Kazakhstan Animal Feed Market (2024-2030) | Revenue, Companies, Industry, Size, Forecast, Analysis, Trends, Outlook, Share, Growth & Value

Market Forecast By Form (Pellets, Crumbles, Mash, Others), By Species (Poultry, Ruminants, Aqua, Swine, Others) And Competitive Landscape

| Product Code: ETC018498 | Publication Date: Nov 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 69 | No. of Figures: 18 | No. of Tables: 5 | |

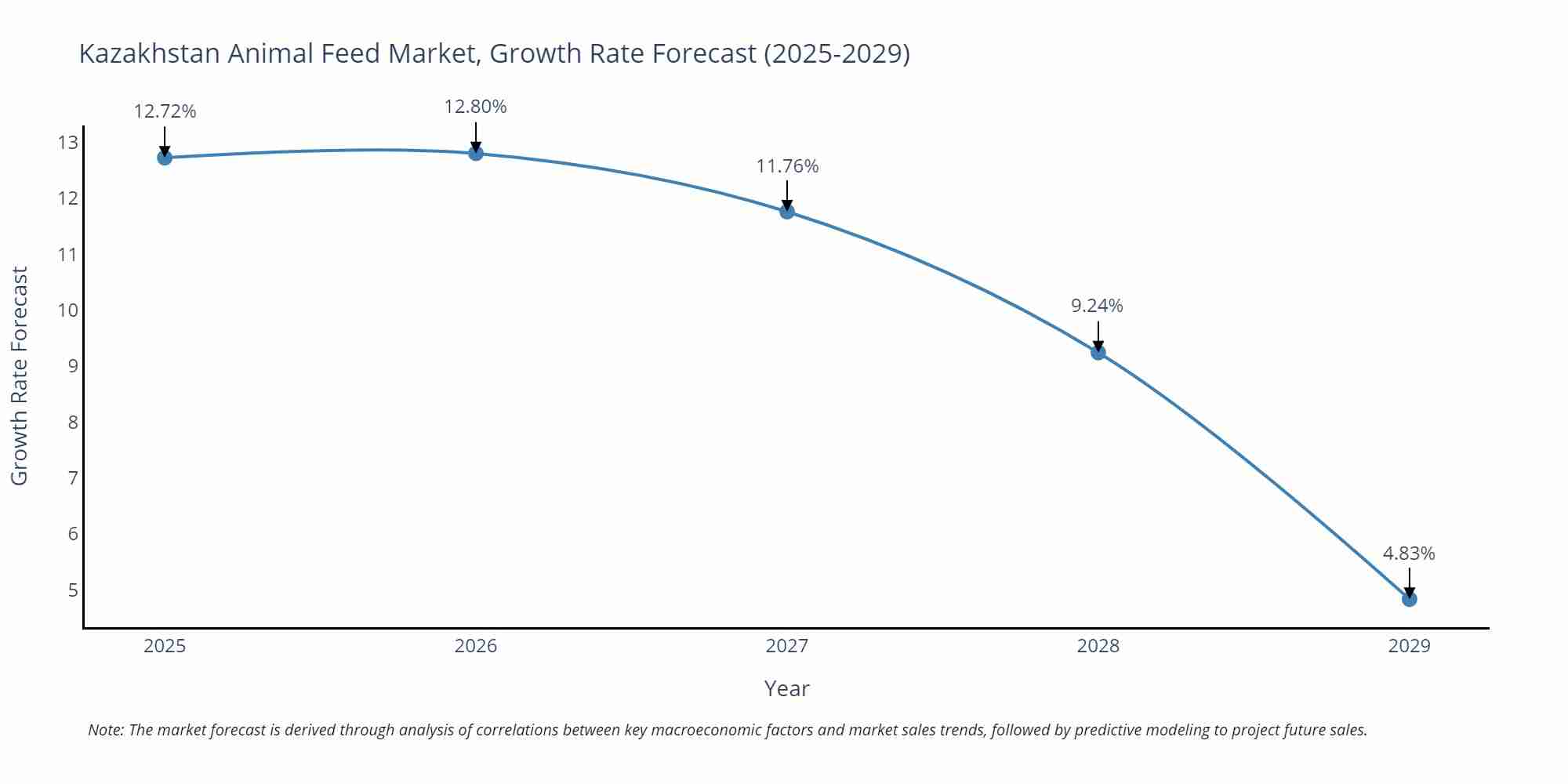

Kazakhstan Animal Feed Market Size Growth Rate

The Kazakhstan Animal Feed Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 12.72% in 2025, climbs to a high of 12.80% in 2026, and moderates to 4.83% by 2029.

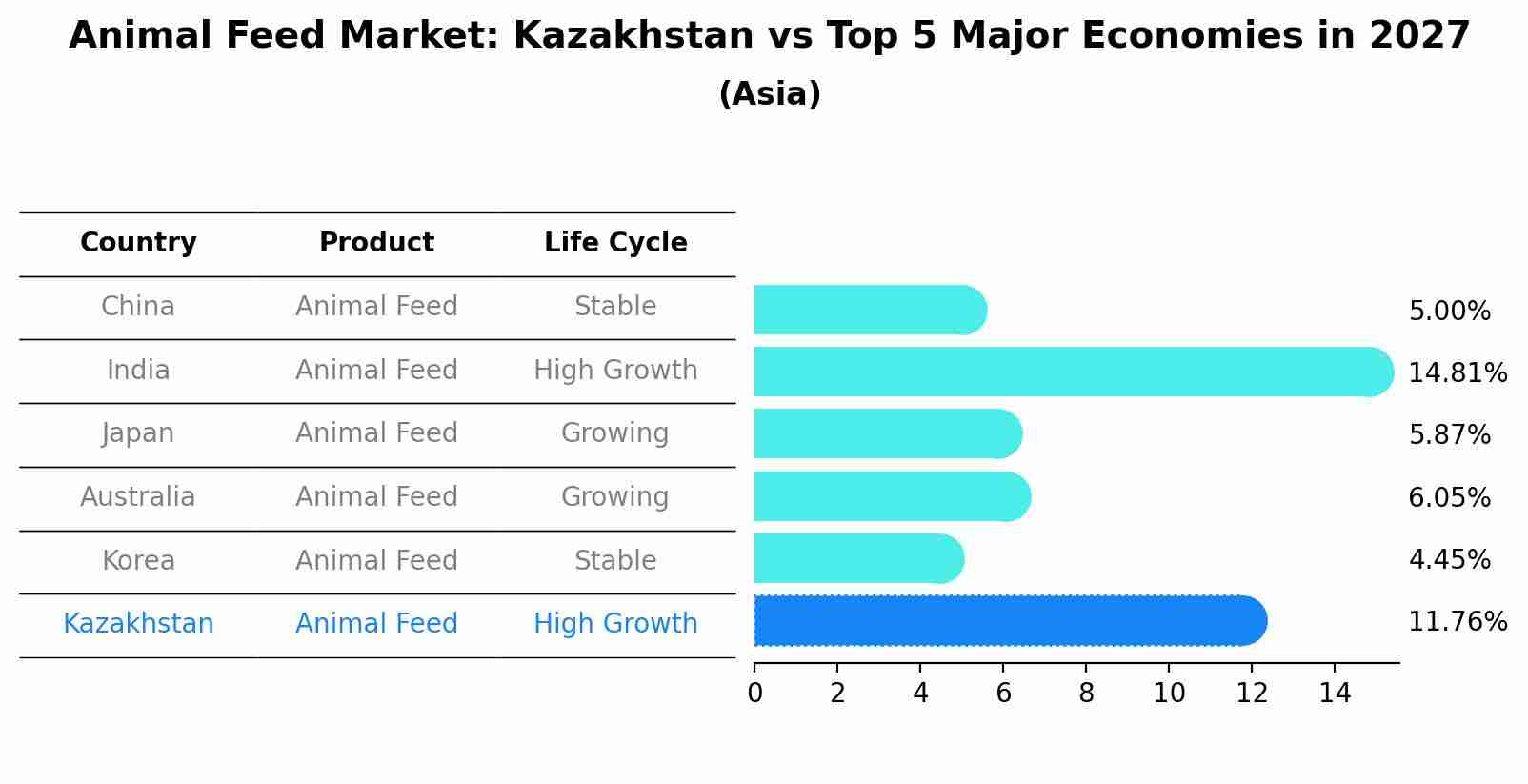

Animal Feed Market: Kazakhstan vs Top 5 Major Economies in 2027 (Asia)

By 2027, Kazakhstan's Animal Feed market is forecasted to achieve a high growth rate of 11.76%, with China leading the Asia region, followed by India, Japan, Australia and South Korea.

Topics Covered in Kazakhstan Animal Feed Market Report

Kazakhstan Animal Feed Market Report thoroughly covers the market by form and species. Kazakhstan Animal Feed Market Outlook report provides an unbiased and detailed analysis of the ongoing Kazakhstan Animal Feed Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Kazakhstan Animal Feed Market Synopsis

Kazakhstan animal feed market has witnessed growth in recent years, fueled by the expanding livestock sector, with sheep and goat numbers increased by 17.7% and cattle by 12.2% in January-March 2020, which led to higher demand for animal feed. For instance, in 2020, Kazakhstan produced 1,807 thousand tonnes of ready-made animal feed except for flour and alfalfa pellets, a 35% increase from the 1,334 thousand tonnes produced in 2019. Further, livestock product production increased by 0.9% in 2022 and 3.6% in the first five months of 2023, which in turn boosted higher demand for animal feed to support the growing livestock population. Additionally, the growing demand for meat and dairy products, fueled by population growth and rising income has pressured livestock farmers in Kazakhstan to increase production efficiency and meat output, thereby further boosting the demand for high-quality animal feed in Kazakhstan.

According to 6Wresearch, the Kazakhstan Animal Feed Market Revenues is projected to grow at a CAGR of 3.6% during 2024-2030. The animal feed market in Kazakhstan is poised for significant growth in the years ahead, driven by increasing dairy production to meet the growing demand for dairy products. For instance, milk production increased by 4.4% from January to August in 2024, highlighting the growth and vitality of dairy sector. Further, Kazakhstan plans to expand its dairy herd by 100,000 and increase milk production by 725,000 tons over the next four years, would drive greater demand for high-quality animal feed to support the growing dairy herd and increased milk production. Further, government’s plan to increase poultry production by 200,000 tons, reaching 530,000 tons by 2026, would increase demand for feed to support the increased poultry production. In addition, government plans to significantly boost feed production to ensure a consistent supply of raw materials, and improve overall industry efficiency. These efforts are poised to support the sustained growth of Kazakhstan's animal feed market in the years to come.

Market Segmentation By Form

In the coming years, Pellets form are expected to garner the highest revenue share and experience rapid growth in Kazakhstan animal feed market due to their superior feed conversion efficiency. The uniform composition of pellets improves feed efficiency and growth rates, critical for intensive farming systems. Additionally, pellets reduce feed waste, meeting the growing demand for cost-effective, sustainable animal nutrition.

Market Segmentation By Species

In the forthcoming years, poultry is expected to generate the highest revenue share and experience rapid growth in Kazakhstan animal feed market due to strong demand for eggs and poultry meat in the country’s growing population. This growth is further bolstered by the government's strategic initiative to enhance poultry production by 200,000 tons, aiming to reach 530,000 tons by 2026.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Kazakhstan Animal Feed Market Overview

- Kazakhstan Animal Feed Market Outlook

- Kazakhstan Animal Feed Market Forecast

- Kazakhstan Animal Feed Market Porter’s Five forces Analysis

- Kazakhstan Animal Feed Market Industry Life Cycle Analysis

- Historical Data and Forecast of Kazakhstan Animal Feed Market Revenues, for the Period 2020-2030F

- Market Drivers and Restraints

- Historical Data and Forecast of Kazakhstan Animal Feed Market Revenues, By Form, for the Period 2020-2030F

- Historical Data and Forecast of Kazakhstan Animal Feed Market Volume, By Form, for the Period 2020-2030F

- Historical Data and Forecast of Kazakhstan Animal Feed Market Revenues, By Species, for the Period 2020-2030F

- Import-Export Analysis

- Key Performance Indicators

- Market Opportunity Assessment

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Form

- Pellets

- Crumbles

- Mash

- Others (Frozen, Dry Kibble etc.)

By Species

- Poultry

- Ruminants

- Aqua

- Others (Pets, Equine etc.)

Kazakhstan Animal Feed Market (2025-2031) : FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of The Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Kazakhstan Animal Feed Market Overview |

| 3.1. Kazakhstan Animal Feed Market Revenues and Volume, 2020-2030F |

| 3.2. Kazakhstan Animal Feed Market- Industry Life Cycle |

| 3.3. Kazakhstan Animal Feed Market Porter’s Five Forces |

| 4. Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraint |

| 5. Kazakhstan Animal Feed Market Trends & Evolution |

| 6. Kazakhstan Animal Feed Market Overview, By Form |

| 6.1 Kazakhstan Animal Feed Market Revenue & Revenue Share, By Form, 2020 & 2030F |

| 6.1.1 Kazakhstan Animal Feed Market Revenues, By Pellets, 2020 & 2030F |

| 6.1.2 Kazakhstan Animal Feed Market Revenues, By Crumbles, 2020 & 2030F |

| 6.1.3 Kazakhstan Animal Feed Market Revenues, By Mash, 2020 & 2030F |

| 6.1.4 Kazakhstan Animal Feed Market Revenues, By Others, 2020 & 2030F |

| 6.2 Kazakhstan Animal Feed Market Volume & Volume Share, By Form, 2020 & 2030F |

| 6.2.1 Kazakhstan Animal Feed Market Volume, By Pellets, 2020 & 2030F |

| 6.2.2 Kazakhstan Animal Feed Market Volume, By Crumbles, 2020 & 2030F |

| 6.2.3 Kazakhstan Animal Feed Market Volume, By Mash, 2020 & 2030F |

| 6.2.4 Kazakhstan Animal Feed Market Volume, By Others, 2020 & 2030F |

| 7. Kazakhstan Animal Feed Market Overview, By Species |

| 7.1 Kazakhstan Animal Feed Market Revenue and Revenue Share, By Species, 2020 & 2030F |

| 7.1.1 Kazakhstan Animal Feed Market Revenues, By Poultry, 2020 & 2030F |

| 7.1.2 Kazakhstan Animal Feed Market Revenues, By Ruminants, 2020 & 2030F |

| 7.1.3 Kazakhstan Animal Feed Market Revenues, By Aqua, 2020 & 2030F |

| 7.1.4 Kazakhstan Animal Feed Market Revenues, By Others, 2020 & 2030F |

| 8. Kazakhstan Animal Feed Market Import-Export Trade Statistics |

| 8.1 Kazakhstan Animal Feed Market Export to Major Countries |

| 8.2 Kazakhstan Animal Feed Market Imports from Major Countries |

| 9. Kazakhstan Animal Feed Market Key Performance Indicators |

| 10. Kazakhstan Animal Feed Market Opportunity Assessment |

| 10.1 Kazakhstan Animal Feed Market Opportunity Assessment, By Form, 2030F |

| 10.2 Kazakhstan Animal Feed Market Opportunity Assessment, By Species, 2030F |

| 11. Kazakhstan Animal Feed Market Competitive Landscape |

| 11.1 Kazakhstan Animal Feed Market Company Ranking, By Top 3 Companies (2023) |

| 11.2 Kazakhstan Animal Feed Market Key Companies Competitive Benchmarking, By Operating Parameters |

| 12. Company Profile |

| 12.1 Oasis Agro |

| 12.2 Kaz Food Products |

| 12.3 Alltech Kazakhstan |

| 12.4 Kaz Organic Product LLP |

| 12.5 Aqua Alliance LLP |

| 12.6 GoodZhem |

| 12.7 Adifeed |

| 12.8 Zinpro |

| 12.9 Dikanshy LLP |

| 12.10 Uyz May Industry |

| 12.11 Mars Petcare |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of figures |

| 1. Kazakhstan Animal Feed Market Revenues and Volume, 2020-2030F (USD Million, Thousand Tons) |

| 2. Kazakhstan Cow’s Milk Production (Thousand Tons), Jan-Jun 2023-2024 |

| 3. Kazakhstan Average Milk Yield Per Dairy Cow, (Kilograms), Jan-Jun 2023-2024 |

| 4. Kazakhstan Soybean Meal Imports (Thousand MT), 2020-2023 |

| 5. Kazakhstan Animal Feed Market Revenue Share, By Form, 2023 & 2030F |

| 6. Kazakhstan Animal Feed Market Volume Share, By Form, 2023 & 2030F |

| 7. Kazakhstan Animal Feed Market Revenue Share, By Species, 2023 & 2030F |

| 8. Kazakhstan Share of Top 3 Import Partners for HS Code 2309, 2023 |

| 9. Market Import Data, By Country for HS Code, 2023 ($ Million) |

| 10. Kazakhstan Share of Top 3 Export Partners for HS Code 2309, 2023 |

| 11. Market Export Data, By Country for HS Code ,2023 ($ Million) |

| 12. Gross Output Of Products (Services) Of Agriculture, Forestry And Fisheries, 2020-2028F ($ Billion) |

| 13. Kazakhstan Number of Livestock and Poultry (In Thousand Heads) July 1, 2023-2024 |

| 14. Kazakhstan Production of Certain Types of Livestock Products, (2022-2023) |

| 15. Kazakhstan Animal Feed Market Opportunity Assessment, By Form, 2030F ($ Million) |

| 16. Kazakhstan Animal Feed Market Opportunity Assessment, By Species, 2030F ($ Million) |

| 17. Kazakhstan Animal Feed Market Revenue Ranking, By Companies, 2023 |

| 18. Kazakhstan Large Agricultural Farms Region |

| List of Tables |

| 1. Kazakhstan Upcoming and Ongoing Animal Feed Project (2024-2027) |

| 2. Kazakhstan Animal Feed Market Revenues, By Form, 2020-2030F ($ Million) |

| 3. Kazakhstan Animal Feed Market Volume, By Form, 2020-2030F (Million Tons) |

| 4. Kazakhstan Animal Feed Market Revenues, By Species, 2020-2030F ($ Million) |

| 5. Kazakhstan Agriculture Investments, 2024 |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero