Vietnam Video Surveillance Market (2023-2029) | Forecast, Size, Analysis, Growth, Trends, Value, Revenue, Outlook, Industry, Share, Segmentation & COVID-19 IMPACT

Market Forecast By Component (Camera (Analog, IP/Network), Recorder (Network Video Recorder (NVR), Digital Video Recorder (DVR)), Encoder, Software), By Application (BFSI (Banking, Financial Services & Insurance), Government & Transportation, Retail & Logistics, Commercial Offices,Oil & Gas,Residential,Hospitality and Healthcare, Tourism and Public Venues & Other (Manufacturing and Critical Infrastructure)) and competitive landscape

| Product Code: ETC003026 | Publication Date: Feb 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 76 | No. of Figures: 19 | No. of Tables: 11 |

Vietnam Video Surveillance Market Synopsis

Vietnam Video Surveillance Market in the year 2020 observed drop in revenues and volume owing to the pandemic since the government of the country enforced lockdown to curb the effect of the pandemic, therefore, commercial and public spaces had to be temporarily closed, thereby creating a negative demand for video surveillance products in Vietnam. Furthermore, the pandemic also led to delay in more than 20% construction projects which further declined the demand for Video Surveillance Market in Vietnam. However, the market started to show signs of recovery in 2021 on the back of commencement of construction projects such as Thanh Da Park and new Hang Ngoai Bridge.

According to 6Wresearch, Vietnam Video Surveillance Market revenue size is anticipated to grow at a CAGR of 12.6% during 2023-2029. The smart city projects such as North Hanoi Smart City and Xuan Mai Smart City are expected to drive the market for video surveillance in Vietnam in the years ahead. Furthermore, a $19.6 million proposal laid by police in southern Binh Duong Province for deployment of 421 cameras on major roads of the province would further augment the Vietnam video surveillance market in upcoming years. The government of Vietnam has also announced to spend $124.5 billion on public investment till 2025 which would also act as a major boost for the growth of video surveillance market in Vietnam. This sector is one of the major parts of the Asia Pacific Video Surveillance Market.

The Vietnam Video Surveillance Industry is likely to observe massive boost on the back of burgeoning infrastructure. The market will grow more efficiently in the coming years as it is supported by many factors.

Market by Components

In the forecast period, video surveillance camera would witness the maximum growth in Vietnam video surveillance market owing to the rise in smart city projects security cameras would be used to monitoring check on safety and security.

Market by Applications

Government and Transportation is anticipated to grow the highest in the forecast period on the back of government initiative of $93 million to to be carried out till 2025 for installation of traffic surveillance cameras on highways and expressways.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2023

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Vietnam Video Surveillance Market Overview

- Vietnam Video Surveillance Market Outlook

- Vietnam Video Surveillance Market Forecast

- Historical Data and Forecast of Vietnam Video Surveillance Market Revenues & Volume for the Period 2019-2029F

- Historical Data and Forecast of Vietnam Video Surveillance Market Revenues & Volume, By Components, for the Period 2019-2029F

- Historical Data and Forecast of Vietnam Video Surveillance Camera Market Revenues & Volume, By Camera Type, for the Period 2019-2029F

- Historical Data and Forecast of Vietnam Video Surveillance Recorder Market Revenues & Volume, By Recorder Type, for the Period 2019-2029F

- Historical Data and Forecast of Vietnam Video Surveillance Market Revenues, By Applications, for the Period 2019-2029F

- Market Drivers and Restraints

- Vietnam Video Surveillance Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Vietnam Video Surveillance Market Revenue Ranking, By Companies

- COVID-19 impact on Video Surveillance Market

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Components

- Video Surveillance Cameras

- Video Surveillance Recorder

- Video Surveillance Encoder

- Video Management Software

By Applications

- Banking & Financial Institutions

- Government & Transportation

- Retail & Logistics

- Commercial Offices

- Industrial & Manufacturing

- Residential

- Hospitality & Healthcare

- Education Institutions

Vietnam Video Surveillance Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Vietnam Video Surveillance Market Overview |

| 3.1 Vietnam Video Surveillance Market Revenues and Volume, 2019-2029F |

| 3.2 Vietnam Video Surveillance Market Industry Life Cycle |

| 3.3 Vietnam Video Surveillance Market Porter's Five Forces |

| 4. Impact Analysis of COVID-19 on Vietnam Video Surveillance Market |

| 5. Vietnam Video Surveillance Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.3 Market Restraints |

| 6. Vietnam Video Surveillance Market Trends |

| 7. Vietnam Video Surveillance Market Overview, By Components |

| 7.1 Vietnam Video Surveillance Market Revenues and Revenue Share, By Components, 2019-2029F |

| 7.1.1 Vietnam Video Surveillance Market Revenues and Revenue Share, By Video Surveillance Camera, 2019-2029F |

| 7.1.2 Vietnam Video Surveillance Market Revenues and Revenue Share, By Video Surveillance Recorder, 2019-2029F |

| 7.1.3 Vietnam Video Surveillance Market Revenues and Revenue Share, By Video Surveillance Encoder, 2019-2029F |

| 7.1.4 Vietnam Video Surveillance Market Revenues and Revenue Share, By Video Surveillance Software, 2019-2029F |

| 7.2 Vietnam Video Surveillance Market Volume and Volume Share, By Components, 2019-2029F |

| 7.2.1 Vietnam Video Surveillance Market Volume and Volume Share, By Video Surveillance Camera, 2019-2029F |

| 7.2.2 Vietnam Video Surveillance Market Volume and Volume Share, By Video Surveillance Recorder, 2019-2029F |

| 7.2.3 Vietnam Video Surveillance Market Volume and Volume Share, By Video Surveillance Encoder, 2019-2029F |

| 8. Vietnam Video Surveillance Market Overview, By Camera Type |

| 8.1 Vietnam Video Surveillance Market Revenues and Revenue Share, By Camera Type, 2019-2029F |

| 8.1.1 Vietnam Video Surveillance Market Revenues and Revenue Share, By Analog Camera, 2019-2029F |

| 8.1.2 Vietnam Video Surveillance Market Revenues and Revenue Share, By IP Camera, 2019-2029F |

| 8.2 Vietnam Video Surveillance Market Volume and Volume Share, By Camera Type, 2019-2029F |

| 8.2.1 Vietnam Video Surveillance Market Volume and Volume Share, By Analog Camera, 2019-2029F |

| 8.2.2 Vietnam Video Surveillance Market Volume and Volume Share, By IP Camera, 2019-2029F |

| 9. Vietnam Video Surveillance Market Overview, By IP Camera Type |

| 9.1 Vietnam Video Surveillance Market Revenues and Revenue Share, By IP Camera Type, 2019-2029F |

| 9.1.1 Vietnam Video Surveillance Market Revenues and Revenue Share, By Wireless IP Camera, 2019-2029F |

| 9.1.2 Vietnam Video Surveillance Market Revenues and Revenue Share, By Wired IP Camera, 2019-2029F |

| 10. Vietnam Video Surveillance Market Overview, By Recorder Type |

| 10.1 Vietnam Video Surveillance Market Revenues and Revenue Share, By Recorder Type, 2019-2029F |

| 10.1.1 Vietnam Video Surveillance Market Revenues and Revenue Share, By NVR, 2019-2029F |

| 10.1.2 Vietnam Video Surveillance Market Revenues and Revenue Share, By DVR, 2019-2029F |

| 10.2 Vietnam Video Surveillance Market Volume and Volume Share, By Recorder Type, 2019-2029F |

| 10.2.1 Vietnam Video Surveillance Market Volume and Volume Share, By NVR, 2019-2029F |

| 10.2.2 Vietnam Video Surveillance Market Volume and Volume Share, By DVR, 2019-2029F |

| 11. Vietnam Video Surveillance Camera Market Overview, By Applications |

| 11.1 Vietnam Video Surveillance Market Revenue Share, By Applications, 2022 & 2029F |

| 11.2 Vietnam Video Surveillance Market Revenues, By Applications, 2019-2029F |

| 11.2.1 Vietnam Video Surveillance Market Revenues, By Government & Transportation, 2019-2029F |

| 11.2.2 Vietnam Video Surveillance Market Revenues, By Banking & Financial Institutions, 2019-2029F |

| 11.2.3 Vietnam Video Surveillance Market Revenues, By Retail & Logistics, 2019-2029F |

| 11.2.4 Vietnam Video Surveillance Market Revenues, By Commercial Offices & Buildings, 2019-2029F |

| 11.2.5 Vietnam Video Surveillance Market Revenues, By Industrial & Manufacturing, 2019-2029F |

| 11.2.6 Vietnam Video Surveillance Market Revenues, By Hospitality & Healthcare, 2019-2029F |

| 11.2.7 Vietnam Video Surveillance Market Revenues, By Residential, 2019-2029F |

| 11.2.8 Vietnam Video Surveillance Market Revenues, By Educational Institutions, 2019-2029F |

| 12. Vietnam Video Surveillance Camera Market Key Performance Indicators |

| 13. Vietnam Video Surveillance Camera Market Opportunity Assessment |

| 13.1 Vietnam Video Surveillance Market Opportunity Assessment, By Components |

| 13.2 Vietnam Video Surveillance Market Opportunity Assessment, By Applications |

| 14. Vietnam Video Surveillance Camera Market Competitive Landscape |

| 14.1 Vietnam Video Surveillance Market Revenue Ranking, By Companies, 2022 |

| 14.2 Vietnam Video Surveillance Market Competitive Benchmarking, By Operating and Technical Parameters |

| 15. Company Profiles |

| 15.1 Axis Communications AB |

| 15.2 Bosch Security Systems Inc. |

| 15.3 Hanwha Corporation |

| 15.4 Honeywell International Inc. |

| 15.5 Hangzhou Hikvision Digital Technology Co. Ltd. |

| 15.6 Panasonic Holdings Corporation |

| 15.7 Zhejiang Dahua Technology Co. Ltd. |

| 15.8 Cisco Systems Inc. |

| 15.9 Avigilon Corporation |

| 15.10 KB Vision Group International LLC |

| 16. Key Strategic Recommendations |

| 17. Disclaimer |

| List of Figures |

| 1. Vietnam Video Surveillance Market Revenues and Volume, 2019-2029F ($ Million, Thousand Units) |

| 2. Vietnam Infrastructure Investment, 2020-2040F ($ Billion) |

| 3. Vietnam Cyberattacks, 2021-2022 |

| 4. Vietnam Video Surveillance Market Revenue Share, By Components, 2022 & 2029F |

| 5. Vietnam Video Surveillance Market Volume Share, By Components, 2022 & 2029F |

| 6. Vietnam Video Surveillance Market Revenue Share, By Camera Type, 2022 & 2029F |

| 7. Vietnam Video Surveillance Market Volume Share, By Camera Type, 2022 & 2029F |

| 8. Vietnam IP Camera Market Revenue Share, By Type, 2022 & 2029F |

| 9. Vietnam Video Surveillance Market Revenue Share, By Recorder Type, 2022 & 2029F |

| 10. Vietnam Video Surveillance Market Volume Share, By Recorder Type, 2022 & 2029F |

| 11. Vietnam Video Surveillance Market Revenue Share, By Applications, 2022 & 2029F |

| 12. Vietnam Number of Projects, By Cities, 2022-2025F |

| 13. Upcoming Hotel Projects in Vietnam, 2022-2025F |

| 14. Vietnam Hotel Project Pipeline, 2022-2025F |

| 15. Vietnam Airport Infrastructure Investment, 2020-2040F ($ Million) |

| 16. Vietnam Rail Infrastructure Investment, 2020-2040F ($ Million) |

| 17. Vietnam Video Surveillance Market Opportunity Assessment, By Components, 2029F |

| 18. Vietnam Video Surveillance Market Opportunity Assessment, By Applications, 2029F |

| 19. Vietnam Video Surveillance Market Revenue Ranking, By Companies, 2022 |

| List of Tables |

| 1. Vietnam Upcoming Infrastructure Projects |

| 2. Vietnam Key Smart City Projects |

| 3. Vietnam Video Surveillance Market Revenues, By Components, 2019-2029F ($ Million) |

| 4. Vietnam Video Surveillance Market Volume, By Components, 2019-2029F (Thousand Units) |

| 5. Vietnam Video Surveillance Market Revenues, By Camera Types, 2019-2029F ($ Million) |

| 6. Vietnam Video Surveillance Market Volume, By Camera Types, 2019-2029F ($ Thousand Units) |

| 7. Vietnam IP Camera Market Revenues, By Type, 2019-2029F ($ Million) |

| 8. Vietnam Video Surveillance Market Revenues, By Recorder Types, 2019-2029F ($ Million) |

| 9. Vietnam Video Surveillance Market Volume, By Recorder Types, 2019-2029F ($ Thousand Units) |

| 10. Vietnam Video Surveillance Market Revenues, By Applications, 2019-2029F ($ Million) |

| 11. Key Road Projects in Vietnam |

Market Forecast By Component Type (Camera (Analog, IP/Network), Recorder (Network Video Recorder (NVR), Digital Video Recorder (DVR)), Encoder, Software), By Application (BFSI (Banking, Financial Services & Insurance), Government & Transportation, Retail & Logistics, Commercial Offices, Oil & Gas, Residential, Hospitality and Healthcare, Tourism and Public Venues & Other (Manufacturing and Critical Infrastructure)) and competitive landscape

| Product Code: ETC003026 | Publication Date: Jun 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 98 | No. of Figures: 38 | No. of Tables: 10 |

Vietnam Video Surveillance Market report comprehensively covers the Vietnam video surveillance market by component types, by applications. and by regions. Vietnam video surveillance market outlook report provides an unbiased and detailed analysis of the video surveillance market on-going trends, opportunities/high growth areas, market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Vietnam Video Surveillance Market Synopsis

Vietnam Video Surveillance Market is anticipated to grow in the forecast period on the account of the growing construction sector upcoming new hotels & shopping malls and rapid urbanization in the country. The market for video surveillance in Vietnam is likely to witness continued growth owing to increasing concerns related to public safety and security, growing adoption of IP cameras along with rising demand for wireless and spy cameras in the years to come. The market has seen a halt owing to the massive outbreak of COVID-19 which resulted in nationwide lockdowns to combat the spread of the virus and has led to a decline in the overall market growth.

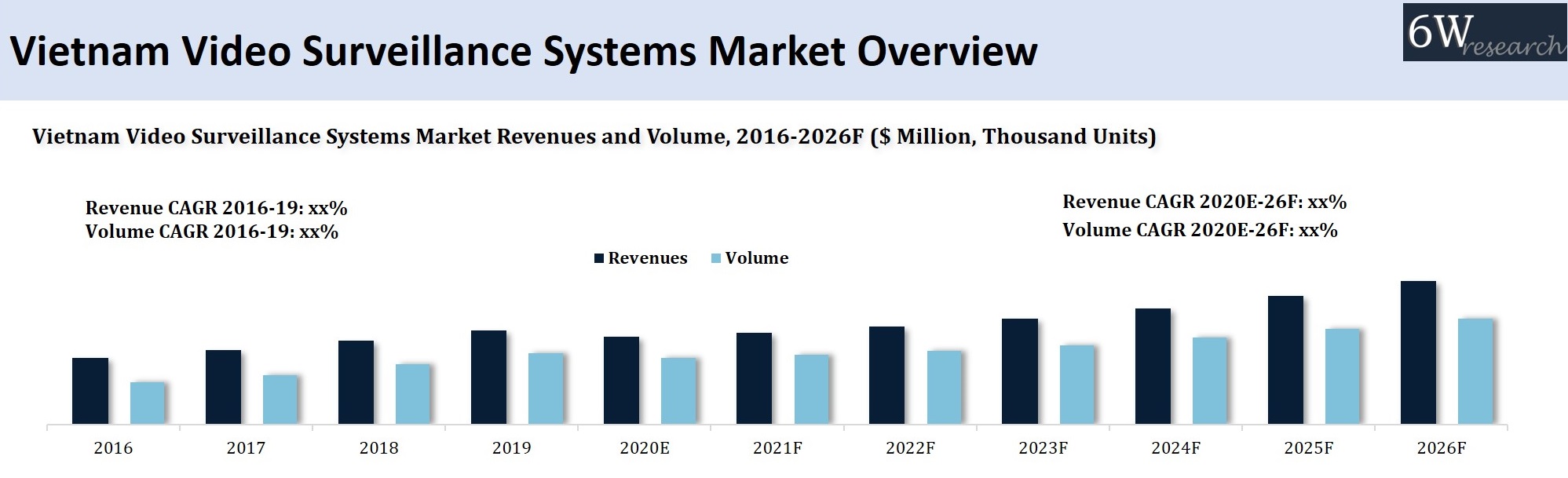

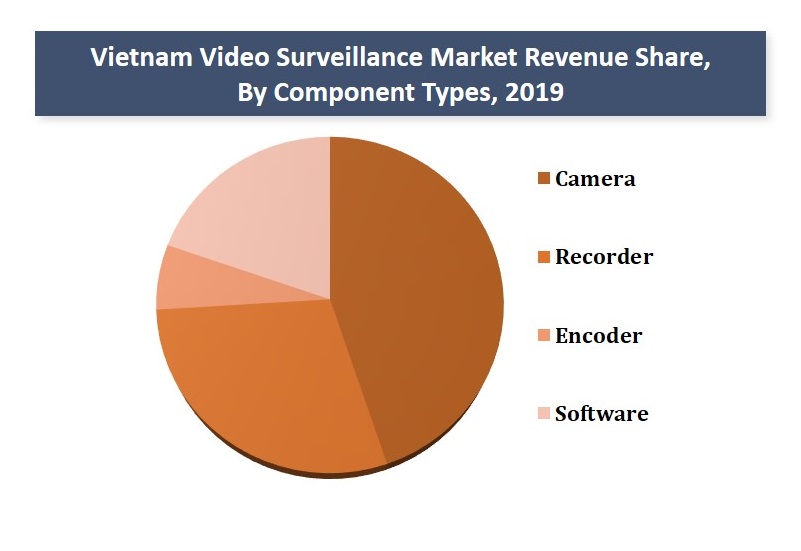

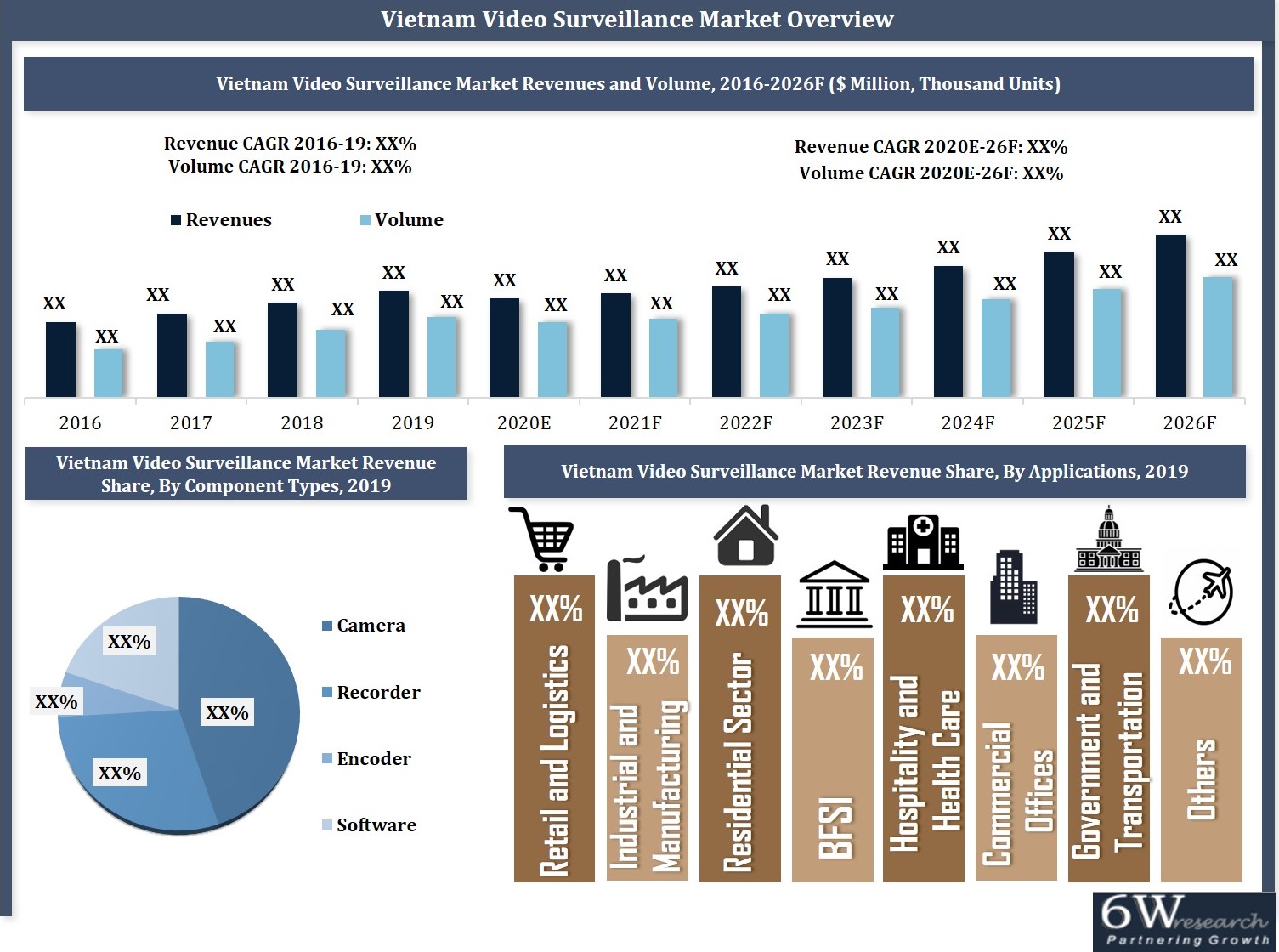

According to 6Wresearch, Vietnam Video Surveillance Market size is projected to grow at CAGR of 6.0% during 2020-2026. The outburst of coronavirus is expected to adversely impact the Vietnam video surveillance market in 2020 as the government has imposed nation-wide lockdown resulting in the closure of all business operations which would impact the demand and supply of video surveillance systems. However, post-COVID-19 the video surveillance market is expected to recover as the economy would resume the normalcy after a protracted period of nationwide lockdown. Additionally, the development of new smart city projects in Vietnam would create more avenues for the deployment of surveillance systems in the coming years. By type, the camera component held the highest revenue share in 2019 due to the universal application of video surveillance for security in various establishments and is likely to maintain its dominance during the forecast period as well.

Market Analysis by Vertical

On the basis of verticals, the government and transportation vertical held the major revenue share in the Vietnam video surveillance market in 2019 and would continue to maintain its dominance during the forecast period as well due to several advantages of video surveillance such as remote monitoring, transportation management, and increased public safety. Further, the rising security concerns among people along with the growing number of residential sector developments in the country would bode well for the demand for video surveillance solutions in the residential domain in the years to come.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects

Key Highlights of the Report

- Vietnam Video Surveillance Market Overview

- Vietnam Video Surveillance Market Outlook

- Vietnam Video Surveillance Market Size and Forecast for the period, 2016-2026F

- Historical Data of Vietnam Video Surveillance Market Revenues and Volume for the period, 2016-2019

- Market size and Forecast of Vietnam Video Surveillance Market Revenues and Volume until 2026F

- Historical Data of Vietnam Video Surveillance Market Revenues for the period, By Applications, 2016-2019

- Market size and Forecast of Vietnam Video Surveillance Market Revenues, By Applications until 2026F

- Historical Data of Vietnam Video Surveillance Market Revenues and Volume for the period, By Component Types, 2016-2019

- Market size and Forecast of Vietnam Video Surveillance Market Revenues and Volume, By Component Types until 2026F

- Historical Data of Vietnam Video Surveillance Market Revenues and Volume for the period, By Regions, 2016-2019

- Market size and forecast of Vietnam Video Surveillance Market Revenues and Volume, By Regions until 2026F

- Market Drivers and Restraints

- Vietnam Video Surveillance Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Vietnam Video Surveillance Market Opportunity Assessment

- Vietnam Video Surveillance Market Revenue Share, By Company

- Vietnam Video Surveillance Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

- By Component Types

- Camera

- Analog

- IP/ Network

- Recorder

- Network Video Recorder (NVR)

- Digital Video Recorder (DVR)

- Encoder

- Software

- By Applications

- BFSI (Banking, Financial Services & Insurance)

- Government & Transportation

- Retail & Logistics

- Commercial Offices

- Residential Sector

- Hospitality and Healthcare

- Industrial and Manufacturing

- Others (Public Venues, Tourism and Educational Institutions)

- By Regions

- Northern

- Central

- Southern

Frequently Asked Questions About the Market Study:

- Does the report consider COVID-19 impact?

The report not only has considered COVID-19 impact but also current market dynamics, trends and KPIs into consideration.

- How much growth is expected in the Vietnam Video Surveillance Market over the coming years?

The Vietnam Video Surveillance Market revenue is anticipated to record a CAGR of 6.0% during 2020-2026.

- Which segment has captured key share of the market?

Camera segment are the leading market segment in the overall market revenues in the year 2019.

- Which segment is exhibited to gain traction over the forecast period?

Government and Transportation vertical is expected to record key growth throughout the forecast period 2020-2026.

- Who are key the key players of the market?

The key players of the market include- Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International Inc., Panasonic Vietnam Co., Ltd, Hanwha Techwin Co. Ltd., Axis Communications AB, Sony Corporation, Robert Bosch Vietnam Co., Ltd., Zhejiang Dahua Technology Co. Ltd., Avigilon Corporation, Pelco - Transom Capital

- Is customization available in the market study?

Yes, we can do customization as per your requirements. Please feel free to write to us sales@6wresearch.com for any customized or any other requirements

- We also want to have market reports for other countries/regions.

6Wresearch has the database of more than 60 countries globally, which can make us your first choice of all your research needs.

Other Key Reports Available:

- Latin America Video Surveillance Market (2020-2026F)

- Europe Video Surveillance Market (2020-2026F)

- APAC Video Surveillance Market (2020-2026F)

- Global Video Surveillance Market (2020-2026F)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero