Vietnam Metalworking Fluids Market (2025-2031) | Analysis, Forecast, Value, Size, Companies, Share, Growth, Revenue, Trends & Industry

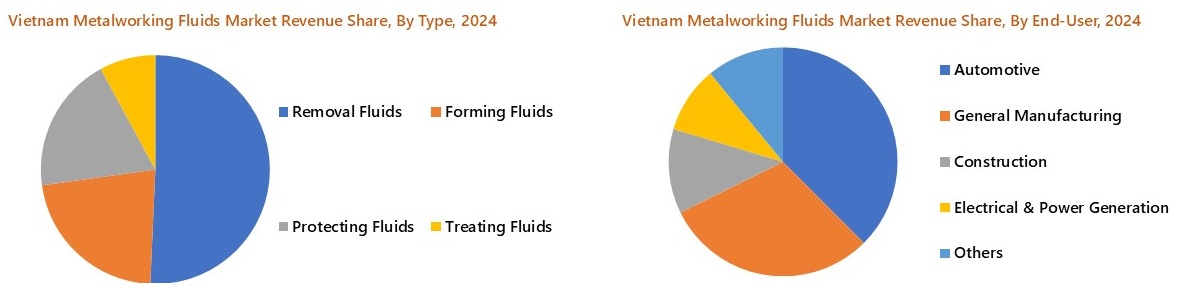

Market Forecast By Type (Removal Fluids, Forming Fluids, Protecting Fluid, Treating Fluids), By End-User (Automotive, General Manufacturing, Construction, Electrical & Power Generation, Others (Chemical Plants, Metallurgy, Transportation Equipment beyond autos, Agriculture, Aerospace) And Competitive Landscape

| Product Code: ETC297990 | Publication Date: Aug 2022 | Updated Date: Sep 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 67 | No. of Figures: 10 | No. of Tables: 4 | |

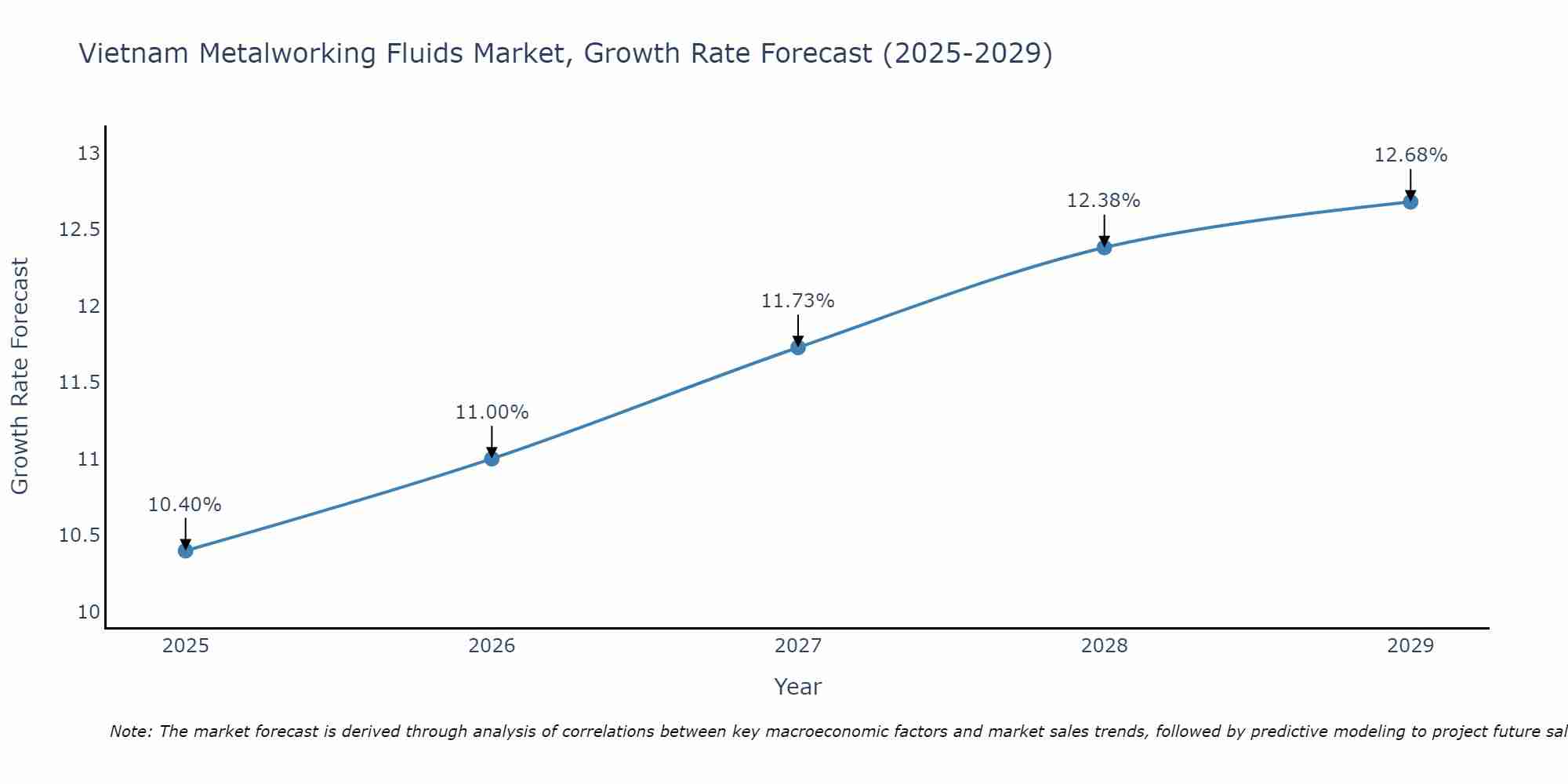

Vietnam Metalworking Fluids Market Size Growth Rate

The Vietnam Metalworking Fluids Market is poised for steady growth rate improvements from 2025 to 2029. From 10.40% in 2025, the growth rate steadily ascends to 12.68% in 2029.

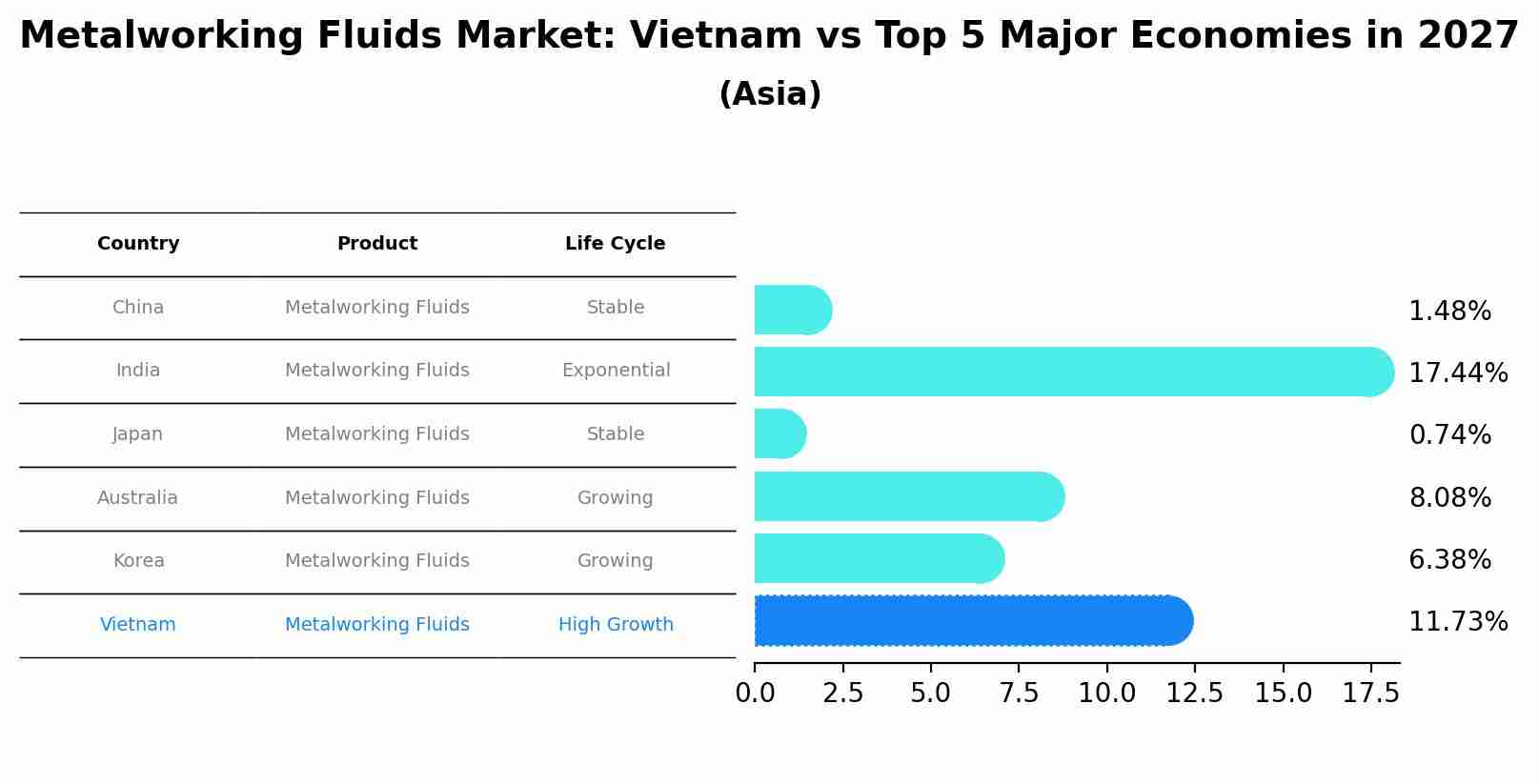

Metalworking Fluids Market: Vietnam vs Top 5 Major Economies in 2027 (Asia)

By 2027, the Metalworking Fluids market in Vietnam is anticipated to reach a growth rate of 11.73%, as part of an increasingly competitive Asia region, where China remains at the forefront, supported by India, Japan, Australia and South Korea, driving innovations and market adoption across sectors.

Topics Covered in Vietnam Metalworking Fluids Market Report

Vietnam Metalworking Fluids Market Report thoroughly covers the market By Type and end user. Vietnam Metalworking Fluids Market Outlook report provides an unbiased and detailed analysis of the ongoing Vietnam Metalworking Fluids Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Vietnam Metalworking Fluids Market Synopsis

The Vietnam Metalworking Fluids Market experienced growth during the past years, supported by the country’s determination to remain a global leader in oil and gas production, fueled by expanding exploration and production (E&P) efforts, particularly in mature onshore fields, alongside increasing offshore operations where coiled tubing is essential for stimulation, wellbore cleanouts, cementing, and other rig-less activities.

Further, large-scale investments by Saudi Aramco, such as those directed toward the Jafurah unconventional gas field, highlight the strategic importance of coiled tubing in enhancing efficiency and extending the productive life of wells. The company’s rising capital expenditure on upstream projects, further illustrates this momentum.

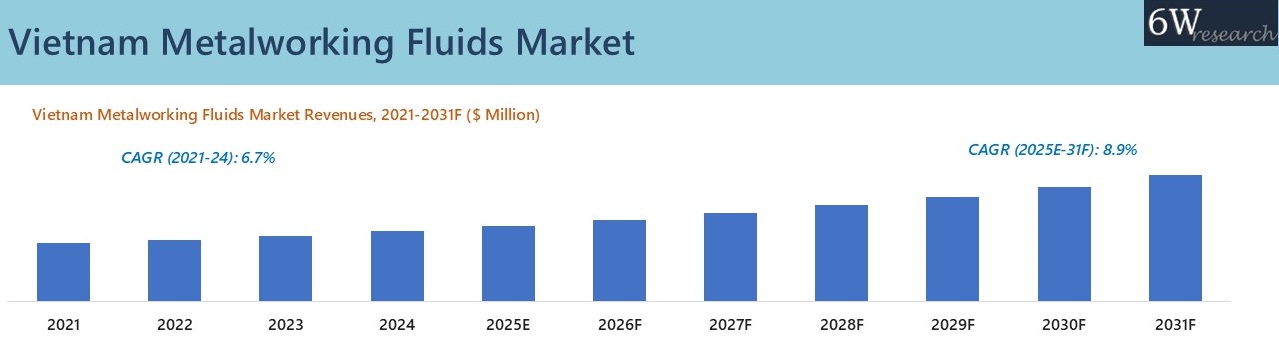

According to 6Wresearch, Vietnam Metalworking Fluids market revenue size is projected to grow at a CAGR of 4.5% during 2025-2031 as Vietnam’s oil and gas sector is a major driver for the Metalworking Fluids market, supported by rising energy demand from emerging economies. Oil and gas output in the kingdom is projected to grow faster than global levels during FY22–30F, with drilling expenditure expected to rise. Saudi Aramco is at the forefront, channeling most of its 2024–2028 capex into upstream development, as part of a broader investment in the sector. The company plans to raise crude oil capacity through projects such as Zuluf, Marjan, and Berri, which together are expected to add millions bpd.

Additionally, the Jafurah unconventional gas project, aims to deliver 2 Bcf/d by 2030, while expansions at Hawiyah, South Ghawar, and Fadhili plants further boost gas output. These large-scale developments, alongside recent discoveries of new fields, underscore the growing demand for advanced Metalworking Fluids, essential for stimulation, cleanouts, and maintenance to maximize recovery and ensure production efficiency.

Market Segmentation By Type

Protective fluids are poised for the fastest growth, driven by Vietnam’s humid climate and export-oriented economy. Rust preventatives are essential to safeguard high-value components during storage and shipping, and rising manufacturing and export volumes will accelerate demand, outpacing process-specific fluids.

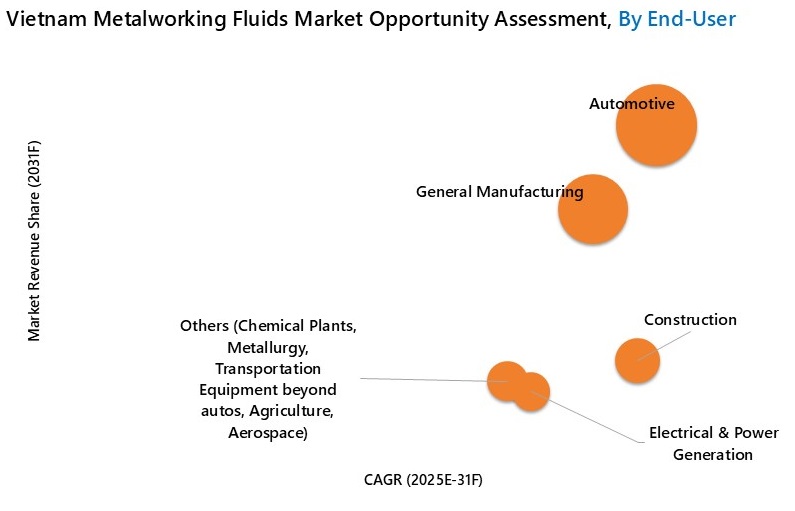

Market Segmentation By End User

The automotive sector is expected to witness the highest growth as an end-user due to Vietnam's rapid expansion as a regional automotive manufacturing hub. Driven by massive foreign investment and a growing domestic market, the industry's expanding production of vehicles, motorcycles, and precision components intensifies demand for all fluid types removal fluids for machining, forming fluids for stamping, and protecting fluids for corrosion prevention making it the primary and fastest-growing driver of consumption.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Vietnam Metalworking Fluids Market Overview

- Vietnam Metalworking Fluids Market Outlook

- Vietnam Metalworking Fluids Market Forecast

- Historical Data and Forecast of Vietnam Metalworking Fluids Market Revenues for the Period 2021-2031F

- Historical Data and Forecast of Vietnam Metalworking Fluids Market Revenues, By Type, for the Period 2021-2031F

- Historical Data and Forecast of Vietnam Metalworking Fluids Market Revenues, By End-User, for the Period 2021-2031F

- Industry Life Cycle

- Porter’s Five Force Analysis

- Vietnam Metalworking Fluids Market Drivers and Restraints

- Market Trends & Evolution

- Market Opportunity Assessment

- Vietnam Metalworking Fluids Market Revenue Ranking, By Top 3 Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Type

- Removal Fluids

- Forming Fluids

- Protecting Fluids

- Treating Fluids

By End-User

- Automotive

- General Manufacturing

- Construction

- Electrical & Power Generation

- Others (Chemical Plants, Metallurgy, Transportation Equipment beyond autos, Agriculture, Aerospace)

Vietnam Metalworking Fluids Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Vietnam Metalworking Fluids Market Overview |

| 3.1. Vietnam Metalworking Fluids Market Revenues (2021-2031F) |

| 3.2. Vietnam Metalworking Fluids Market Industry Life Cycle |

| 3.3. Vietnam Metalworking Fluids Market Porter’s Five Forces |

| 4. Vietnam Metalworking Fluids Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Vietnam Metalworking Fluids Market Trends |

| 6. Vietnam Metalworking Fluids Market Overview, By Type |

| 6.1. Vietnam Metalworking Fluids Market Revenue Share, By Type (2024 & 2031F) |

| 6.1.1. Vietnam Metalworking Fluids Market Revenues, By Removal Fluids (2021-2031F) |

| 6.1.2. Vietnam Metalworking Fluids Market Revenues, By Forming Fluids (2021-2031F) |

| 6.1.3. Vietnam Metalworking Fluids Market Revenues, By Protecting Fluids (2021-2031F) |

| 6.1.4. Vietnam Metalworking Fluids Market Revenues, By Treating Fluids (2021-2031F) |

| 7. Vietnam Metalworking Fluids Market Overview, By End-User |

| 7.1. Vietnam Metalworking Fluids Market Revenue Share, By End-User (2024 & 2031F) |

| 7.1.1. Vietnam Metalworking Fluids Market Revenues, By Automotive (2021-2031F) |

| 7.1.2. Vietnam Metalworking Fluids Market Revenues, By General Manufacturing (2021-2031F) |

| 7.1.3. Vietnam Metalworking Fluids Market Revenues, By Construction (2021-2031F) |

| 7.1.4. Vietnam Metalworking Fluids Market Revenues, By Electrical & Power Generation (2021-2031F) |

| 7.1.5 Vietnam Metalworking Fluids Market Revenues, By Others (2021-2031F) |

| 8. Vietnam Metalworking Fluids Market - Key Performance Indicators |

| 9. Vietnam Metalworking Fluids Market Opportunity Assessment |

| 9.1 Vietnam Metalworking Fluids Market Opportunity Assessment, By Type (2031F) |

| 9.2 Vietnam Metalworking Fluids Market Opportunity Assessment, By End-User (2031F) |

| 10. Vietnam Metalworking Fluids Market Competitive Landscape |

| 10.1 Vietnam Metalworking Fluids Market Revenue Share, By Top 3 Companies |

| 10.2 Vietnam Metalworking Fluids Market Competitive Benchmarking, By Technical Parameters |

| 10.3 Vietnam Metalworking Fluids Market Competitive Benchmarking, By Operating Parameters |

| 11. Company Profiles |

| 11.1 Quaker Houghton |

| 11.2 Castrol |

| 11.3 FUCHS |

| 11.4 Yushiro |

| 11.5 Lube Tech |

| 11.6 Vina Buhmwoo |

| 11.7 Moresco |

| 11.8 Francool |

| 11.9 Valvoline |

| 11.10 Master Fluid Solutions |

| 11.11 Henkel |

| 11.12 ExxonMobil Chemical |

| 12. Key Strategic Recommendation |

| 13. Disclaimer |

| List of figures |

| 1. Vietnam Metalworking Fluids Market Revenues, 2021-2031F ($ Million) |

| 2. Vietnam Aviation Industry Snapshot |

| 3. Vietnam Shipbuilding Industry Snapshot |

| 4. Vietnam Metalworking Fluids Market Revenue Share, By Type, 2024 & 2031F |

| 5. Vietnam Metalworking Fluids Market Revenue Share, By End-User, 2024 & 2031F |

| 6. Vietnam Newly Registered Manufacturing FDI by Province, Q1/2024 to Q3/2O24, in $ Million |

| 7. Vietnam Manufacturing Output, In $ Billion (2020-2023) |

| 8. Vietnam Metalworking Fluids Market Opportunity Assessment, By Type, 2031F |

| 9. Vietnam Metalworking Fluids Market Opportunity Assessment, By End-User, 2031F |

| 10. Vietnam Metalworking Fluids Market Revenue Ranking, By Companies, 2024 |

| List of table |

| 1. Vietnam Upcoming Railway Projects |

| 2. Vietnam Metalworking Fluids Market Revenues, By Type, 2021-2031F, ($ Million) |

| 3. Vietnam Metalworking Fluids Market Revenues, By End-User, 2021-2031F, ($ Million) |

| 4. Vietnam’s Policy Targets for 2025 and 2030 |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero