China Animal Feed Market (2025-2031) | Forecast, Share, Revenue, Trends, Growth, Companies, Industry, Value, Analysis, Outlook & Size

Market Forecast By Form (Pellets, Crumbles, Mash, Others), By Species (Poultry, Ruminants, Aqua, Swine, Others), By Type (Acidifiers, Probiotics, Enzyme, Antioxidants, Antibiotics, Vitamins, Minerals, Others) And Competitive Landscape

| Product Code: ETC018461 | Publication Date: Nov 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

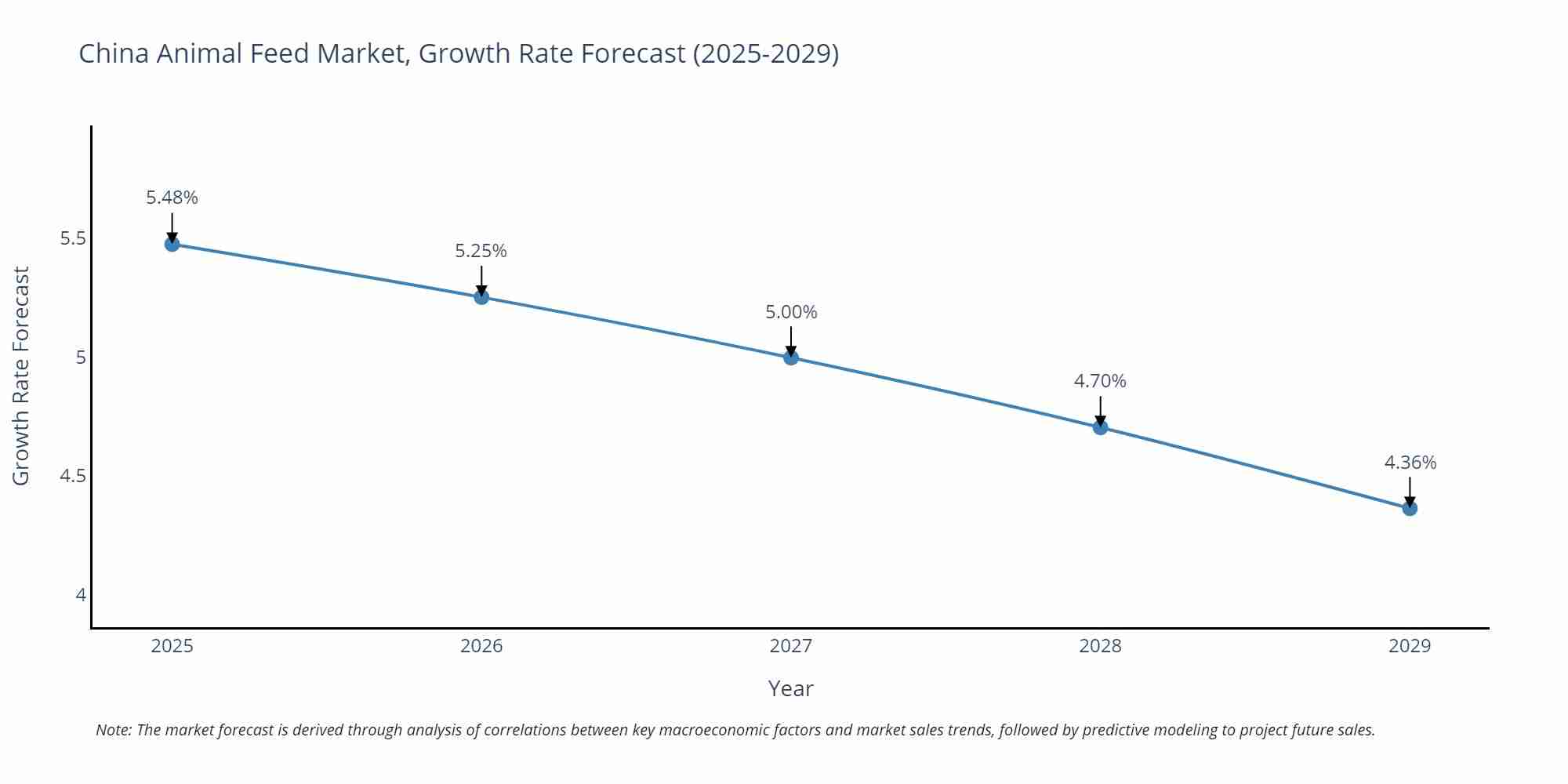

China Animal Feed Market Size Growth Rate

The China Animal Feed Market may undergo a gradual slowdown in growth rates between 2025 and 2029. Starting high at 5.48% in 2025, the market steadily declines to 4.36% by 2029.

Topics Covered in the China Animal Feed Market

China Animal Feed Market report thoroughly covers the market by form, by species, and by type. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

China Animal Feed Market Synopsis

China Animal Feed Market is one of the largest and most complex in the world. With its vast network of suppliers, distributors, and end-users, it is also one of the most fragmented. China animal feed market is a complex industry that involves the processing and production of feed for various livestock animals. It is also a crucial sector that provides the necessary nutrition for animals, helping them grow and produce quality meat and dairy products.

According to 6Wresearch, the China Animal Feed Market Size is estimated to grow at a CAGR of 4.56% to reach US$102.889 billion, from US$75.498 billion over the forecast period of 2025-2031. One of the key drivers of the China animal feed market growth is the growing demand for meat, dairy products, and eggs. As the Chinese middle class expands, so does their demand for high-quality protein. Additionally, the government's push to modernize its agriculture sector has led to an increase in livestock farming, thereby driving up demand for feed. Despite the growth potential of the China animal feed market, there are several challenges that industry players must navigate. One of the significant challenges is the volatile pricing of raw materials such as corn, soybean, and wheat. Another challenge is the regulatory environment, which is complex and ever-changing. Additionally, the highly fragmented nature of the market makes it difficult for suppliers and distributors to establish strong relationships with buyers. The China animal feed industry is undergoing several trends, primarily driven by sustainable development and technological advancements. One of the key trends is a growing demand for organic, non-GMO, and clean-label products. Farmers are increasingly demanding feed that is free from pesticides, chemicals, and other harmful additives. Another significant trend is the adoption of technology, such as precision farming and Internet of Things (IoT). These technologies help farmers optimize their feed usage, reduce waste, and improve animal health. Despite the challenges faced by the China animal feed market, there are several opportunities for industry players. One of the significant opportunities is the increasing demand for premium, specialty, and functional feed. Farmers are willing to pay a premium for feed that has added benefits such as improving the gut health of the animal or enhancing its immune system.

Government policies and schemes introduced in the China Animal Feed Market

The China government has introduced several policies to regulate and support the animal feed industry. One such policy is the "China Feed Safety Law." This law sets the standards for the production and distribution of animal feed in China. It also outlines the procedures for inspecting and enforcing the law. The policy aims to ensure that animal feed produced and distributed in China is safe and meets the nutritional requirements of livestock. Another key policy introduced by the Chinese government is the "National Five-Year Plan." This policy aims to increase the production and development of the animal husbandry industry, including animal feed. The plan includes measures to improve the quality of animal feed, and increase the efficiency of production. The policy is expected to have a significant impact on the animal feed industry, particularly in rural areas. The government has also introduced several schemes to support the animal feed industry. One such scheme is the "One Village, One Product" program. This program aims to promote the development of agricultural products in rural areas. The program provides financial and technical assistance to farmers to help them improve the quality and efficiency of their animal feed production.

Leading players in the China Animal Feed Market

The China Animal Feed Market Share is dominated by several players, including Cargill, New Hope Group, and Charoen Pokphand Group. These companies account for a significant share of the market. Cargill, for example, is one of the largest animal feed producers in China and operates around 30 animal feed facilities across the country. New Hope Group, on the other hand, produces more than 20 million tonnes of animal feed annually and is a leading producer of poultry, swine, and beef in China. Other notable players in the market include Guangdong Haid Group, Beijing Dabeinong Technology Group, and Tangrenshen Group. These companies are known for their advanced technologies and innovative products and are expected to play a significant role in the growth of the animal feed industry in China.

Market Analysis by Species

According to Saurabh, Senior Research Analyst, 6Wresearch, the Poultry segment is the only one that has shown a consistent increase in demand. The production of eggs in China is on the rise, with the country being a breeding ground for broilers. As a result, Poultry farmers prefer more cost-effective and protein-rich feed that helps increase productivity.

Market Analysis by Type

By Type, acidifiers segment is one that has been growing over the past few years. Acidifiers are food additives that help animals maintain a low intestinal pH balance, which helps with digestion and the growth of beneficial bacteria. This is attributed to the desire to raise animals without using antibiotics and concerns regarding antibiotic resistance.

Key attractiveness of the report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- China Animal Feed Market Outlook

- Market Size of China Animal Feed Market, 2024

- Forecast of China Animal Feed Market, 2031

- Historical Data and Forecast of China Animal Feed Revenues & Volume for the Period 2021 - 2031

- China Animal Feed Market Trend Evolution

- China Animal Feed Market Drivers and Challenges

- China Animal Feed Price Trends

- China Animal Feed Porter's Five Forces

- China Animal Feed Industry Life Cycle

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Form for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Pellets for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Crumbles for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Mash for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Species for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Poultry for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Ruminants for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Aqua for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Swine for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Acidifiers for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Probiotics for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Enzyme for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Antioxidants for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Antibiotics for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Vitamins for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Minerals for the Period 2021 - 2031

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Others for the Period 2021 - 2031

- China Animal Feed Import Export Trade Statistics

- Market Opportunity Assessment By Form

- Market Opportunity Assessment By Species

- Market Opportunity Assessment By Type

- China Animal Feed Top Companies Market Share

- China Animal Feed Competitive Benchmarking By Technical and Operational Parameters

- China Animal Feed Company Profiles

- China Animal Feed Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Form

- Pellets

- Crumbles

- Mash

- Others

By Species

- Poultry

- Ruminants

- Aqua

- Swine

- Others

By Type

- Acidifiers

- Probiotics

- Enzyme

- Antioxidants

- Antibiotics

- Vitamins

- Minerals

- Others

China Animal Feed Market (2025-2031)

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 China Animal Feed Market Overview |

| 3.1 China Country Macro Economic Indicators |

| 3.2 China Animal Feed Market Revenues & Volume, 2021 & 2031F |

| 3.3 China Animal Feed Market - Industry Life Cycle |

| 3.4 China Animal Feed Market - Porter's Five Forces |

| 3.5 China Animal Feed Market Revenues & Volume Share, By Form, 2021 & 2031F |

| 3.6 China Animal Feed Market Revenues & Volume Share, By Species, 2021 & 2031F |

| 3.7 China Animal Feed Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 4 China Animal Feed Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 China Animal Feed Market Trends |

| 6 China Animal Feed Market, By Types |

| 6.1 China Animal Feed Market, By Form |

| 6.1.1 Overview and Analysis |

| 6.1.2 China Animal Feed Market Revenues & Volume, By Form, 2021 & 2031F |

| 6.1.3 China Animal Feed Market Revenues & Volume, By Pellets, 2021 & 2031F |

| 6.1.4 China Animal Feed Market Revenues & Volume, By Crumbles, 2021 & 2031F |

| 6.1.5 China Animal Feed Market Revenues & Volume, By Mash, 2021 & 2031F |

| 6.1.6 China Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 6.2 China Animal Feed Market, By Species |

| 6.2.1 Overview and Analysis |

| 6.2.2 China Animal Feed Market Revenues & Volume, By Poultry, 2021 & 2031F |

| 6.2.3 China Animal Feed Market Revenues & Volume, By Ruminants, 2021 & 2031F |

| 6.2.4 China Animal Feed Market Revenues & Volume, By Aqua, 2021 & 2031F |

| 6.2.5 China Animal Feed Market Revenues & Volume, By Swine, 2021 & 2031F |

| 6.2.6 China Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 6.3 China Animal Feed Market, By Type |

| 6.3.1 Overview and Analysis |

| 6.3.2 China Animal Feed Market Revenues & Volume, By Acidifiers, 2021 & 2031F |

| 6.3.3 China Animal Feed Market Revenues & Volume, By Probiotics, 2021 & 2031F |

| 6.3.4 China Animal Feed Market Revenues & Volume, By Enzyme, 2021 & 2031F |

| 6.3.5 China Animal Feed Market Revenues & Volume, By Antioxidants, 2021 & 2031F |

| 6.3.6 China Animal Feed Market Revenues & Volume, By Antibiotics, 2021 & 2031F |

| 6.3.7 China Animal Feed Market Revenues & Volume, By Vitamins, 2021 & 2031F |

| 6.3.8 China Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 6.3.9 China Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 7 China Animal Feed Market Import-Export Trade Statistics |

| 7.1 China Animal Feed Market Export to Major Countries |

| 7.2 China Animal Feed Market Imports from Major Countries |

| 8 China Animal Feed Market Key Performance Indicators |

| 9 China Animal Feed Market - Opportunity Assessment |

| 9.1 China Animal Feed Market Opportunity Assessment, By Form, 2021 & 2031F |

| 9.2 China Animal Feed Market Opportunity Assessment, By Species, 2021 & 2031F |

| 9.3 China Animal Feed Market Opportunity Assessment, By Type, 2021 & 2031F |

| 10 China Animal Feed Market - Competitive Landscape |

| 10.1 China Animal Feed Market Revenue Share, By Companies, 2024 |

| 10.2 China Animal Feed Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Form (Pellets, Crumbles, Mash, Others), By Species (Poultry, Ruminants, Aqua, Swine, Others), By Type (Acidifiers, Probiotics, Enzyme, Antioxidants, Antibiotics, Vitamins, Minerals, Others) And Competitive Landscape

| Product Code: ETC018461 | Publication Date: Oct 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

China Animal Feed Market is projected to grow over the coming year. China Animal Feed Market report is a part of our periodical regional publication Asia Pacific Animal Feed Market outlook report. 6W tracks Animal Feed market for over 60 countries with individual country-wise market opportunity assessment and publishes with the report titled Global Animal Feed Market outlook report annually.

China Animal Feed Market report thoroughly covers market by Form, species and type. The market report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

China Animal Feed Market Synopsis

China Animal Feed Market is likely to project modest growth during the forthcoming years on account of increasing commercialization of livestock. Rising urbanization backed by upsurge in disposable income has led to the increasing growth of the market. The growing penetration of consumer towards the consumption of high-quality meat and animal-based product is accelerating the growth of animal feed market in China. Moreover, the adoption of vegan diet has further contributed towards the China Animal Feed Market Share.

According to 6Wresearch, China Animal Feed Market size is projected to register growth during 2020-2026. Ministry Of Agriculture and Rural Affairs in China has implemented a three-year mission plan for swine production and supply that has further led to the growth of Animal Feed Market in China. Increasing penetration of Chinese consumers towards the consumption of poultry triggers the potential growth of the Market. Increasing disposable income backed by rising demand for processed meat is adding to the China Animal Feed Market Revenue. The global health emergency amid the outbreak of COVID-19 has declined the China Animal Feed Market Growth. Nationwide lockdown led to the disruption in supply chain further beholds the negative growth of China Animal Feed Market Growth.

Market Analysis by Species

On the basis of Species, Poultry segment is accounting the largest share and is expected to lead the market during the forecast period on account of increasing export opportunities.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- China Animal Feed Market Outlook

- Market Size of China Animal Feed Market, 2019

- Forecast of China Animal Feed Market, 2026

- Historical Data and Forecast of China Animal Feed Revenues & Volume for the Period 2016 - 2026

- China Animal Feed Market Trend Evolution

- China Animal Feed Market Drivers and Challenges

- China Animal Feed Price Trends

- China Animal Feed Porter's Five Forces

- China Animal Feed Industry Life Cycle

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Form for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Pellets for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Crumbles for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Mash for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Others for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Species for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Poultry for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Ruminants for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Aqua for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Swine for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Others for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Type for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Acidifiers for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Probiotics for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Enzyme for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Antioxidants for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Antibiotics for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Vitamins for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Minerals for the Period 2016 - 2026

- Historical Data and Forecast of China Animal Feed Market Revenues & Volume By Others for the Period 2016 - 2026

- China Animal Feed Import Export Trade Statistics

- Market Opportunity Assessment By Form

- Market Opportunity Assessment By Species

- Market Opportunity Assessment By Type

- China Animal Feed Top Companies Market Share

- China Animal Feed Competitive Benchmarking By Technical and Operational Parameters

- China Animal Feed Company Profiles

- China Animal Feed Key Strategic Recommendations

Market Segmentation:

The report provides a detailed analysis of the following market segments:

- By Form

- Pellets

- Crumbles

- Mash

- Others

- By Species

- Poultry

- Ruminants

- Aqua

- Swine

- Others

- By Type

- Acidifiers

- Probiotics

- Enzyme

- Antioxidants

- Antibiotics

- Vitamins

- Minerals

- Others

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero