United States (US) Dental chairs Market (2023-2029) | Share, Growth, Analysis, Size, Industry, Forecast, Outlook, Trends, Segmentation & COVID-19 IMPACT

Market Forecast By Type (Ceiling-mounted Design, Mobile-independent Design, Dental Chair-mounted Design), By Product (Non-powered Dental Chairs, Powered Dental Chairs), By Component (Chair, Dental Cuspidor, Dental Chair Handpiece, Others), By Application (Examination, Surgery, Orthodontic Applications, Others), By End User (Hospitals, Dental Clinics, Research & Academic Institutes) And Competitive Landscape

| Product Code: ETC094640 | Publication Date: Jun 2021 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

USA Dental Chairs Market | Country-Wise Share and Competition Analysis

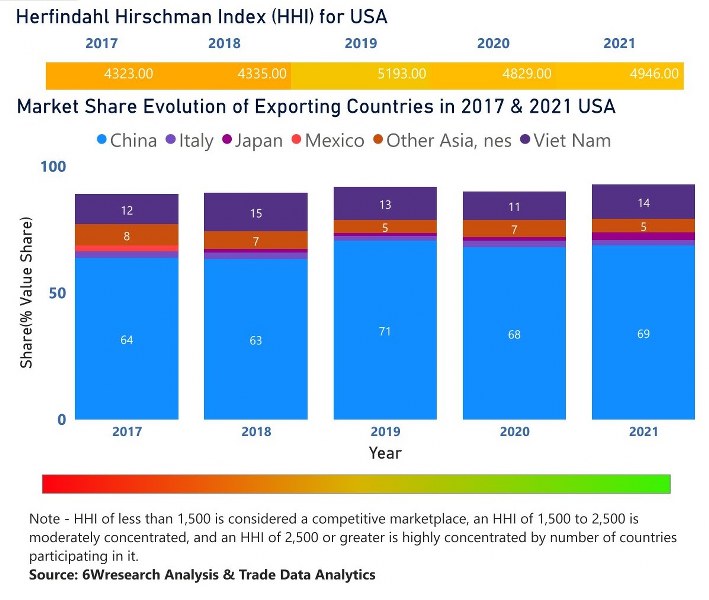

In the year 2021, China was the largest exporter in terms of value, followed by Viet Nam. It has registered a growth of 34.63% over the previous year. While Viet Nam registered a growth of 61.23% as compared to the previous year. In the year 2017, China was the largest exporter followed by Viet Nam. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, the USA has a Herfindahl index of 4323 in 2017 which signifies high concentration also in 2021 it registered a Herfindahl index of 4946 which signifies high concentration in the market.

![USA Dental Chairs Market | Country-Wise Share and Competition Analysis]() USA Dental Chairs Market - Export Market Opportunities

USA Dental Chairs Market - Export Market Opportunities

Topics Covered in the United States (US) Dental Chairs Market

United States (US) Dental Chairs Market report thoroughly covers the market by type, by product, by component, by application, and by end user. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

United States (US) Dental Chairs Market Synopsis

The United States Dental Chairs Market is estimated to boost in the coming years the country owing to the rising dental treatments and check-ups due to increasing awareness to maintain oral hygiene coupled with the increasing prevalence of oral diseases have led to a surge in the adoption of dental chairs. Additionally, the rising investment in technological advancement in dental chairs is a great trend that opens up the growth corridors for the United States (US) Dental Chairs industry at a considerable rate.

According to 6Wresearch, the United States (US) Dental Chairs Market size is projected to secure tremendous growth during 2023-2029. The market has been growing in the country at a rapid pace on account of the increasing adoption of digital or electric dental chairs in comparison with traditional hydraulic ones due to their benefits such as high comfort and ease of use and also allow dentists to work efficiently and more accurately while dental procedures. The government is improving the healthcare sector by adopting advanced healthcare equipment including, advanced features and integrated dental chairs is estimated to widen the market growth. Moreover, the growing elderly population is diagnosed more with oral diseases which drives the need for oral treatments which is estimated to fuel the adoption of dental chairs and further estimated to contribute to the United States Dental Chairs Market growth.

COVID-19 Impact on the United States (US) Dental Chairs Market

The COVID-19 impact on the United States dental chairs market was adverse. The complete lockdown in the country resulted in the shutdown of certain dental clinics while some remained open, nevertheless, with the major restrictions on trade coupled with economic downfall market faced a major decline in the United States Dental Chairs Market shares.

Key Players in the United States (US) Dental Chairs Market

Several significant key players in the market are listed below:

- A-dec Inc. is a prominent dental chair manufacturer in the country that offers an advanced range of dental chairs at an affordable price.

- Danaher Corporation is a leading player in the country that provides a spectrum range of dental equipment including dental chairs also.

- Dexta Corporation has been growing tremendously by offering an extensive range of dental equipment including, dental chairs

- Midmark Corporation has been growing with a strong market prevalence in the country and offers a wide range of dental equipment integrated with advanced features.

Market Analysis by Type

Based on the type, it is difficult to specify which type is dominating in the market as all types are used by dentists, however, Mobile-Independent Design is estimated to gain momentum in the estimated years due to its portable feature that can be fitted in small spaced areas.

Market Analysis by Product

According to Shivankar, Research Manager, 6Wresearch, non-powered dental chairs are still used by dentists to their easy use and operation, while powered product dental chairs are estimated to hold the largest market share in the coming years underpinned by their advanced adjustable features.

Market Analysis by Component

Based on the component, all components are witnessing growth in the market underpinned by their different functions and features, whereas, the Dental Chair Handpiece segment is estimated to secure a double-digit growth in the market due to their wide use in various tasks, like, scaling and drilling.

Market Analysis by Application

Based on the application, all applications are surging the market growth owing to each practice is being performed during dental procedures. Hence, the demand for each application including, examination, Surgery, and Orthodontic dental chairs is increasing.

Key attractiveness of the report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022.

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- United States (US) Dental chairs Market Outlook

- Market Size of United States (US) Dental chairs Market, 2022

- Forecast of United States (US) Dental chairs Market, 2029

- Historical Data and Forecast of United States (US) Dental chairs Revenues & Volume for the Period 2019 - 2029

- United States (US) Dental chairs Market Trend Evolution

- United States (US) Dental chairs Market Drivers and Challenges

- United States (US) Dental chairs Price Trends

- United States (US) Dental chairs Porter's Five Forces

- United States (US) Dental chairs Industry Life Cycle

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Type for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Ceiling-mounted Design for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Mobile-independent Design for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Dental Chair-mounted Design for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Product for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Non-powered Dental Chairs for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Powered Dental Chairs for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Component for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Chair for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Dental Cuspidor for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Dental Chair Handpiece for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Others for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Application for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Examination for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Surgery for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Orthodontic Applications for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Others for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By End User for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Hospitals for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Dental Clinics for the Period 2019 - 2029

- Historical Data and Forecast of United States (US) Dental chairs Market Revenues & Volume By Research & Academic Institutes for the Period 2019 - 2029

- United States (US) Dental chairs Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Component

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By End User

- United States (US) Dental chairs Top Companies Market Share

- United States (US) Dental chairs Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Dental chairs Company Profiles

- United States (US) Dental chairs Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Ceiling-Mounted Design

- Mobile-Independent Design

- Dental Chair-Mounted Design

By Product

- Non-Powered Dental Chairs

- Powered Dental Chairs

By Component

- Chair

- Dental Cuspidor

- Dental Chair Hand piece

- Others

By Application

- Examination

- Surgery

- Orthodontic Applications

- Others

By End User

- Hospitals

- Dental Clinics

- Research & Academic Institutes

United States (US) Dental chairs Market: FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 United States (US) Dental chairs Market Overview |

| 3.1 United States (US) Dental chairs Market Revenues & Volume, 2019 - 2029F |

| 3.2 United States (US) Dental chairs Market - Industry Life Cycle |

| 3.3 United States (US) Dental chairs Market - Porter's Five Forces |

| 3.4 United States (US) Dental chairs Market Revenues & Volume Share, By Type, 2022 & 2029F |

| 3.5 United States (US) Dental chairs Market Revenues & Volume Share, By Product, 2022 & 2029F |

| 3.6 United States (US) Dental chairs Market Revenues & Volume Share, By Component, 2022 & 2029F |

| 3.7 United States (US) Dental chairs Market Revenues & Volume Share, By Application, 2022 & 2029F |

| 3.8 United States (US) Dental chairs Market Revenues & Volume Share, By End User, 2022 & 2029F |

| 4 United States (US) Dental chairs Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for dental services and procedures in the United States |

| 4.2.2 Technological advancements in dental chair designs and features |

| 4.2.3 Growing focus on patient comfort and ergonomics in dental practices |

| 4.3 Market Restraints |

| 4.3.1 High initial cost of dental chair equipment |

| 4.3.2 Stringent regulations and standards for dental equipment in the US market |

| 4.3.3 Limited insurance coverage for dental chair purchases |

| 5 United States (US) Dental chairs Market Trends |

| 6 United States (US) Dental chairs Market Segmentation |

| 6.1 United States (US) Dental chairs Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 United States (US) Dental chairs Market Revenues & Volume, By Type, 2019 - 2029F |

| 6.1.3 United States (US) Dental chairs Market Revenues & Volume, By Ceiling-mounted Design, 2019 - 2029F |

| 6.1.4 United States (US) Dental chairs Market Revenues & Volume, By Mobile-independent Design, 2019 - 2029F |

| 6.1.5 United States (US) Dental chairs Market Revenues & Volume, By Dental Chair-mounted Design, 2019 - 2029F |

| 6.2 United States (US) Dental chairs Market, By Product |

| 6.2.1 Overview and Analysis |

| 6.2.2 United States (US) Dental chairs Market Revenues & Volume, By Non-powered Dental Chairs, 2019 - 2029F |

| 6.2.3 United States (US) Dental chairs Market Revenues & Volume, By Powered Dental Chairs, 2019 - 2029F |

| 6.3 United States (US) Dental chairs Market, By Component |

| 6.3.1 Overview and Analysis |

| 6.3.2 United States (US) Dental chairs Market Revenues & Volume, By Chair, 2019 - 2029F |

| 6.3.3 United States (US) Dental chairs Market Revenues & Volume, By Dental Cuspidor, 2019 - 2029F |

| 6.3.4 United States (US) Dental chairs Market Revenues & Volume, By Dental Chair Handpiece, 2019 - 2029F |

| 6.3.5 United States (US) Dental chairs Market Revenues & Volume, By Others, 2019 - 2029F |

| 6.4 United States (US) Dental chairs Market, By Application |

| 6.4.1 Overview and Analysis |

| 6.4.2 United States (US) Dental chairs Market Revenues & Volume, By Examination, 2019 - 2029F |

| 6.4.3 United States (US) Dental chairs Market Revenues & Volume, By Surgery, 2019 - 2029F |

| 6.4.4 United States (US) Dental chairs Market Revenues & Volume, By Orthodontic Applications, 2019 - 2029F |

| 6.4.5 United States (US) Dental chairs Market Revenues & Volume, By Others, 2019 - 2029F |

| 6.5 United States (US) Dental chairs Market, By End User |

| 6.5.1 Overview and Analysis |

| 6.5.2 United States (US) Dental chairs Market Revenues & Volume, By Hospitals, 2019 - 2029F |

| 6.5.3 United States (US) Dental chairs Market Revenues & Volume, By Dental Clinics, 2019 - 2029F |

| 6.5.4 United States (US) Dental chairs Market Revenues & Volume, By Research & Academic Institutes, 2018 - 2027F |

| 7 United States (US) Dental chairs Market Import-Export Trade Statistics |

| 7.1 United States (US) Dental chairs Market Export to Major Countries |

| 7.2 United States (US) Dental chairs Market Imports from Major Countries |

| 8 United States (US) Dental chairs Market Key Performance Indicators |

| 8.1 Average number of dental procedures performed per dental chair per month |

| 8.2 Percentage of dental practices investing in upgraded dental chair models annually |

| 8.3 Average lifespan of dental chairs in use in the United States |

| 9 United States (US) Dental chairs Market - Opportunity Assessment |

| 9.1 United States (US) Dental chairs Market Opportunity Assessment, By Type, 2022 & 2029F |

| 9.2 United States (US) Dental chairs Market Opportunity Assessment, By Product, 2022 & 2029F |

| 9.3 United States (US) Dental chairs Market Opportunity Assessment, By Component, 2022 & 2029F |

| 9.4 United States (US) Dental chairs Market Opportunity Assessment, By Application, 2022 & 2029F |

| 9.5 United States (US) Dental chairs Market Opportunity Assessment, By End User, 2022 & 2029F |

| 10 United States (US) Dental chairs Market - Competitive Landscape |

| 10.1 United States (US) Dental chairs Market Revenue Share, By Companies, 2020 |

| 10.2 United States (US) Dental chairs Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero