.5 United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume Share, By Type, 2022 & 2029F |

| 3.6 United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume Share, By Application, 2022 & 2029F |

| 4 United Arab Emirates (UAE) Air Conditioner Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Growth in construction activities and infrastructure development in the UAE |

| 4.2.2 Increasing disposable income and urbanization leading to higher demand for air conditioners |

| 4.2.3 Hot climate in the region driving the need for air conditioning solutions |

| 4.3 Market Restraints |

| 4.3.1 Fluctuations in oil prices impacting consumer spending and economic growth |

| 4.3.2 Competition from other cooling technologies such as evaporative coolers and fans |

| 4.3.3 High initial cost and maintenance expenses associated with air conditioners |

| 5 United Arab Emirates (UAE) Air Conditioner Market Trends |

| 6 United Arab Emirates (UAE) Air Conditioner Market, By Types |

| 6.1 United Arab Emirates (UAE) Air Conditioner Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume, By Type, 2019 - 2029F |

| 6.1.3 United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume, By Room Air Conditioner, 2019 - 2029F |

| 6.1.4 United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume, By Ducted Air Conditioner, 2019 - 2029F |

| 6.1.5 United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume, By Ductless Air Conditioner, 2019 - 2029F |

| 6.1.6 United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume, By Centralized Air Conditioner, 2019 - 2029F |

| 6.2 United Arab Emirates (UAE) Air Conditioner Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume, By Residential, 2019 - 2029F |

| 6.2.3 United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume, By Healthcare, 2019 - 2029F |

| 6.2.4 United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume, By Commercial & Retail, 2019 - 2029F |

| 6.2.5 United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume, By Transportation & Infrastructure, 2019 - 2029F |

| 6.2.6 United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume, By Hospitality, 2019 - 2029F |

| 6.2.7 United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume, By Others, 2019 - 2029F |

| 7 United Arab Emirates (UAE) Air Conditioner Market Import-Export Trade Statistics |

| 7.1 United Arab Emirates (UAE) Air Conditioner Market Export to Major Countries |

| 7.2 United Arab Emirates (UAE) Air Conditioner Market Imports from Major Countries |

| 8 United Arab Emirates (UAE) Air Conditioner Market Key Performance Indicators |

| 9 United Arab Emirates (UAE) Air Conditioner Market - Opportunity Assessment |

| 9.1 United Arab Emirates (UAE) Air Conditioner Market Opportunity Assessment, By Type, 2022 & 2029F |

| 9.2 United Arab Emirates (UAE) Air Conditioner Market Opportunity Assessment, By Application, 2022 & 2029F |

| 10 United Arab Emirates (UAE) Air Conditioner Market - Competitive Landscape |

| 10.1 United Arab Emirates (UAE) Air Conditioner Market Revenue Share, By Companies, 2022 |

| 10.2 United Arab Emirates (UAE) Air Conditioner Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others) And Competitive Landscape

| Product Code: ETC090099 | Publication Date: Aug 2021 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

United Arab Emirates (UAE) Air Conditioner (AC) Market is projected to grow over the coming years. United Arab Emirates (UAE) Air Conditioner (AC) Market report is a part of our periodical regional publication Middle East Air Conditioner (AC) Market outlook report. 6W tracks air conditioner market for over 60 countries with individual country-wise market opportunity assessment and publishes with the report titled Global Air Conditioner (AC) Market outlook report annually.

United Arab Emirates (UAE) Air conditioner (AC) Market report comprehensively covers the market type and application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

United Arab Emirates (UAE) Air Conditioner Market Synopsis

United Arab Emirates (UAE) Air Conditioner Market is anticipated to register substantial growth during the upcoming years owing to the rising standard of living coupled with increasing disposable income. Rise in per capita income of people drives the improved lifestyle leading to increased usage of Air Conditioner further contribute to the development of the market. Government’s continuous initiatives for infrastructure development is also driving the growth of the market.

According to 6Wresearch, United Arab Emirates (UAE) Air Conditioner (AC) Market size is projected to grow at a CAGR of 4.3% during 2021-2027. UAE occupies 2nd position in terms of the market size in the Middle East Air Conditioner Market. Strengthening of construction sector coupled with increasing establishment of government offices, private complex, shopping malls and hotels is driving the growth of the market. Additionally, the rising development in hospitality sector is also booming the growth of the market. The market suffered a major setback due to the outburst of COVID-19 leading to the disruption in supply chain of the market. Nationwide lockdown led to the closure of manufacturing units and shutting down of retail stores as well, further leading to the negative growth of the market.

In terms of market by types, Centralized Air Conditioner dominates the market and is expected to remain in a dominant position in the coming years. However, Ducted Air Conditioner is expected to have the fastest growth rate among all types.

In terms of application, Commercial & Retail segment dominates the market and is expected to remain in a dominant position in the coming years. However, Hospitality is expected to have the fastest growth rate among all applications.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- United Arab Emirates (UAE) Air Conditioner Market Outlook

- Market Size of United Arab Emirates (UAE) Air Conditioner Market, 2020

- Forecast of United Arab Emirates (UAE) Air Conditioner Market, 2027

- Historical Data and Forecast of United Arab Emirates (UAE) Air Conditioner Revenues & Volume for the Period 2017 - 2027

- United Arab Emirates (UAE) Air Conditioner Market Trend Evolution

- United Arab Emirates (UAE) Air Conditioner Market Drivers and Challenges

- United Arab Emirates (UAE) Air Conditioner Price Trends

- United Arab Emirates (UAE) Air Conditioner Porter's Five Forces

- United Arab Emirates (UAE) Air Conditioner Industry Life Cycle

- Historical Data and Forecast of United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume By Type for the Period 2017 - 2027

- Historical Data and Forecast of United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume By Application for the Period 2017 - 2027

- Historical Data and Forecast of United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume By Healthcare for the Period 2017 - 2027

- Historical Data and Forecast of United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2017 - 2027

- Historical Data and Forecast of United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2017 - 2027

- Historical Data and Forecast of United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume By Hospitality for the Period 2017 - 2027

- Historical Data and Forecast of United Arab Emirates (UAE) Air Conditioner Market Revenues & Volume By Others for the Period 2017 - 2027

- United Arab Emirates (UAE) Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- United Arab Emirates (UAE) Air Conditioner Top Companies Market Share

- United Arab Emirates (UAE) Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- United Arab Emirates (UAE) Air Conditioner Company Profiles

- United Arab Emirates (UAE) Air Conditioner Key Strategic Recommendations

Market Segmentation:

The report provides a detailed analysis of the following market segments:

- By Types:

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

- By Application:

- Residential

- Commercial & Retail

- Healthcare

- Hospitality

- Transportation & Infrastructure

- Others

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero