US Air Conditioner Market (2025-2031) | Analysis, Size, Share, Revenue, Growth, Industry, Forecast, Trends

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others) And Competitive Landscape

| Product Code: ETC090060 | Publication Date: Dec 2023 | Updated Date: Sep 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 3 | |

US Air Conditioner Market Growth Rate

According to 6Wresearch internal database and industry insights, The US Air Conditioner Market is expected to register a compound annual growth rate (CAGR) of 6.4% during the forecast period (2025-2031).

| Report Name | US Air Conditioner Market |

| Forecast Period | 2025-2031 |

| CAGR | 6.4% |

| Growing Sector | Residential & Commercial |

Topics Covered in the US Air Conditioner Market Report

The US Air Conditioner Market report thoroughly covers the market by types and applications. The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders to devise and align their market strategies according to the current and future market dynamics.

US Air Conditioner Market Synopsis

United States air conditioner market has been substantially growing, influenced by various factors such as climate variations, high population growth, and technological advancements. Key trends include a growing demand for energy efficiency, and increasing awareness of environmental sustainability. Also, the changing lifestyle has increased demand for smart air conditioners that can be controlled remotely through smartphones. These ongoing developments have burgeoned the United States Air Conditioner (AC) Market revenue in the upcoming years.

Evaluation of Growth Drivers in the US Air Conditioner Market

|

Driver |

Primary Segments Affected |

Why it matters (evidence) |

|

Rising Urbanization & Housing Demand |

Residential, Room AC & Ductless AC |

Rapid construction of housing complexes across urban and suburban areas drives demand for affordable and efficient cooling solutions. |

|

Healthcare Infrastructure Expansion |

Healthcare, Centralized AC |

The development of hospitals and medical facilities requires constant climate control, spurring demand for centralized and ducted AC systems. |

|

Growing Commercial Real Estate |

Commercial & Retail, Hospitality |

Rapid growth in office spaces, malls, and hotels increases demand for large-scale ducted and centralized AC solutions. |

|

Technological Advancements |

All types |

Wide spread Adoption of inverter technology, smart sensors, and IoT-enabled AC units enhances energy efficiency and consumer convenience. |

|

Heatwaves & Climate Change |

Residential & Commercial |

Increasing frequency of heatwaves in the US boosts the need for air conditioning as a necessity, not just a luxury. |

United States (US) Air Conditioner (AC) Market size is estimated to grow at a CAGR of 6.4% during the forecast period 2025-2031. This growth is underpinned by several ongoing latest developments & factors are high temperatures and changes in climate patterns. Furthermore, due to high competition in the market companies have started developing advanced technology air conditioners for efficient performance. Additionally, the rising energy-efficient regulations by the government encourage manufacturers to produce energy-efficient air conditioning systems for better environmental conditions.

Evaluation of Restraints in the US Air Conditioner Market

|

Restraint |

Primary Segments Affected |

What this means (evidence) |

|

High Energy Consumption |

Residential & Commercial |

Air conditioners account for a large share of household energy bills, deterring low-income households. |

|

Stringent Energy Efficiency Regulations |

All New Installs |

US Department of Energy (DOE) regulations require higher Seasonal Energy Efficiency Ratios (SEER), raising costs for manufacturers and consumers. |

|

High Installation & Maintenance Costs |

Centralized & Ducted AC |

Complex systems such as centralized ACs involve expensive installation and maintenance, limiting adoption. |

|

Environmental Concerns |

All types |

Hydrofluorocarbon (HFC) refrigerants contribute to global warming, creating pressure for eco-friendly alternatives. |

|

Market Saturation in Mature Cities |

Room AC, Commercial |

High penetration in developed states such as California and New York limits further expansion without product innovation. |

US Air Conditioner Market Challenges

The United States air conditioner industry is facing some challenges such as increased energy efficiency regulations, supply chain disruptions affecting component availability, and growing environmental concerns influencing consumer preferences towards sustainable options. The market has seen a growing emphasis on energy efficiency, smart technology integration, and environmentally friendly refrigerants. Additionally, there was an increasing demand for systems with better air quality features, such as advanced filtration

US Air Conditioner Market Trends

There are diverse trends reshaping the US Air Conditioner Market Growth include:

Commercial Integration of Smart HVAC: Businesses adopting advanced energy management solutions integrated with AC systems.

Shift Toward Eco-Friendly Refrigerants: Manufacturers are increasingly adopting R32 and other low-GWP refrigerants to meet regulatory norms.

Energy-Efficient Inverter Technology: High demand for inverter-based ACs that adjust compressor speed and cut electricity bills.

Smart & Connected ACs: Rising adoption of Wi-Fi-enabled and voice-controlled ACs for smart homes.

Ductless Mini-Splits Expansion: Growing popularity of ductless systems due to flexible installation, especially in older buildings.

Investment Opportunities in the US Air Conditioner Industry

Some prominent investment opportunities reshaping the market include:

Healthcare & Senior Living Facilities – Expansion of climate-controlled environments in response to the aging population.

Green & Hybrid Cooling Solutions – Launching AC units that integrate renewable energy or solar-assisted cooling.

Large Infrastructure Projects – Supplying centralized AC systems for airports, metro stations, and shopping complexes.

Top 5 Leading Players in the US Air Conditioner Market

Some of the leading companies dominating the US Air Conditioner Market are mentioned below:

1. Lennox International Inc.

| Company Name | Lennox International Inc. |

| Established Year | 1895 |

| Headquarters | Richardson, Texas, USA |

| Official Website | Click Here |

Lennox International Inc. is a US-based leader in climate control solutions, providing air conditioners with strong emphasis on smart technology and sustainability.

2. Carrier Global Corporation

| Company Name | Carrier Global Corporation |

| Established Year | 1915 |

| Headquarters | Palm Beach Gardens, Florida, USA |

| Official Website | Click Here |

Carrier is one of the leading US-based company specializing in HVAC solutions, including residential, commercial, and industrial air conditioning systems.

3. Daikin Industries Ltd.

| Company Name | Daikin Industries Ltd. |

| Established Year | 1924 |

| Headquarters | Osaka, Japan |

| Official Website | Click Here |

Daikin Industries Ltd. extensively operates widely across the US, offering ductless mini-splits, central ACs, and energy-efficient HVAC systems.

4. Rheem Manufacturing Company

| Company Name | Rheem Manufacturing Company |

| Established Year | 1925 |

| Headquarters | Atlanta, Georgia, USA |

| Official Website | Click Here |

This is one of the most renowned manufactures who widely produces a range of HVAC solutions, including residential and commercial air conditioning systems with advanced features.

5. Trane Technologies plc

| Company Name | Trane Technologies plc |

| Established Year | 1913 |

| Headquarters | Swords, Ireland (US Operations in Davidson, NC) |

| Official Website | Click Here |

This prominent company is known for its high-performance air conditioners with a focus on energy efficiency and sustainable solutions.

Government Regulations Introduced in the US Air Conditioner Market

According to American Government Data, there are various measures which have been implemented to promote energy efficiency and environmental sustainability in the HVAC (Heating, Ventilation, and Air Conditioning) sector. These initiatives often include energy efficiency standards, tax incentives, and rebate programs to encourage consumers and businesses to adopt more energy-efficient and environmentally friendly air conditioning systems. Additionally, some states may have specific regulations or programs aimed at reducing the environmental impact of air conditioning technologies.

Future Insights of the US Air Conditioner Market

Over the years, the market for Air Conditioner in US is expected to expand backed by increasing importance of energy-efficient solutions. Apart from this, increasing investments in smart homes, development of healthcare infrastructure, and amalgamation of ACs with renewable energy will continue to drive the US Air Conditioner Market Growth. In addition to this, climate change-induced heatwaves and regulatory support for sustainable cooling will ensure strong long-term demand.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Ductless Air Conditioners to Dominate the Market – By Type

According to Dhaval, Research Manager, 6Wresearch, the ductless air conditioners have been securing significant growth in the United States owing to their energy efficiency, flexibility, and ease of installation.

Residential and Commercial to Dominate the Market – By Applications

The residential and commercial sectors have been contributing to the growth of the air conditioner market in the country. The residential sector tends to show consistent and high demand owing to new constructions and replacements.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- United States (US) Air Conditioner Market Outlook

- Market Size of United States (US) Air Conditioner Market, 2024

- Forecast of United States (US) Air Conditioner Market, 2031

- Historical Data and Forecast of United States (US) Air Conditioner Revenues & Volume for the Period 2021 - 2031

- United States (US) Air Conditioner Market Trend Evolution

- United States (US) Air Conditioner Market Drivers and Challenges

- United States (US) Air Conditioner Price Trends

- United States (US) Air Conditioner Porter's Five Forces

- United States (US) Air Conditioner Industry Life Cycle

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Residential for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Healthcare for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Hospitality for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Others for the Period 2021 - 2031

- United States (US) Air Conditioner Import Export Trade Statistics

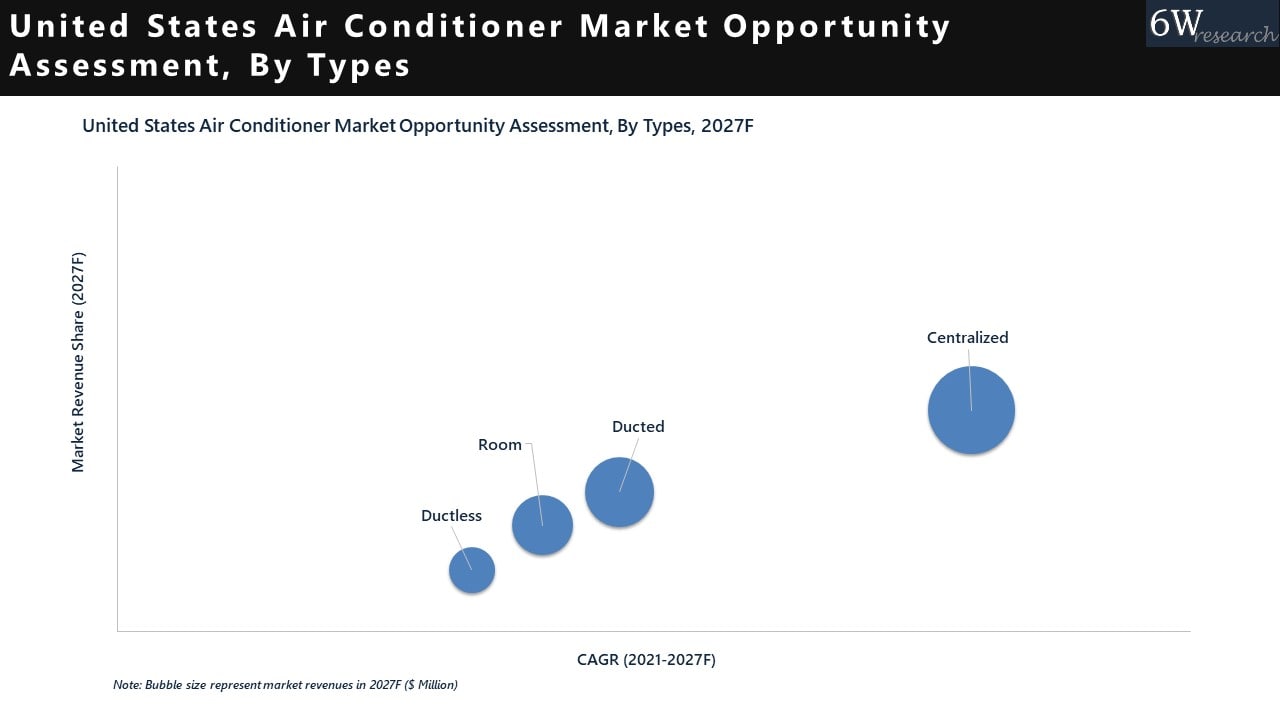

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- United States (US) Air Conditioner Top Companies Market Share

- United States (US) Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Air Conditioner Company Profiles

- United States (US) Air Conditioner Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Application

- Residential

- Healthcare

- Commercial & Retail

- Transportation & Infrastructure

- Hospitality

- Others

- United States (US) Air Conditioner Market Outlook

- Market Size of United States (US) Air Conditioner Market, 2024

- Forecast of United States (US) Air Conditioner Market, 2031

- Historical Data and Forecast of United States (US) Air Conditioner Revenues & Volume for the Period 2021 - 2031

- United States (US) Air Conditioner Market Trend Evolution

- United States (US) Air Conditioner Market Drivers and Challenges

- United States (US) Air Conditioner Price Trends

- United States (US) Air Conditioner Porter's Five Forces

- United States (US) Air Conditioner Industry Life Cycle

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Residential for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Healthcare for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Hospitality for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Others for the Period 2021 - 2031

- United States (US) Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- United States (US) Air Conditioner Top Companies Market Share

- United States (US) Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Air Conditioner Company Profiles

- United States (US) Air Conditioner Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Applications

- Residential

- Healthcare

- Commercial & Retail

- Transportation & Infrastructure

- Hospitality

- Others

US Air Conditioner Market (2025-2031) : FAQ's

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 United States (US) Air Conditioner Market Overview |

| 3.1 United States (US) Country Macro Economic Indicators |

| 3.2 United States (US) Air Conditioner Market Revenues & Volume, 2021 & 2031F |

| 3.3 United States (US) Air Conditioner Market - Industry Life Cycle |

| 3.4 United States (US) Air Conditioner Market - Porter's Five Forces |

| 3.5 United States (US) Air Conditioner Market Revenues & Volume Share, By Type, 2021& 2031F |

| 3.6 United States (US) Air Conditioner Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 4 United States (US) Air Conditioner Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for energy-efficient air conditioners due to rising awareness about environmental sustainability and energy conservation. |

| 4.2.2 Growing construction activities in the residential and commercial sectors driving the demand for air conditioning systems. |

| 4.2.3 Technological advancements leading to the development of smart air conditioning systems with features like remote monitoring and energy-saving modes. |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating raw material prices affecting the manufacturing cost of air conditioners. |

| 4.3.2 Seasonal variations impacting the demand for air conditioners, with higher sales during summer months. |

| 4.3.3 Stringent government regulations related to energy efficiency standards influencing product development and pricing. |

| 5 United States (US) Air Conditioner Market Trends |

| 6 United States (US) Air Conditioner Market, By Types |

| 6.1 United States (US) Air Conditioner Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 United States (US) Air Conditioner Market Revenues & Volume, By Type, 2021 - 2031F |

| 6.1.3 United States (US) Air Conditioner Market Revenues & Volume, By Room Air Conditioner, 2021 - 2031F |

| 6.1.4 United States (US) Air Conditioner Market Revenues & Volume, By Ducted Air Conditioner, 2021 - 2031F |

| 6.1.5 United States (US) Air Conditioner Market Revenues & Volume, By Ductless Air Conditioner, 2021 - 2031F |

| 6.1.6 United States (US) Air Conditioner Market Revenues & Volume, By Centralized Air Conditioner, 2021 - 2031F |

| 6.2 United States (US) Air Conditioner Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 United States (US) Air Conditioner Market Revenues & Volume, By Residential, 2021 - 2031F |

| 6.2.3 United States (US) Air Conditioner Market Revenues & Volume, By Healthcare, 2021 - 2031F |

| 6.2.4 United States (US) Air Conditioner Market Revenues & Volume, By Commercial & Retail, 2021 - 2031F |

| 6.2.5 United States (US) Air Conditioner Market Revenues & Volume, By Transportation & Infrastructure, 2021 - 2031F |

| 6.2.6 United States (US) Air Conditioner Market Revenues & Volume, By Hospitality, 2021 - 2031F |

| 6.2.7 United States (US) Air Conditioner Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 United States (US) Air Conditioner Market Import-Export Trade Statistics |

| 7.1 United States (US) Air Conditioner Market Export to Major Countries |

| 7.2 United States (US) Air Conditioner Market Imports from Major Countries |

| 8 United States (US) Air Conditioner Market Key Performance Indicators |

| 8.1 Energy Efficiency Rating: Tracking the energy efficiency levels of air conditioners in the market. |

| 8.2 Adoption Rate of Smart Air Conditioners: Monitoring the rate at which consumers are switching to smart air conditioning systems. |

| 8.3 Replacement Rate: Measuring how frequently consumers are replacing their existing air conditioners with newer models to assess market growth potential. |

| 9 United States (US) Air Conditioner Market - Opportunity Assessment |

| 9.1 United States (US) Air Conditioner Market Opportunity Assessment, By Type, 2021& 2031F |

| 9.2 United States (US) Air Conditioner Market Opportunity Assessment, By Application, 2021 & 2031F |

| 10 United States (US) Air Conditioner Market - Competitive Landscape |

| 10.1 United States (US) Air Conditioner Market Revenue Share, By Companies, 2024 |

| 10.2 United States (US) Air Conditioner Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others) And Competitive Landscape

| Product Code: ETC090060 | Publication Date: Aug 2021 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

US Air Conditioner (AC) Market | Country-Wise Share and Competition Analysis

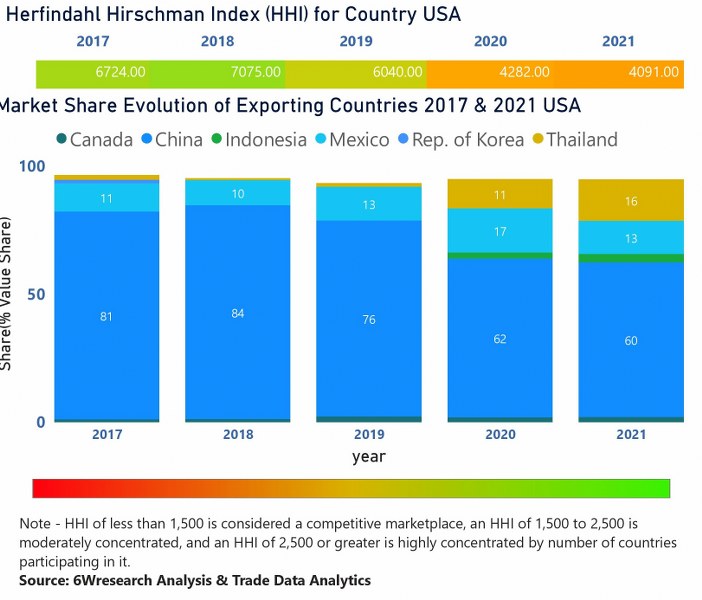

In the year 2021, China was the largest exporter in terms of value, followed by Thailand. It has registered a growth of 26.14% over the previous year. While Thailand registered a growth of 84.23% over the previous year. While in 2017 China was the largest exporter followed by Mexico. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, the USA has Herfindahl index of 6724 in 2017 which signifies high concentration while in 2021 it registered a Herfindahl index of 4091 which signifies high concentration in the market

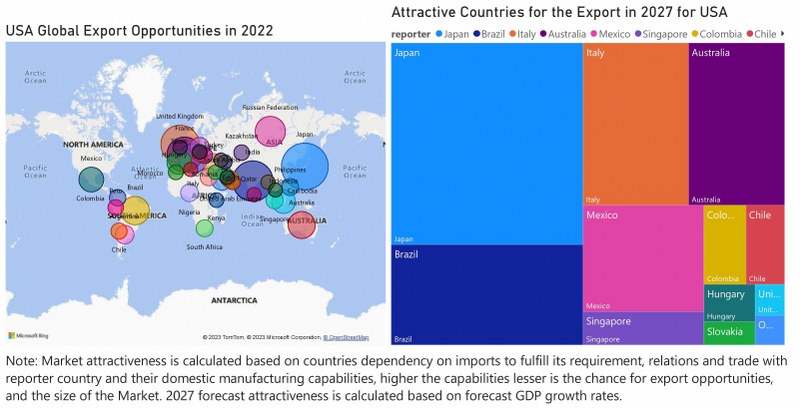

US Air Conditioner (AC) Market - Export Market Opportunities

US Air Conditioner (AC) Market - Export Market Opportunities

Latest (2023) Development in the United States Air Conditioner (AC) Market

United States Air Conditioner (AC) Market is surging in the country underpinned by several ongoing latest developments & factors are high temperatures and changes in climate patterns. Furthermore, due to high competition in the market companies have started developing advanced technology air conditioners for efficient performance. Additionally, the rising energy-efficient regulations by the government encourage manufacturers to produce energy-efficient air conditioning systems for better environmental conditions. Moreover, post-COVID-19 people have become more aware of indoor air quality, this has changed customers’ preferences towards the adoption of better air filtration air conditioners. Also, the changing lifestyle has increased demand for smart air conditioners that can be controlled remotely through smartphones. These ongoing developments have burgeoned the United States Air Conditioner (AC) Market revenue in the upcoming years.

Topics Covered in the United States (US) Air Conditioner (AC) Market

United States (US) Air Conditioner (AC) Market is projected to grow over the coming years. The United States (US) Air Conditioner (AC) Market report is a part of our periodical regional publication North America Air Conditioner (AC) Market Outlook Report. 6W tracks the air conditioner market for over 60 countries with individual country-wise market opportunity assessments and publishes the report titled Global Air Conditioner (AC) Market outlook report annually.

United States (US) Air conditioner (AC) Market report comprehensively covers the market type and application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

United States Air Conditioner Market Synopsis

The United States Air Conditioner Market is anticipated to project substantial growth during the upcoming period on account of an increasing number of commercial investments, especially in urban areas is propelling the growth of the US Air Conditioner Market. Also, the setting up of various institutions, offices, shopping complexes and malls is leading to the development of the market. Increasing investment by the public and private sectors is fueling the Air Conditioner Market in the US.

According to 6Wresearch, the United States (US) Air Conditioner (AC) Market size is projected to grow at a CAGR of 6.1% during 2021-2027. The United States occupies 1st position in terms of the market size in the North America Air Conditioner Market. Unfavourable weather conditions along with soaring temperatures beholds an upsurge in the growth of the market. Moreover, a massive surge in the construction sector coupled with rising investment by the public and private sectors adds to the development of the market. However, the market experienced a major setback on account of COVID-19 backed by the shutting down of retail stores and manufacturing units hampering the supply chain of the market. The US Air conditioner market growth was also hampered by the restriction on the movement of goods.

COVID-19 Impact on the United States (US) Air Conditioner (AC) Market

The COVID-19 pandemic had a profound impact on the United States' Air Conditioner (AC) market. The closure of all the offline ACs stores was caused by the government's strict pandemic lockdown measures, including, restrictions on trade due to curb the COVID-19 prevalence, this led to an interruption in the product supply chain & raw materials and affected the manufacturing process. With the reduction in the ACs demand had affected the United States (US) Air Conditioner (AC) industry during the COVID-19 pandemic.

Market Analysis by Type

In terms of market by types, Centralized Air Conditioner dominates the market and is expected to remain in a dominant position in the coming years with the fastest growth rate among all types.

Market Analysis by Application

In terms of application, Commercial & Retail dominates the market and is expected to remain in a dominant position in the coming years. However, Hospitality is expected to have the fastest growth rate among all applications.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- United States (US) Air Conditioner Market Outlook

- Market Size of United States (US) Air Conditioner Market, 2020

- Forecast of United States (US) Air Conditioner Market, 2027

- Historical Data and Forecast of United States (US) Air Conditioner Revenues & Volume for the Period 2017 - 2027

- United States (US) Air Conditioner Market Trend Evolution

- United States (US) Air Conditioner Market Drivers and Challenges

- United States (US) Air Conditioner Price Trends

- United States (US) Air Conditioner Porter's Five Forces

- United States (US) Air Conditioner Industry Life Cycle

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Type for the Period 2017 - 2027

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Application for the Period 2017 - 2027

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Healthcare for the Period 2017 - 2027

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2017 - 2027

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2017 - 2027

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Hospitality for the Period 2017 - 2027

- Historical Data and Forecast of United States (US) Air Conditioner Market Revenues & Volume By Others for the Period 2017 - 2027

- United States (US) Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- United States (US) Air Conditioner Top Companies Market Share

- United States (US) Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Air Conditioner Company Profiles

- United States (US) Air Conditioner Key Strategic Recommendations

Market Segmentation:

The report provides a detailed analysis of the following market segments:

By Types:

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Application:

- Residential

- Commercial & Retail

- Healthcare

- Hospitality

- Transportation & Infrastructure

- Others

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero