Morocco Air Conditioner Market (2025-2031) | Trends, Analysis, Revenue, Growth, Size, Share, Outlook, Industry, Forecast, Segmentation

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others), And Competitive Landscape

| Product Code: ETC090112 | Publication Date: Dec 2023 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Topics Covered in the Morocco Air Conditioner Market

Morocco Air Conditioner Market report thoroughly covers the market by type and by application. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Morocco Air Conditioner Market Synopsis

Morocco is one country where the heat can become unbearable, especially during the summer months. The market is driven significantly by harsh climatic conditions, which makes the deployment of air conditioning systems necessary. As such, manufacturers are developing air conditioner systems with advanced features such as voice control, app integration, and AI-based automation. This is one of the leading trends proliferating the growth of the Morocco Air Conditioner industry.

According to 6Wresearch, the Morocco Air Conditioner Market size is expected to grow at a CAGR of 7.7% during the forecast period 2025-2031. The Moroccan government has been actively promoting economic growth through the construction of infrastructure and investment in various industries such as tourism, agriculture, and manufacturing. All these factors have created a conducive climate for both domestic and international air conditioner manufacturers to invest in the Moroccan market. The growing number of residential and commercial establishments is the primary driver of the Morocco Air Conditioner Market growth.

On the other hand, market faces some challenges such as high energy costs and lack of access to reliable electrical grids also contribute to the low adoption rates of air conditioners in rural areas. However, this situation presents an opportunity for manufacturers to invest in renewable energy sources to power air conditioners or provide more affordable alternatives such as solar-powered systems. However, the rising of smart air conditioning systems. There is an increased demand for energy-efficient and environmentally friendly air conditioning systems that can be controlled using smart home or office applications.

Government Initiatives introduced in the Morocco Air Conditioner Market

The Moroccan government has been keen on driving sustainable development and reducing energy consumption in the country. To this end, the country's energy regulator, ANRE, has launched a program to promote energy-efficient air conditioners by setting minimum energy efficiency standards for air conditioners sold in the country. Additionally, the government has implemented initiatives aimed at promoting renewable energy, such as solar energy. The government has also been providing subsidies to lower-income households to enable them to access affordable air conditioning systems.

Key Players in the Morocco Air Conditioner Market

Several global and local air conditioner manufacturers have a presence in the Moroccan market. The biggest players include LG Electronics, Samsung, Carrier Corporation, Daikin Industries, and Gree Electric Appliances. Local manufacturers include Climatiseur Comfort Plus and Vega Clim.

Market Analysis by Type

According to shivankar, Research Manager, 6Wresearch, Ductless Air Conditioners are leading in the market underpinned by its versatility, energy efficiency, and ease of installation.

Market Analysis by Application

Based on the application, the residential application is leading in the market due to the growing population of middle-class households and the rise in urbanization. The cost of air conditioners has gradually reduced, making it an affordable luxury for most households.

Key attractiveness of the report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Morocco Air Conditioner Market Outlook

- Market Size of Morocco Air Conditioner Market, 2024

- Forecast of Morocco Air Conditioner Market, 2031

- Historical Data and Forecast of Morocco Air Conditioner Revenues & Volume for the Period 2021 - 2031

- Morocco Air Conditioner Market Trend Evolution

- Morocco Air Conditioner Market Drivers and Challenges

- Morocco Air Conditioner Price Trends

- Morocco Air Conditioner Porter's Five Forces

- Morocco Air Conditioner Industry Life Cycle

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Residential for the Period 2021 - 2031

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Healthcare for the Period 2021 - 2031

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2021 - 2031

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2021 - 2031

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Hospitality for the Period 2021 - 2031

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Others for the Period 2021 - 2031

- Morocco Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Morocco Air Conditioner Top Companies Market Share

- Morocco Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- Morocco Air Conditioner Company Profiles

- Morocco Air Conditioner Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Application

- Residential

- Healthcare

- Commercial & Retail

- Transportation & Infrastructure

- Hospitality

- Others

Morocco Air Conditioner Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Morocco Air Conditioner Market Overview |

| 3.1 Morocco Air Conditioner Market Revenues & Volume, 2021 - 2031F |

| 3.2 Morocco Air Conditioner Market - Industry Life Cycle |

| 3.3 Morocco Air Conditioner Market - Porter's Five Forces |

| 3.4 Morocco Air Conditioner Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.5 Morocco Air Conditioner Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 4 Morocco Air Conditioner Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Morocco Air Conditioner Market Trends |

| 6 Morocco Air Conditioner Market Segmentation |

| 6.1 Morocco Air Conditioner Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Morocco Air Conditioner Market Revenues & Volume, By Type, 2021 - 2031F |

| 6.1.3 Morocco Air Conditioner Market Revenues & Volume, By Room Air Conditioner, 2021 - 2031F |

| 6.1.4 Morocco Air Conditioner Market Revenues & Volume, By Ducted Air Conditioner, 2021 - 2031F |

| 6.1.5 Morocco Air Conditioner Market Revenues & Volume, By Ductless Air Conditioner, 2021 - 2031F |

| 6.1.6 Morocco Air Conditioner Market Revenues & Volume, By Centralized Air Conditioner, 2021 - 2031F |

| 6.2 Morocco Air Conditioner Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Morocco Air Conditioner Market Revenues & Volume, By Residential, 2021 - 2031F |

| 6.2.3 Morocco Air Conditioner Market Revenues & Volume, By Healthcare, 2021 - 2031F |

| 6.2.4 Morocco Air Conditioner Market Revenues & Volume, By Commercial & Retail, 2021 - 2031F |

| 6.2.5 Morocco Air Conditioner Market Revenues & Volume, By Transportation & Infrastructure, 2021 - 2031F |

| 6.2.6 Morocco Air Conditioner Market Revenues & Volume, By Hospitality, 2021 - 2031F |

| 6.2.7 Morocco Air Conditioner Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 Morocco Air Conditioner Market Import-Export Trade Statistics |

| 7.1 Morocco Air Conditioner Market Export to Major Countries |

| 7.2 Morocco Air Conditioner Market Imports from Major Countries |

| 8 Morocco Air Conditioner Market Key Performance Indicators |

| 9 Morocco Air Conditioner Market - Opportunity Assessment |

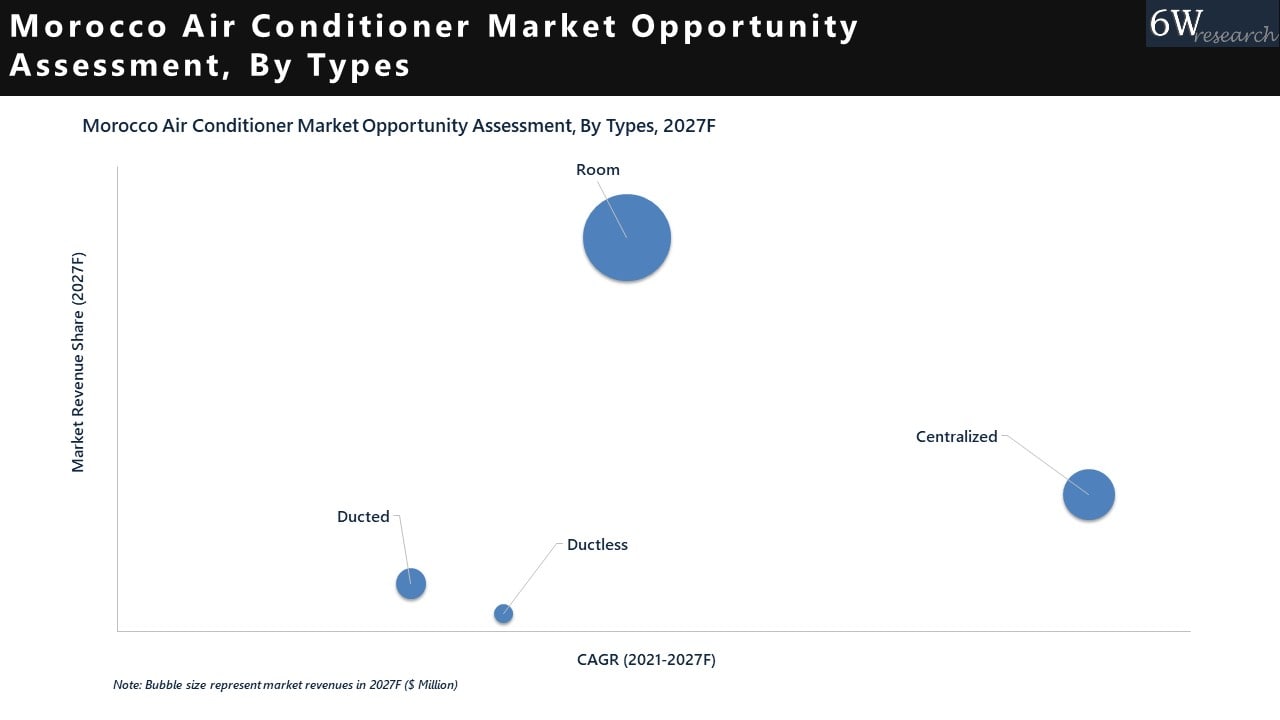

| 9.1 Morocco Air Conditioner Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 Morocco Air Conditioner Market Opportunity Assessment, By Application, 2021 & 2031F |

| 10 Morocco Air Conditioner Market - Competitive Landscape |

| 10.1 Morocco Air Conditioner Market Revenue Share, By Companies, 2024 |

| 10.2 Morocco Air Conditioner Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others), And Competitive Landscape

| Product Code: ETC090112 | Publication Date: Aug 2021 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Morocco Air Conditioner (AC) Market | Country-Wise Share and Competition Analysis

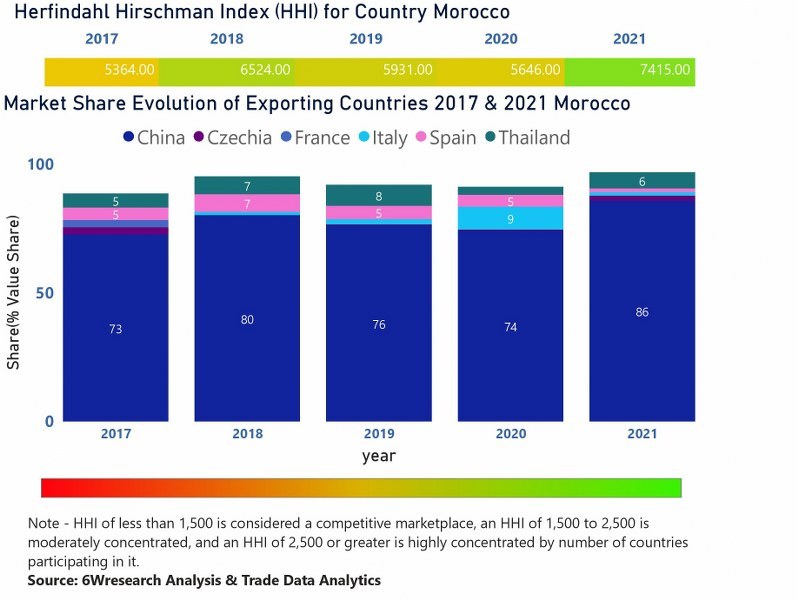

In the year 2021, China was the largest exporter in terms of value, followed by Thailand. It has registered a growth of 50.35% over previous year. While Thailand registered a growth of 165.42% over previous year. While in 2017 China was the largest exporter followed by Thailand. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Morocco has Herfindahl index of 5364 in 2017 which signifies high concentration while in 2021 it registered a Herfindahl index of 7415 which signifies high concentration in the market

Morocco Air Conditioner (AC) Market - Export Market Opportunities

Morocco Air Conditioner (AC) Market - Export Market Opportunities

Topics Covered in the Morocco Air Conditioner (AC) Market

Morocco Air Conditioner (AC) Market report thoroughly covers the market by type and by application. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Morocco Air Conditioner (AC) Market is projected to grow over the coming years. Morocco Air Conditioner (AC) Market report is a part of our periodical regional publication Africa Air Conditioner (AC) Market outlook report. 6W tracks the air conditioner market for over 60 countries with individual country-wise market opportunity assessments and publishes the report titled Global Air Conditioner (AC) Market outlook report annually.

Morocco Air Conditioner (AC) Market Synopsis

Morocco Air Conditioner (AC) Market is expected to gain traction over the years. The major factors propelling growth in the industry include the growing demand for energy-efficient and cost-effective systems in the country. Additionally, favorable government initiatives such as subsidies and tax exemptions are also furthering the Morocco Air Conditioner Market Growth. Generally, ACs are becoming a necessity owing to the rising temperatures and humidity levels.

According to 6Wresearch, the Morocco Air Conditioner (AC) Market size is anticipated to grow at a higher growth rate during 2021-27. The rising discretionary expenses and changing lifestyles are the major factors driving the growth of the air conditioner market in Morocco. Moreover, the rising awareness about energy-efficient air conditioners is one of the major trends in the market. Apart from this, there are several benefits of investing in the Morocco Air Conditioner (AC) Industry as the population in Morocco is increasingly urbanized and prosperous and there is a young population with a high demand for cooling solutions. However, the high initial cost of air conditioners and limited awareness about energy-saving models are the major factors hindering the growth in this market. To overcome these challenges, many companies are adopting various strategies such as product differentiation and efficient after-sales service network.

COVID-19 Impact on the Morocco Air Conditioner (AC) Market

The COVID-19 outburst has had an adverse impact on the Morocco Air Conditioner market share as it has severely disrupted the global supply chain, resulting in shortages of raw materials for AC production. Also, there has been a slight decrease in demand for ACs as many businesses and industries have been scaled back their operations to a great extent. With people spending more time at home during the quarantine period, there has been an increase in demand for ACs in the residential sector.

Key Players in the Morocco Air Conditioner (AC) Market

Some of the companies leading the Morocco Air Conditioner (AC) Industry include;

- LG Electronics

- Panasonic Corporation

- Daikin Industries Ltd.

- Carrier Corporation

- Haier Group Corporation

- Samsung

Market Analysis by Type

According to Dhaval, Research Manager, 6Wresearch, the room air conditioner segment is expected to gain traction over the years due to the increasing demand for individual cooling solutions in households. Additionally, the ductless air conditioner segment is also growing due to its ease of installation. On the other hand, the centralized air conditioner is dominating the Morocco Air Conditioner (AC) Market Revenue due to its increasing use in large commercial and industrial establishments.

Market Analysis by Application

By application, the residential and commercial & retail application segments are projected to experience significant growth on account of increasing urbanization and rising temperatures.

Key attractiveness of the report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020.

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Morocco Air Conditioner Market Outlook

- Market Size of Morocco Air Conditioner Market, 2020

- Forecast of Morocco Air Conditioner Market, 2027

- Historical Data and Forecast of Morocco Air Conditioner Revenues & Volume for the Period 2017 - 2027

- Morocco Air Conditioner Market Trend Evolution

- Morocco Air Conditioner Market Drivers and Challenges

- Morocco Air Conditioner Price Trends

- Morocco Air Conditioner Porter's Five Forces

- Morocco Air Conditioner Industry Life Cycle

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Type for the Period 2017 - 2027

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Application for the Period 2017 - 2027

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Healthcare for the Period 2017 - 2027

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2017 - 2027

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2017 - 2027

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Hospitality for the Period 2017 - 2027

- Historical Data and Forecast of Morocco Air Conditioner Market Revenues & Volume By Others for the Period 2017 - 2027

- Morocco Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Morocco Air Conditioner Top Companies Market Share

- Morocco Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- Morocco Air Conditioner Company Profiles

- Morocco Air Conditioner Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Application

- Residential

- Healthcare

- Commercial & Retail

- Transportation & Infrastructure

- Hospitality

- Others

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero