United Kingdom Air Conditioner Market (2025-2031) | Companies, Analysis, Revenue, Trends, Size, Industry, Share, Value, Outlook, Growth & Forecast

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others) And Competitive Landscape

| Product Code: ETC090068 | Publication Date: Dec 2023 | Updated Date: Sep 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

United Kingdom Air Conditioner Market Growth Rate

According to 6Wresearch internal database and industry insights, the United Kingdom Air Conditioner Market is projected to grow at a compound annual growth rate (CAGR) of 5.7% during the forecast period 2025-2031.

| Report Name | United Kingdom Air Conditioner Market |

| Forecast Period | 2025-2031 |

| CAGR | 5.7% |

| Growing Sector | Residential & Hospitality |

Topics Covered in the United Kingdom Air Conditioner Market Report

The United Kingdom Air Conditioner Market report thoroughly covers the market by Type, and by applications. The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders to devise and align their market strategies according to the current and future market dynamics.

United Kingdom Air Conditioner Market Synopsis

United Kingdom Air Conditioner Market is experiencing moderate growth over past few years. Air conditioners are categorized into room units and ductless splits to ducted and centralized systems are increasingly deployed across residential apartments, retail formats, hotels, healthcare facilities, transport hubs, and data-intensive workplaces. The focus is emphasizing on inverter technology, smart controls, and low-GWP refrigerants is further supporting market expansion.

Evaluation of Growth Drivers in the United Kingdom Air Conditioner Market

There are some major drivers and their influence to the market dynamics:

|

Driver |

Primary Segments Affected |

Why it matters (evidence) |

|

Heatwaves & Warmer Summers |

Room & Ductless; Residential, Hospitality |

More frequent hot spells drive first-time adoption and upgrades to maintain comfort and protect revenue in homes and hotels. |

|

Building Energy Retrofits & MEES |

Ductless/VRF & Ducted; Commercial & Retail |

Efficiency rules and EPC targets push replacement of legacy systems with high-SEER inverter units to cut bills and meet compliance. |

|

Healthcare & IAQ Priorities |

Centralized, Ducted & Ductless; Healthcare, Education |

Enhanced filtration and ventilation integration raise demand for systems delivering clean, controlled indoor environments. |

|

Data Center & Edge Expansion |

Centralized & Ducted; Commercial (IT & Offices) |

Growth in digital infrastructure elevates precision cooling and redundancy requirements across facilities nationwide. |

|

Tourism & Events Footfall |

Ductless & Ducted; Hospitality, Transportation & Infrastructure |

Venue and hotel refurbishments adopt scalable cooling with remote monitoring for uptime and guest comfort. |

United Kingdom Air Conditioner Market size is anticipated to expand at the substantial CAGR of 5.7% during the forecast period of 2025-2031. The expansion of market is propelled by first-time adoption in homes, energy-efficient retrofits in commercial spaces, and replacement cycles favouring inverter-based systems. Also, the renewal of aging public and private buildings and growth in heat-sensitive sectors are disrupting the growth of market such as healthcare and data services are accelerating the installations.

Evaluation of Restraints in the United Kingdom Air Conditioner Market

Below mentioned are some major restraints and their influence to the market dynamics:

|

Restraint |

Primary Segments Affected |

What this means (evidence) |

|

F-Gas Phase-Down & Low-GWP Transition |

New installs; all Types |

Shares and refrigerant changes raise compliance costs and require technician certification and retooling. |

|

High Electricity Prices |

Residential & Small Commercial |

Operating cost sensitivity delays purchases or shifts demand to premium high-efficiency models and smart controls. |

|

Planning/Noise Restrictions |

Residential & Mixed-use Areas |

Outdoor unit placement and acoustic limits constrain installations in dense and heritage zones. |

|

Seasonal Demand Volatility |

Room & Portable; E-commerce/Retail |

Heatwave-driven spikes strain supply chains and cause short-term price volatility. |

|

Skilled Installer Shortage |

Ducted & Centralized; Large Projects |

Limited specialist labour lengthens project timelines and increases installed costs. |

United Kingdom Air Conditioner Market Challenges

There are numbers of the obstacles in the market which include navigating refrigerant phase-downs alongside the need for rapid technician retraining, to balance the upfront price premiums of inverter and low-GWP systems with payback expectations, and addressing constraints in older buildings where space, electrical capacity, and façade rules complicate outdoor unit placement. Distributors also face inventory risk amid seasonal demand variability and evolving compliance requirements.

United Kingdom Air Conditioner Market Trends

Some strong trends are observed in the market include:

Inverter & VRF Penetration: Rapid shift from fixed-speed units to inverter splits and VRF for higher efficiency, precise comfort, and lower lifecycle costs.

Low-GWP Refrigerants: Transition from legacy blends to R32/R454B and emerging natural options, reducing environmental impact and futureproofing assets.

Smart & Connected Controls: Rising adoption of Wi-Fi/BMS-enabled systems for predictive maintenance, energy optimization, and multi-site fleet oversight.

Hybrid Heating & Cooling: Increasing selection of heat-pump-ready AC solutions to deliver year-round comfort with lower emissions.

Compact & Retrofit-Friendly Designs: Slim outdoor units, modular indoor cassettes, and concealed ducted options tailored to the UK’s retrofit-heavy stock.

Investment Opportunities in the United Kingdom Air Conditioner Industry

There are various investment opportunities in the market which include:

High-Efficiency Ductless Expansion - Scale inverter mini-split and multi-split portfolios targeting space-constrained residential and high-street retail retrofits.

VRF for Commercial Refurbishments - Provide design-build services for offices, healthcare, and education estates seeking efficient, low-disruption upgrades.

Cooling-as-a-Service – Delivers the subscription models bundling equipment, monitoring, and maintenance to reduce capex barriers for SMEs and hospitality chains.

Low-GWP Refrigerant Services - Invest in recovery, reclamation, and technician training centres to support compliant transitions and aftermarket revenues.

Smart Energy Integration - Develop AC systems compatible with demand response and dynamic tariffs to unlock operating cost savings.

Top 5 Leading Players in the United Kingdom Air Conditioner Market

Those leading players dominate the market include:

1. Daikin Industries, Ltd.

| Company Name | Daikin Industries, Ltd. |

| Established Year | 1924 |

| Headquarters | Osaka, Japan |

| Official Website | Click Here |

This company provides the wide portfolio spanning room ACs, multi-split, and VRV/VRF systems with strong UK presence in residential and commercial retrofit solutions.

2. Mitsubishi Electric Corporation

| Company Name | Mitsubishi Electric Corporation |

| Established Year | 1921 |

| Headquarters | Tokyo, Japan |

| Official Website | Click Here |

This company supplies energy-efficient room, ductless, and VRF systems widely adopted across UK homes, offices, and public sector estates.

3. Toshiba Carrier Corporation

| Company Name | Toshiba Carrier Corporation |

| Established Year | 1999 |

| Headquarters | Tokyo, Japan |

| Official Website | Click Here |

This company provides inverter-driven split and VRF technologies with a focus on quiet operation and low-GWP readiness for UK retrofit markets.

4. LG Electronics Inc.

| Company Name | LG Electronics Inc. |

| Established Year | 1958 |

| Headquarters | Seoul, South Korea |

| Official Website | Click Here |

This company delivers residential and light-commercial split& multi-split systems and control platforms, emphasizing energy savings and compact design for UK sites.

5. Johnson Controls International plc (YORK)

| Company Name | Johnson Controls International plc (YORK) |

| Established Year | 1885 |

| Headquarters | Cork, Ireland |

| Official Website | Click Here |

Johnson Controls (YORK) provides centralized and ducted solutions for large commercial facilities, integrating building controls and service capabilities.

Government Regulations Introduced in the United Kingdom Air Conditioner Market

According to United Kingdom government data, several initiatives have been introduced in United Kingdom Air Conditioner Market aimed at reducing carbon emissions and improving energy efficiency in buildings. The UK’s retained F-Gas regime continues to phase down high-GWP refrigerants, steering the market toward lower-GWP alternatives and certified handling. For instance, updates to Building Regulations (Part L and Part F) promote better building fabric and ventilation, encouraging deployment of high-efficiency AC and heat-pump-ready systems in refurbishments. Minimum Energy Efficiency Standards (MEES) for rented properties incentivize landlords to upgrade old cooling systems to improve EPC ratings.

Future Insights of the United Kingdom Air Conditioner Market

The future of United Kingdom Air Conditioner Market share is estimated to rise in the coming years. This industry is supported by hotter summers, deep retrofit cycles, and digitization of building operations. Low-GWP transitions are widely used of connected controls, and alignment with decarbonization goals will favour premium, inverter-based solutions. Growth will also be underpinned by multi-site retail and hospitality rollouts, healthcare capacity additions, and cooling needs in data-rich workplaces.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Ductless Air Conditioner to Dominate the Market- By Type

According to Parth, Senior Research Analyst, 6Wresearch, the Ductless air conditioner is likely to dominate the market. Retrofitting constraints in existing housing stock, heritage façades, and limited ceiling voids make wall-mounted and multi-split solutions the preferred choice. Inverter mini-splits is also gaining traction with quiet operation, zoning, and strong seasonal efficiency.

Residential to Dominate the Market- By Applications

Residential segment is expected to hold the largest United Kingdom Air Conditioner Market Share, propelled by first-time adoption during hotter summers and replacement of portable units with efficient split systems. Homeowners prioritize comfort, noise reduction, and smart controls, while developers and landlords pursue EPC improvements.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- United Kingdom Air Conditioner Market Outlook

- Market Size of United Kingdom Air Conditioner Market, 2024

- Forecast of United Kingdom Air Conditioner Market, 2031

- Historical Data and Forecast of United Kingdom Air Conditioner Revenues & Volume for the Period 2021 - 2031

- United Kingdom Air Conditioner Market Trend Evolution

- United Kingdom Air Conditioner Market Drivers and Challenges

- United Kingdom Air Conditioner Price Trends

- United Kingdom Air Conditioner Porter's Five Forces

- United Kingdom Air Conditioner Industry Life Cycle

- Historical Data and Forecast of United Kingdom Air Conditioner Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Air Conditioner Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Air Conditioner Market Revenues & Volume By Residential for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Air Conditioner Market Revenues & Volume By Healthcare for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Air Conditioner Market Revenues & Volume By Hospitality for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Air Conditioner Market Revenues & Volume By Others for the Period 2021 - 2031

- United Kingdom Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- United Kingdom Air Conditioner Top Companies Market Share

- United Kingdom Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- United Kingdom Air Conditioner Company Profiles

- United Kingdom Air Conditioner Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Applications

- Residential

- Healthcare

- Commercial & Retail

- Transportation & Infrastructure

- Hospitality

- Others

United Kingdom Air Conditioner Market (2025-2031): FAQ's

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 United Kingdom Air Conditioner Market Overview |

| 3.1 United Kingdom Air Conditioner Market Revenues & Volume, 2021 - 2031F |

| 3.2 United Kingdom Air Conditioner Market - Industry Life Cycle |

| 3.3 United Kingdom Air Conditioner Market - Porter's Five Forces |

| 3.4 United Kingdom Air Conditioner Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.5 United Kingdom Air Conditioner Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 4 United Kingdom Air Conditioner Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for energy-efficient air conditioners due to growing environmental concerns and government regulations. |

| 4.2.2 Rising temperatures and heatwaves in the United Kingdom driving the need for air conditioning units. |

| 4.2.3 Technological advancements leading to the development of smart and connected air conditioners. |

| 4.2.4 Growing construction activities and infrastructure development boosting the demand for air conditioning systems. |

| 4.3 Market Restraints |

| 4.3.1 High initial costs associated with purchasing and installing air conditioning units. |

| 4.3.2 Seasonal demand fluctuations impacting sales and revenue. |

| 4.3.3 Dependency on electricity supply and potential energy consumption concerns. |

| 4.3.4 Limited awareness and adoption of energy-efficient air conditioning solutions among consumers. |

| 5 United Kingdom Air Conditioner Market Trends |

| 6 United Kingdom Air Conditioner Market Segmentation |

| 6.1 United Kingdom Air Conditioner Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 United Kingdom Air Conditioner Market Revenues & Volume, By Type, 2021 - 2031F |

| 6.1.3 United Kingdom Air Conditioner Market Revenues & Volume, By Room Air Conditioner, 2021 - 2031F |

| 6.1.4 United Kingdom Air Conditioner Market Revenues & Volume, By Ducted Air Conditioner, 2021 - 2031F |

| 6.1.5 United Kingdom Air Conditioner Market Revenues & Volume, By Ductless Air Conditioner, 2021 - 2031F |

| 6.1.6 United Kingdom Air Conditioner Market Revenues & Volume, By Centralized Air Conditioner, 2021 - 2031F |

| 6.2 United Kingdom Air Conditioner Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 United Kingdom Air Conditioner Market Revenues & Volume, By Residential, 2021 - 2031F |

| 6.2.3 United Kingdom Air Conditioner Market Revenues & Volume, By Healthcare, 2021 - 2031F |

| 6.2.4 United Kingdom Air Conditioner Market Revenues & Volume, By Commercial & Retail, 2021 - 2031F |

| 6.2.5 United Kingdom Air Conditioner Market Revenues & Volume, By Transportation & Infrastructure, 2021 - 2031F |

| 6.2.6 United Kingdom Air Conditioner Market Revenues & Volume, By Hospitality, 2021 - 2031F |

| 6.2.7 United Kingdom Air Conditioner Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 United Kingdom Air Conditioner Market Import-Export Trade Statistics |

| 7.1 United Kingdom Air Conditioner Market Export to Major Countries |

| 7.2 United Kingdom Air Conditioner Market Imports from Major Countries |

| 8 United Kingdom Air Conditioner Market Key Performance Indicators |

| 8.1 Energy efficiency ratings of air conditioning units sold in the UK market. |

| 8.2 Adoption rate of smart and connected air conditioning systems. |

| 8.3 Number of new construction projects incorporating air conditioning systems with environmentally friendly refrigerants. |

| 8.4 Percentage of households or commercial buildings equipped with air conditioning systems. |

| 9 United Kingdom Air Conditioner Market - Opportunity Assessment |

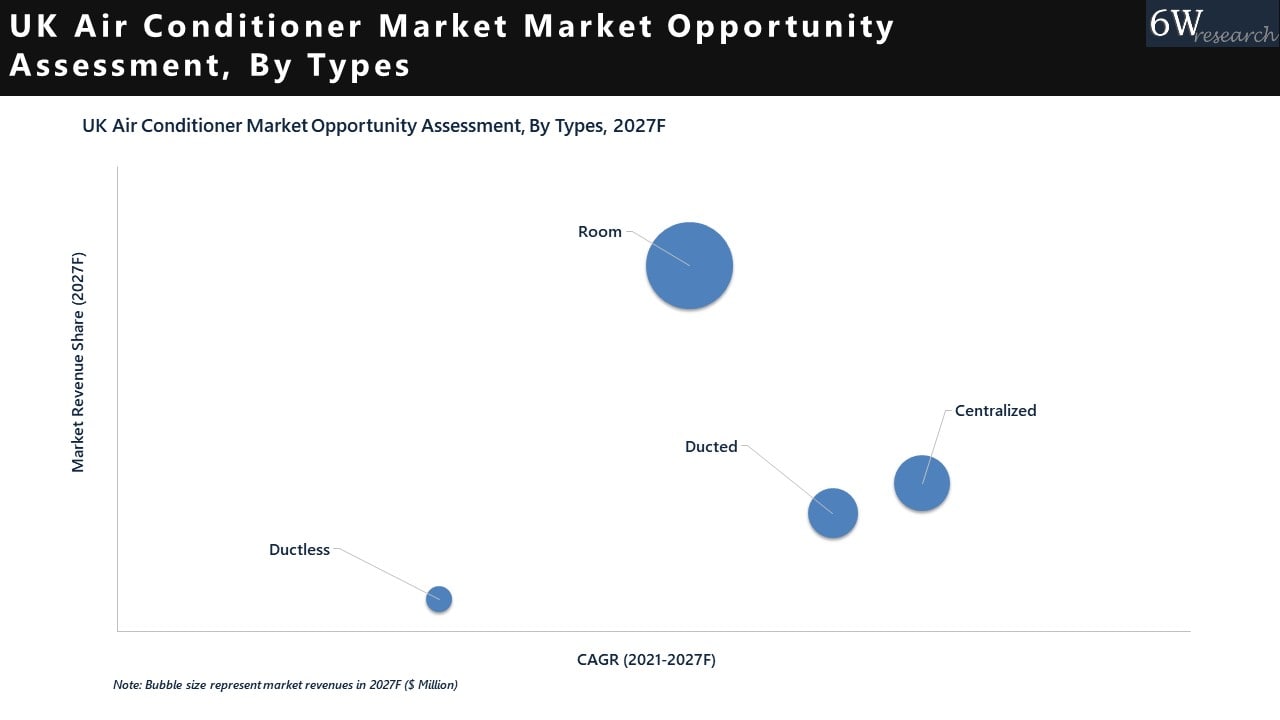

| 9.1 United Kingdom Air Conditioner Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 United Kingdom Air Conditioner Market Opportunity Assessment, By Application, 2021 & 2031F |

| 10 United Kingdom Air Conditioner Market - Competitive Landscape |

| 10.1 United Kingdom Air Conditioner Market Revenue Share, By Companies, 2024 |

| 10.2 United Kingdom Air Conditioner Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others) And Competitive Landscape

| Product Code: ETC090068 | Publication Date: Aug 2021 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

United Kingdom (UK) Air Conditioner (AC) Market is projected to grow over the coming years. United Kingdom (UK) Air Conditioner (AC) Market report is a part of our periodical regional publication Europe Air Conditioner (AC) Market outlook report. 6W tracks air conditioner market for over 60 countries with individual country-wise market opportunity assessment and publishes with the report titled Global Air Conditioner (AC) Market outlook report annually.

United Kingdom (UK) Air conditioner (AC) Market report comprehensively covers the market type and application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

United Kingdom (UK) Air Conditioner (AC) Market Synopsis

United Kingdom Air Conditioner Market is anticipated to generate sound revenues on account of rising stability of income especially among middle class. The increasing per capita income of European people beholds the increasing growth of the market. The market is also driven by increasing urbanization, construction activities and infrastructure development. Moreover, soaring temperature and unfavorable weather conditions are likely to further trigger the potential growth of the market. Adoption of Air conditioner as a level of comfort backed by rising standard of living beholds the growth of the market.

According to 6Wresearch, United Kingdom Air Conditioner (AC) Market size is projected to grow at a CAGR of 4.5% during 2021-2027. United Kingdom occupies 5th position in terms of the market size in the Europe Air Conditioner Market. Increasing development of infrastructure backed by establishment of offices, private complex and shopping malls is driving the increasing growth of the market. Rising level of humidity also adds to the growth of the market. However, the outbreak of COVID-19 has impacted the growth of the market owing to the lack of funds. Nationwide lockdown acted as a hindrance in the growth of the market backed by shutting down of manufacturing units and retail stores.

Market Analysis by Type

In terms of market by types, Room Air Conditioner dominates the market and is expected to remain in a dominant position in the coming years. However, Centralized Air Conditioner is expected to have the fastest growth rate among all types.

Market Analysis by Application

In terms of application, Residential dominates the market and is expected to remain in a dominant position in the coming years. However, Commercial & Retail is expected to have the fastest growth rate among all applications.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- United Kingdom (UK) Air Conditioner Market Outlook

- Market Size of United Kingdom (UK) Air Conditioner Market, 2020

- Forecast of United Kingdom (UK) Air Conditioner Market, 2027

- Historical Data and Forecast of United Kingdom (UK) Air Conditioner Revenues & Volume for the Period 2017 - 2027

- United Kingdom (UK) Air Conditioner Market Trend Evolution

- United Kingdom (UK) Air Conditioner Market Drivers and Challenges

- United Kingdom (UK) Air Conditioner Price Trends

- United Kingdom (UK) Air Conditioner Porter's Five Forces

- United Kingdom (UK) Air Conditioner Industry Life Cycle

- Historical Data and Forecast of United Kingdom (UK) Air Conditioner Market Revenues & Volume By Type for the Period 2017 - 2027

- Historical Data and Forecast of United Kingdom (UK) Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of United Kingdom (UK) Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of United Kingdom (UK) Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of United Kingdom (UK) Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of United Kingdom (UK) Air Conditioner Market Revenues & Volume By Application for the Period 2017 - 2027

- Historical Data and Forecast of United Kingdom (UK) Air Conditioner Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of United Kingdom (UK) Air Conditioner Market Revenues & Volume By Healthcare for the Period 2017 - 2027

- Historical Data and Forecast of United Kingdom (UK) Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2017 - 2027

- Historical Data and Forecast of United Kingdom (UK) Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2017 - 2027

- Historical Data and Forecast of United Kingdom (UK) Air Conditioner Market Revenues & Volume By Hospitality for the Period 2017 - 2027

- Historical Data and Forecast of United Kingdom (UK) Air Conditioner Market Revenues & Volume By Others for the Period 2017 - 2027

- United Kingdom (UK) Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- United Kingdom (UK) Air Conditioner Top Companies Market Share

- United Kingdom (UK) Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- United Kingdom (UK) Air Conditioner Company Profiles

- United Kingdom (UK) Air Conditioner Key Strategic Recommendations

Market Segmentation:

The report provides a detailed analysis of the following market segments:

- By Types:

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

- By Application:

- Residential

- Commercial & Retail

- Healthcare

- Hospitality

- Transportation & Infrastructure

- Others

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero