Cambodia Animal Feed Market (2025-2031) | Industry, Size, Value, Trends, Analysis, Revenue, Outlook, Companies, Forecast, Share & Growth

Market Forecast By Form (Pellets, Crumbles, Mash, Others), By Species (Poultry, Ruminants, Aqua, Swine, Others), By Type (Acidifiers, Probiotics, Enzyme, Antioxidants, Antibiotics, Vitamins, Minerals, Others) And Competitive Landscape

| Product Code: ETC018473 | Publication Date: Oct 2020 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Cambodia Animal Feed Market Size Growth Rate

The Cambodia Animal Feed Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 9.56% in 2025, climbs to a high of 13.72% in 2027, and moderates to 10.18% by 2029.

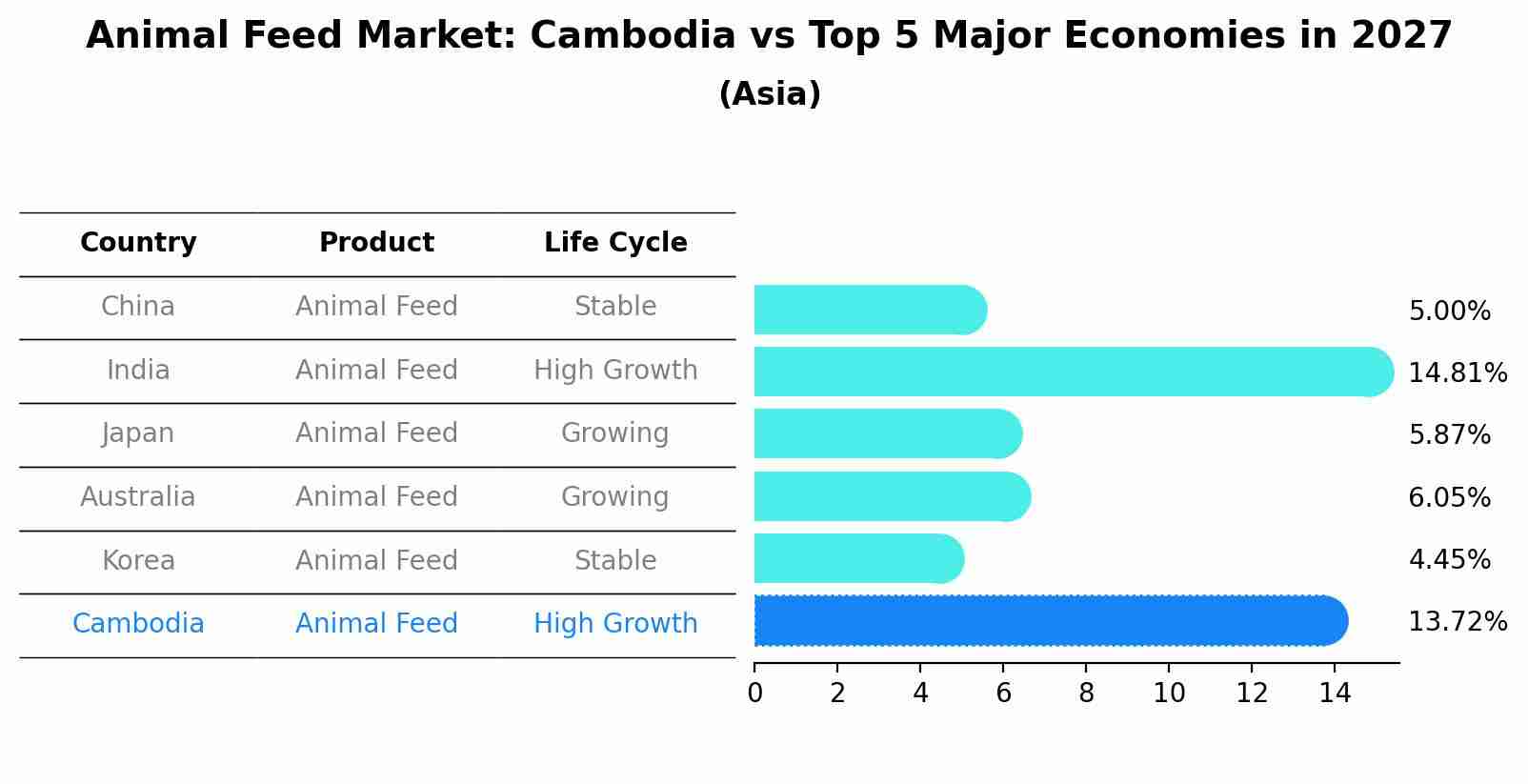

Animal Feed Market: Cambodia vs Top 5 Major Economies in 2027 (Asia)

The Animal Feed market in Cambodia is projected to grow at a high growth rate of 13.72% by 2027, within the Asia region led by China, along with other countries like India, Japan, Australia and South Korea, collectively shaping a dynamic and evolving market environment driven by innovation and increasing adoption of emerging technologies.

Topics Covered in the Cambodia Animal Feed Market

Cambodia Animal Feed Market report thoroughly covers the market by form, by species, and by type. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Cambodia Animal Feed Market Synopsis

Cambodia Animal Feed Market is expected to grow in the forecast period on the account of increasing country's agriculture and livestock industries. It plays a pivotal role in ensuring the quality and nutritional value of animal diets, ultimately impacting the productivity and health of livestock. The market encompasses a wide range of animal feed products, including compound feed, concentrates, feed additives, and more. Cambodia's animal feed industry is influenced by factors such as the country's expanding livestock production, the increasing focus on animal nutrition, and the need for sustainable and efficient feed solutions. As the demand for animal products like meat, eggs, and dairy continues to rise in Cambodia, the animal feed market is expected to witness steady growth.

According to 6Wresearch, the Cambodia Animal Feed Market Size was valued at approximately USD 600 million and is projected to reach USD 1.3 billion over the years, growing at a CAGR of 12.7% during the forecast period of 2025-2031. Cambodia is an agricultural country that is rich in natural resources which can grow livestock and cultivate varieties of crops. The livestock industry has developed significantly in the past few years in Cambodia, with the animal feed market playing a crucial role. The animal feed market in Cambodia has been witnessing growth due to various driving factors like a rise in the demand for meat and poultry, the government's initiatives, and an increase in the number of livestock farms. There are certain challenges in the market leading to reduction in Cambodia Animal Feed Market Share. One of the biggest challenges in the animal feed market is the lack of awareness and education on the science of animal nutrition. Many farmers do not understand the importance of feeding their animals with balanced and healthy diets, leading to a lower quality of animal products. To address this challenge, there needs to be a comprehensive education program aimed at teaching farmers about the right feeding practices. This will go a long way in reducing animal diseases and increasing meat quality. The cost of raw materials for animal feed production in Cambodia is relatively high. Many producers have to import raw materials from neighbouring countries which significantly affects the price of animal feed. To overcome this challenge, the government needs to invest in more animal feed research and development centres to produce more cost-effective raw materials locally.

The Impact of COVID-19 on the Cambodia Animal Feed Market

The COVID-19 pandemic has severely affected the Animal feed market in Cambodia. The closure of borders and reduced imports of raw materials have led to a shortage of feed raw materials. Additionally, the disruption of the supply chain has severely impacted the poultry industry, resulting in reduced demand for animal feed. Despite the challenges, the animal feed market in Cambodia has managed to survive, adapting to the changing dynamics of the market.

Government policies and schemes introduced in the Cambodia Animal Feed Market

The Cambodian government has taken several initiatives to boost the Cambodia animal feed market Growth and address the challenges faced by the industry. The government has invested in the development of infrastructure, including transport and storage facilities. The government has also implemented policies to support and encourage domestic production of raw materials and reduce dependence on imports. The Cambodian government is actively promoting the development of the animal feed industry and the livestock sub-sector as a whole. In 2019, the Ministry of Agriculture, Forestry, and Fisheries (MAFF) launched the Animal Feed Master Plan, aimed at facilitating the development of the animal feed industry by improving feed quality and production and enhancing the regulatory framework. The government has also implemented policies aimed at improving animal health and productivity.

Leading players in the Cambodia Animal Feed Market

Several companies operate in the Cambodia animal feed Industry, including suppliers of raw materials, feed millers, and distributors. Some of the significant players in the market include CP Cambodia Co., Ltd, Swissmill Cambodia Co., Ltd, and Greenfeed (Cambodia) Corp. Ltd. These companies operate in various segments of the market and offer a wide range of animal feed products.

Market By Form

Pellet feed is convenient and easy to handle, making it a preferred choice for many livestock farmers. It offers advantages such as reduced wastage and improved feed efficiency. As the demand for efficient feed management and consistent nutrition grows, pellet feeds are expected to witness increased adoption in Cambodia.

Market By Species

According to Shivankar, Research Manager, 6Wresearch, the aqua sector is expected to see substantial growth in the market. The increasing demand for fish and seafood, coupled with efforts to develop sustainable aquaculture practices, will drive the need for high-quality aquatic animal feed. As Cambodia aims to expand its aquaculture production, there will be a growing focus on nutritionally optimized feeds for fish and other aquatic species.

Market By Type

Probiotics and enzymes in animal feed have gained attention for their role in improving animal health and overall productivity. They contribute to better digestion and nutrient absorption, which is essential for efficient livestock production. With an increasing emphasis on animal welfare and sustainable agriculture, the use of probiotics and enzymes is likely to grow in Cambodia's animal feed market.

Key attractiveness of the report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Cambodia Animal Feed Market Outlook

- Market Size of Cambodia Animal Feed Market, 2024

- Forecast of Cambodia Animal Feed Market, 2031

- Historical Data and Forecast of Cambodia Animal Feed Revenues & Volume for the Period 2021 - 2031

- Cambodia Animal Feed Market Trend Evolution

- Cambodia Animal Feed Market Drivers and Challenges

- Cambodia Animal Feed Price Trends

- Cambodia Animal Feed Porter's Five Forces

- Cambodia Animal Feed Industry Life Cycle

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Form for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Pellets for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Crumbles for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Mash for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Species for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Poultry for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Ruminants for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Aqua for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Swine for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Acidifiers for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Probiotics for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Enzyme for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Antioxidants for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Antibiotics for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Vitamins for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Minerals for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Animal Feed Market Revenues & Volume By Others for the Period 2021 - 2031

- Cambodia Animal Feed Import Export Trade Statistics

- Market Opportunity Assessment By Form

- Market Opportunity Assessment By Species

- Market Opportunity Assessment By Type

- Cambodia Animal Feed Top Companies Market Share

- Cambodia Animal Feed Competitive Benchmarking By Technical and Operational Parameters

- Cambodia Animal Feed Company Profiles

- Cambodia Animal Feed Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

Market By Form

- Pellet

- Crumbles

- Mash

- Others

Market By Species

- Poultry

- Ruminants

- Aqua

- Swine

- Others

Market By Type

- Acidifiers

- Probiotics

- Enzyme

- Antioxidants

- Antibiotics

- Vitamins

- Minerals

- Others

Cambodia Animal Feed Market (2025-2031)

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Cambodia Animal Feed Market Overview |

| 3.1 Cambodia Country Macro Economic Indicators |

| 3.2 Cambodia Animal Feed Market Revenues & Volume, 2021 & 2031F |

| 3.3 Cambodia Animal Feed Market - Industry Life Cycle |

| 3.4 Cambodia Animal Feed Market - Porter's Five Forces |

| 3.5 Cambodia Animal Feed Market Revenues & Volume Share, By Form, 2021 & 2031F |

| 3.6 Cambodia Animal Feed Market Revenues & Volume Share, By Species, 2021 & 2031F |

| 3.7 Cambodia Animal Feed Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 4 Cambodia Animal Feed Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Cambodia Animal Feed Market Trends |

| 6 Cambodia Animal Feed Market, By Types |

| 6.1 Cambodia Animal Feed Market, By Form |

| 6.1.1 Overview and Analysis |

| 6.1.2 Cambodia Animal Feed Market Revenues & Volume, By Form, 2021 & 2031F |

| 6.1.3 Cambodia Animal Feed Market Revenues & Volume, By Pellets, 2021 & 2031F |

| 6.1.4 Cambodia Animal Feed Market Revenues & Volume, By Crumbles, 2021 & 2031F |

| 6.1.5 Cambodia Animal Feed Market Revenues & Volume, By Mash, 2021 & 2031F |

| 6.1.6 Cambodia Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 6.2 Cambodia Animal Feed Market, By Species |

| 6.2.1 Overview and Analysis |

| 6.2.2 Cambodia Animal Feed Market Revenues & Volume, By Poultry, 2021 & 2031F |

| 6.2.3 Cambodia Animal Feed Market Revenues & Volume, By Ruminants, 2021 & 2031F |

| 6.2.4 Cambodia Animal Feed Market Revenues & Volume, By Aqua, 2021 & 2031F |

| 6.2.5 Cambodia Animal Feed Market Revenues & Volume, By Swine, 2021 & 2031F |

| 6.2.6 Cambodia Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 6.3 Cambodia Animal Feed Market, By Type |

| 6.3.1 Overview and Analysis |

| 6.3.2 Cambodia Animal Feed Market Revenues & Volume, By Acidifiers, 2021 & 2031F |

| 6.3.3 Cambodia Animal Feed Market Revenues & Volume, By Probiotics, 2021 & 2031F |

| 6.3.4 Cambodia Animal Feed Market Revenues & Volume, By Enzyme, 2021 & 2031F |

| 6.3.5 Cambodia Animal Feed Market Revenues & Volume, By Antioxidants, 2021 & 2031F |

| 6.3.6 Cambodia Animal Feed Market Revenues & Volume, By Antibiotics, 2021 & 2031F |

| 6.3.7 Cambodia Animal Feed Market Revenues & Volume, By Vitamins, 2021 & 2031F |

| 6.3.8 Cambodia Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 6.3.9 Cambodia Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 7 Cambodia Animal Feed Market Import-Export Trade Statistics |

| 7.1 Cambodia Animal Feed Market Export to Major Countries |

| 7.2 Cambodia Animal Feed Market Imports from Major Countries |

| 8 Cambodia Animal Feed Market Key Performance Indicators |

| 9 Cambodia Animal Feed Market - Opportunity Assessment |

| 9.1 Cambodia Animal Feed Market Opportunity Assessment, By Form, 2021 & 2031F |

| 9.2 Cambodia Animal Feed Market Opportunity Assessment, By Species, 2021 & 2031F |

| 9.3 Cambodia Animal Feed Market Opportunity Assessment, By Type, 2021 & 2031F |

| 10 Cambodia Animal Feed Market - Competitive Landscape |

| 10.1 Cambodia Animal Feed Market Revenue Share, By Companies, 2024 |

| 10.2 Cambodia Animal Feed Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero