Algeria Air Conditioner Market (2025-2031) | Trends, Share, Analysis, Industry, Growth, Value, Size, Revenue, Forecast, Outlook

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others), And Competitive Landscape

| Product Code: ETC090110 | Publication Date: Dec 2023 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Topics Covered in the Algeria Air Conditioner (AC) Market

Algeria Air Conditioner (AC) Market report thoroughly covers the market by type and by application. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Algeria Air Conditioner (AC) Market Synopsis

Algeria Air Conditioner Market has been growing with the growing environmental concerns and electricity costs, consumers look for ways to decrease their carbon footprint. The rise in the adoption of advanced home technology in air conditioners is another notable development in the sector. Smart thermostats as well as other connected devices provide control over temperature settings and the potential to optimize performance and monitor energy usage.

According to 6Wresearch, the Algeria Air Conditioner (AC) Market size is expected to grow at a CAGR of 7.9% during the forecast period 2025-2031. The growing demand for air conditioners that are portable as they can be easily moved, and this trend is driven by the rise in smaller living spaces or an urge for more flexibility. The rising demand for air conditioning systems that are energy-efficient is one of the prominent developments. The demand for air conditioners demand has increased due to a rise in purchasing power of the population.

Additionally, the rising demand for energy-efficient air conditioners and technically advanced inverter ACs are impacting positive impact on the Algeria Air Conditioner (AC) Market growth. However, the market is facing some challenges that can affect the market growth such as the lack of reliable electricity supply or power cuts in some areas and intense competition in the market. Nevertheless, the increasing demand for energy-efficient air conditioners and the introduction of inverter technology is estimated to surge the market growth. Also, there is an increased demand for low-profile air conditioning systems due to the new building rules, which have assigned a maximum height for outdoor units.

Government Initiatives introduced in the Algeria Air Conditioner (AC) Market

Algeria Air Conditioner (AC) Market share The Algerian government recognizes the relevance of air conditioners in the economy and the lives of its citizens. As a result, it has initiated several programs aimed at promoting energy-efficient air conditioners. One of these programs is the Eco-appliance label, which is a voluntary label that rates the energy efficiency of domestic appliances in Algeria. Through this label, the government aims to encourage Algerian households to purchase energy-efficient air conditioners and reduce their energy consumption.

Key Players in the Algeria Air Conditioner (AC) Market

The Algerian air conditioner market is majorly operated by three companies; LG, Samsung, and Condor. LG and Samsung are global brands that have strong brand recognition in Algeria, while Condor is a local manufacturer with a market share. The competition in this market is fierce, with these companies have been investing actively in introducing new and improved models regularly to gain a higher market share.

Market Analysis by Type

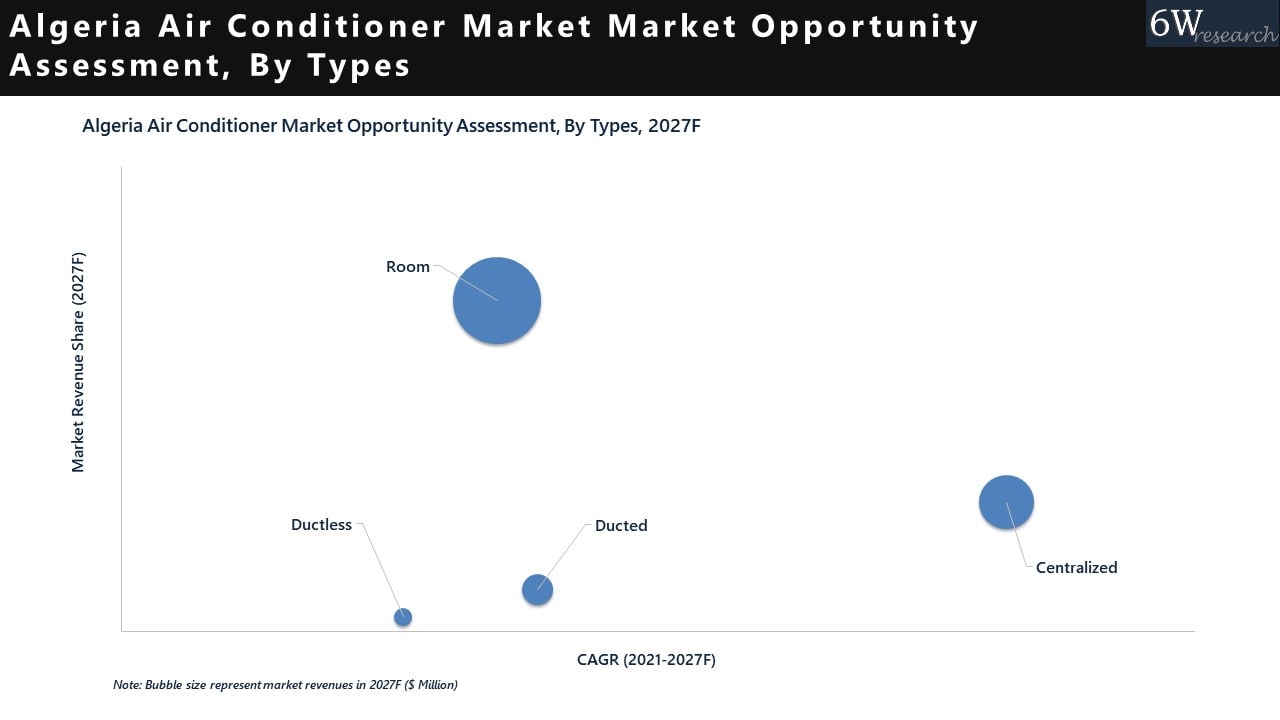

According to Dhaval, Research Manager, 6Wresearch, the centralized air conditioner is the only type of air conditioner leading the Algeria market, primarily due to the high usage of air conditioning in commercial spaces.

Market Analysis by Application

Based on the application, the residential application takes the lead in the Algeria AC market. This is mainly due to the growing population and an increase in the construction of residential properties.

Key attractiveness of the report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Algeria Air Conditioner Market Outlook

- Market Size of Algeria Air Conditioner Market, 2024

- Forecast of Algeria Air Conditioner Market, 2031

- Historical Data and Forecast of Algeria Air Conditioner Revenues & Volume for the Period 2021 - 2031

- Algeria Air Conditioner Market Trend Evolution

- Algeria Air Conditioner Market Drivers and Challenges

- Algeria Air Conditioner Price Trends

- Algeria Air Conditioner Porter's Five Forces

- Algeria Air Conditioner Industry Life Cycle

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Residential for the Period 2021 - 2031

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Healthcare for the Period 2021 - 2031

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2021 - 2031

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2021 - 2031

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Hospitality for the Period 2021 - 2031

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Others for the Period 2021 - 2031

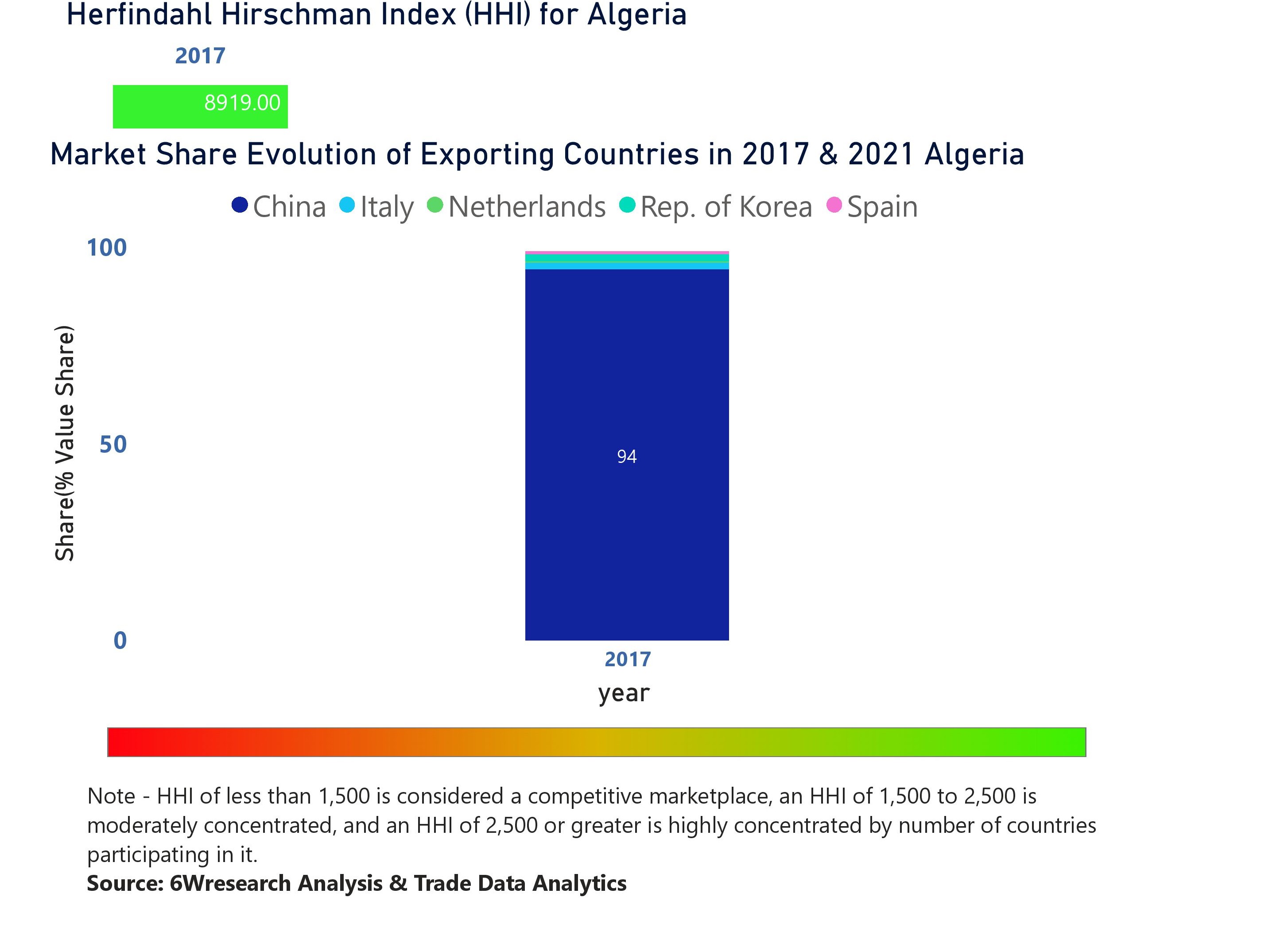

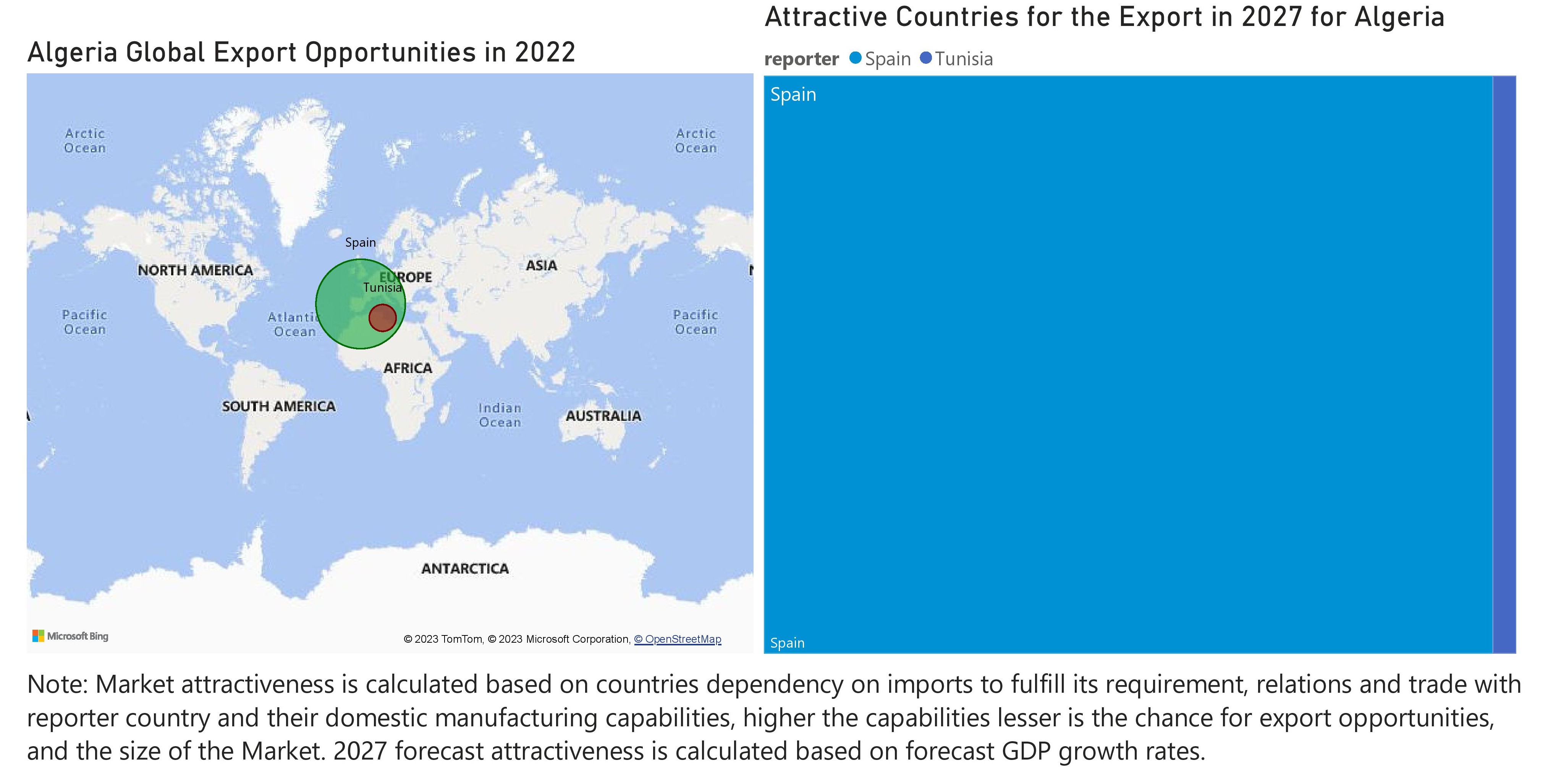

- Algeria Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Algeria Air Conditioner Top Companies Market Share

- Algeria Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- Algeria Air Conditioner Company Profiles

- Algeria Air Conditioner Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Application

- Residential

- Healthcare

- Commercial & Retail

- Transportation & Infrastructure

- Hospitality

- Others

Algeria Air Conditioner Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Algeria Air Conditioner Market Overview |

| 3.1 Algeria Air Conditioner Market Revenues & Volume, 2021 - 2031F |

| 3.2 Algeria Air Conditioner Market - Industry Life Cycle |

| 3.3 Algeria Air Conditioner Market - Porter's Five Forces |

| 3.4 Algeria Air Conditioner Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.5 Algeria Air Conditioner Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 4 Algeria Air Conditioner Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Algeria Air Conditioner Market Trends |

| 6 Algeria Air Conditioner Market Segmentation |

| 6.1 Algeria Air Conditioner Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Algeria Air Conditioner Market Revenues & Volume, By Type, 2021 - 2031F |

| 6.1.3 Algeria Air Conditioner Market Revenues & Volume, By Room Air Conditioner, 2021 - 2031F |

| 6.1.4 Algeria Air Conditioner Market Revenues & Volume, By Ducted Air Conditioner, 2021 - 2031F |

| 6.1.5 Algeria Air Conditioner Market Revenues & Volume, By Ductless Air Conditioner, 2021 - 2031F |

| 6.1.6 Algeria Air Conditioner Market Revenues & Volume, By Centralized Air Conditioner, 2021 - 2031F |

| 6.2 Algeria Air Conditioner Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Algeria Air Conditioner Market Revenues & Volume, By Residential, 2021 - 2031F |

| 6.2.3 Algeria Air Conditioner Market Revenues & Volume, By Healthcare, 2021 - 2031F |

| 6.2.4 Algeria Air Conditioner Market Revenues & Volume, By Commercial & Retail, 2021 - 2031F |

| 6.2.5 Algeria Air Conditioner Market Revenues & Volume, By Transportation & Infrastructure, 2021 - 2031F |

| 6.2.6 Algeria Air Conditioner Market Revenues & Volume, By Hospitality, 2021 - 2031F |

| 6.2.7 Algeria Air Conditioner Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 Algeria Air Conditioner Market Import-Export Trade Statistics |

| 7.1 Algeria Air Conditioner Market Export to Major Countries |

| 7.2 Algeria Air Conditioner Market Imports from Major Countries |

| 8 Algeria Air Conditioner Market Key Performance Indicators |

| 9 Algeria Air Conditioner Market - Opportunity Assessment |

| 9.1 Algeria Air Conditioner Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 Algeria Air Conditioner Market Opportunity Assessment, By Application, 2021 & 2031F |

| 10 Algeria Air Conditioner Market - Competitive Landscape |

| 10.1 Algeria Air Conditioner Market Revenue Share, By Companies, 2024 |

| 10.2 Algeria Air Conditioner Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others), And Competitive Landscape

| Product Code: ETC090110 | Publication Date: Aug 2021 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Algeria Air Conditioner (AC) Market | Country-Wise Share and Competition Analysis

Algeria Air Conditioner (AC) Market - Export Market Opportunities

Topics Covered in the Report in the Algeria Air Conditioner Market

Topics Covered in the Report in the Algeria Air Conditioner Market

Algeria Air Conditioner (AC) Market is projected to grow over the coming years. Algeria Air Conditioner (AC) Market report is a part of our periodical regional publication Africa Air Conditioner (AC) Market outlook report. 6W tracks the air conditioner market for over 60 countries with individual country-wise market opportunity assessments and publishes with the report titled Global Air Conditioner (AC) Market outlook report annually.

The Algeria Air Conditioner Market report thoroughly covers the market by types and application. The report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Latest 2023 Developments of the Algeria Air Conditioner Market

The rising demand for air conditioning systems that are energy-efficient is one of the prominent developments in the Algeria Air Conditioner Market. With growing environmental concerns and electricity costs, consumers look for ways to decrease their carbon footprint. The rise in the adoption of advanced home technology in air conditioners is another notable development in the sector. Smart thermostats as well as other connected devices provide control over temperature settings and the potential to optimize performance and monitor energy usage. Additionally, there is a growth in demand for air conditioners that are portable as they can be easily moved, and this trend is driven by the rise in smaller living spaces or an urge for more flexibility. Manufacturers in the market are developing new kinds of refrigerants with low global warming potential as compared to conventional options like R-410A or R-22.

Algeria Air Conditioner Market Synopsis

The Algeria Air Conditioner Market is anticipated to gain enormous growth over the forecast period on the back of the rise in demand for air conditioners since more people in the country are capable of purchasing air conditioners and they look for comfortable living.

According to 6Wresearch, Algeria Air Conditioner Market grew by 25.9% in 2017- 2020 and is expected to grow at a CAGR of 8.7% during 2021- 2027. Algeria occupies 1st position in terms of the market size in the Africa Air Conditioner Market. The nation has experienced faster economic growth and it is anticipated to grow more in the future, and economic growth of the nation has led to a rise in demand for air conditioners since more people in the country can afford air conditioners. The expansion in the construction sector of the nation is also stimulating the Algeria Air Conditioner Market Growth. An increase in disposable incomes of people and enhancing economic conditioners are leading to growth in the sector. The middle-class population of the country is growing, which will help in increased spending on items like air conditioners. The country’s government is taking initiatives to enhance power generation capacity as well as encourage energy efficiency, which will help in boosting the Algeria Air Conditioner Market Share.

COVID-19 Impact on Algeria Air Conditioner Market

The imposition of lockdown owing to the coronavirus pandemic hampered the growth of several industries globally. The pandemic negatively affected the Air Conditioners Market in Algeria. The lockdown resulted in a decrease in demand for air conditioners in the country since businesses were not supposed to work and companies enabled work from home to their employees. The commercial sector in the country is amongst the biggest end-user of air conditioners and since commercial buildings were closed, it led to a reduced demand for air conditioners. A number of construction projects were delayed, which, in turn, affected the market. Many consumers had to cut down on their purchases on account of pay cuts and job losses caused by the COVID-19 pandemic.

Algeria Air Conditioner Industry: Key Players

Some prominent players that are currently dominating the market and are anticipated to dominate it in the future are:

- LG Electronics

- Samsung Electronics Co., Ltd.

- Carrier Corporation

- Daikin Industries Ltd.

- Blue Star Limited.

The growth opportunities for manufacturers of air conditioners seem promising with a rise in construction activities as well as government initiatives across commercial and residential sectors.

Market by Type

Room Air Conditioner dominates the market and is expected to remain in a dominant position in the coming years. However, Centralized Air Conditioner is expected to have the fastest growth rate among all types.

Market by Application

Residential dominates the market and is expected to remain in a dominant position in the coming years. However, Commercial & Retail is expected to have the fastest growth rate among all applications.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020.

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- Algeria Air Conditioner Market Outlook

- Market Size of Algeria Air Conditioner Market, 2020

- Forecast of Algeria Air Conditioner Market, 2027

- Historical Data and Forecast of Algeria Air Conditioner Revenues & Volume for the Period 2017 - 2027

- Algeria Air Conditioner Market Trend Evolution

- Algeria Air Conditioner Market Drivers and Challenges

- Algeria Air Conditioner Price Trends

- Algeria Air Conditioner Porter's Five Forces

- Algeria Air Conditioner Industry Life Cycle

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Type for the Period 2017 - 2027

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Application for the Period 2017 - 2027

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Healthcare for the Period 2017 - 2027

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2017 - 2027

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2017 - 2027

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Hospitality for the Period 2017 - 2027

- Historical Data and Forecast of Algeria Air Conditioner Market Revenues & Volume By Others for the Period 2017 - 2027

- Algeria Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Algeria Air Conditioner Top Companies Market Share

- Algeria Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- Algeria Air Conditioner Company Profiles

- Algeria Air Conditioner Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Type

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Application

- Residential

- Healthcare

- Commercial & Retail

- Transportation & Infrastructure

- Hospitality

- Others

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- Mexico Dispersion Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- United States Video Conferencing Market (2025-2031) | Outlook, Industry, Size, Revenue, Share, Trends, Forecast, Growth, Companies, Analysis & Value

- Australia Electric Motor Market (2025-2031) | Trends, Share, Size, Value, Revenue, Industry, Growth, Analysis, Segmentation & Outlook

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines