Sri Lanka Animal Feed Market (2025-2031) | Companies, Trends, Size, Outlook, Revenue, Share, Forecast, Growth, Value, Industry & Analysis

Market Forecast By Form (Pellets, Crumbles, Mash, Others), By Species (Poultry, Ruminants, Aqua, Swine, Others), By Type (Acidifiers, Probiotics, Enzyme, Antioxidants, Antibiotics, Vitamins, Minerals, Others) And Competitive Landscape

| Product Code: ETC018471 | Publication Date: Oct 2020 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

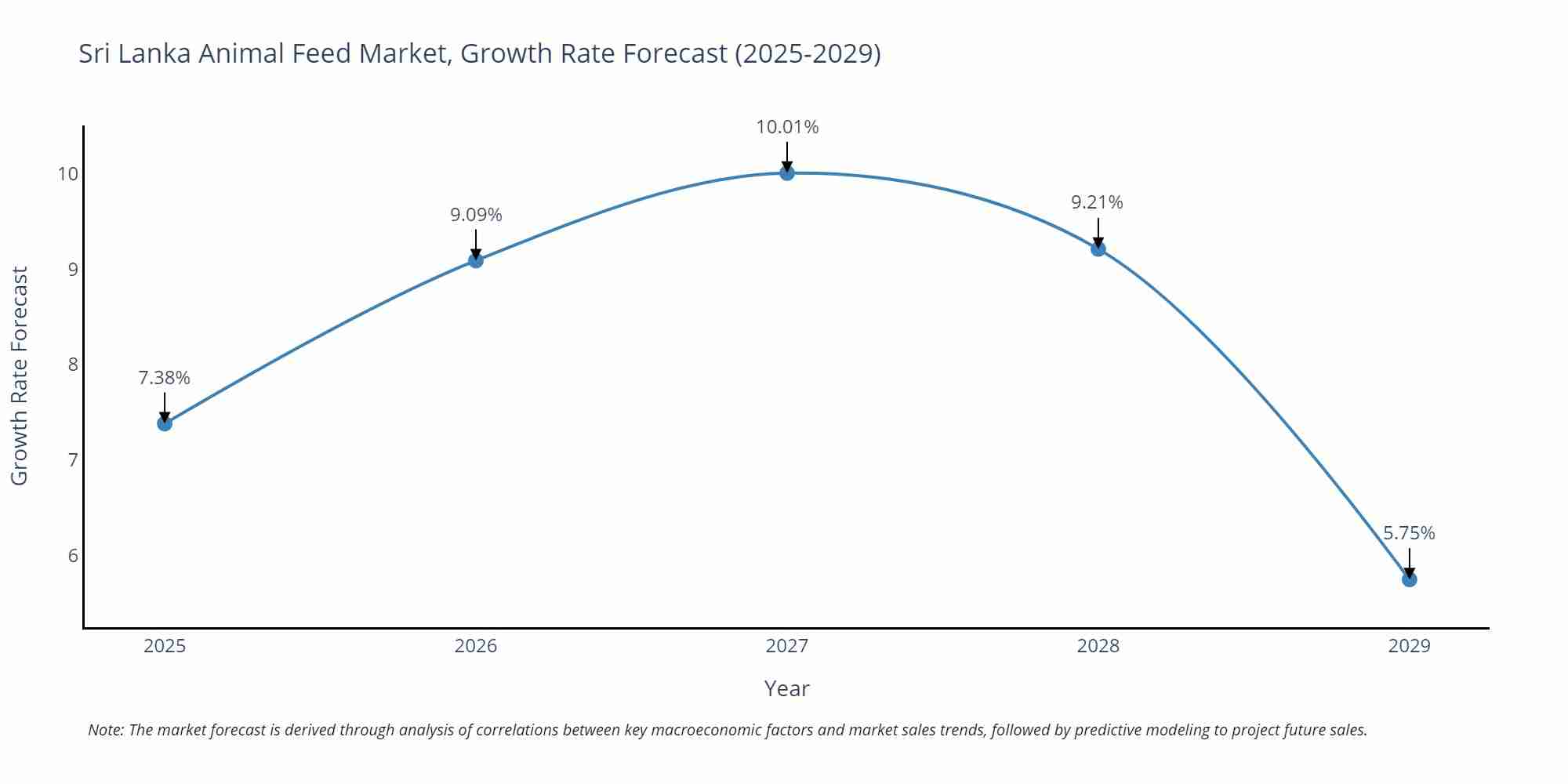

Sri Lanka Animal Feed Market Size Growth Rate

The Sri Lanka Animal Feed Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 7.38% in 2025, the market peaks at 10.01% in 2027, and settles at 5.75% by 2029.

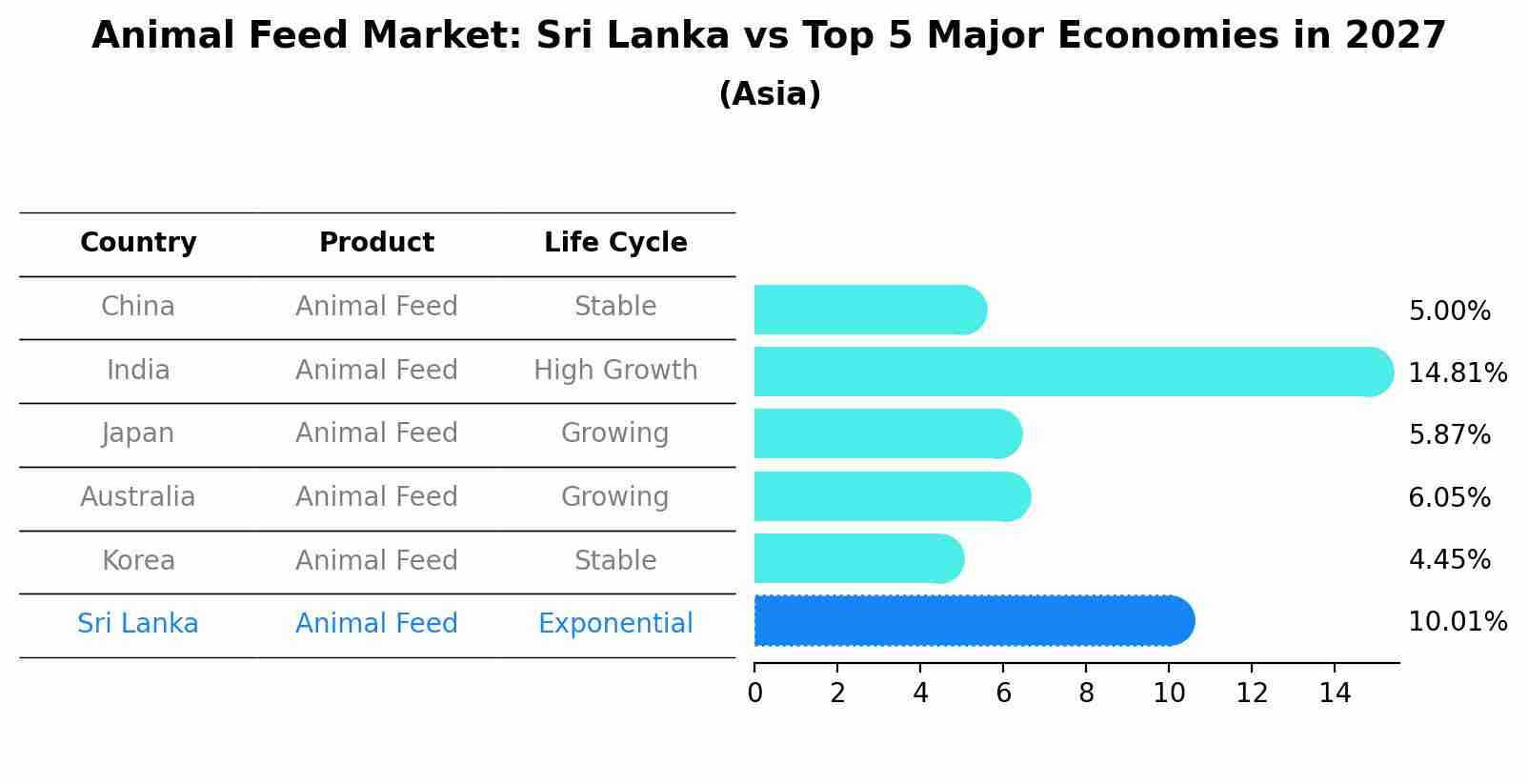

Animal Feed Market: Sri Lanka vs Top 5 Major Economies in 2027 (Asia)

The Animal Feed market in Sri Lanka is projected to grow at a high growth rate of 10.01% by 2027, highlighting the country's increasing focus on advanced technologies within the Asia region, where China holds the dominant position, followed closely by India, Japan, Australia and South Korea, shaping overall regional demand.

Sri Lanka Animal Feed Market | Country-Wise Share and Competition Analysis

In the year 2021, Viet Nam was the largest exporter in terms of value, followed by the USA. It has registered a growth of 66.77% over the previous year. While the USA registered a growth of 14.86% as compared to the previous year. In the year 2017, Malaysia was the largest exporter followed by Sri Lanka. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, Sri Lanka has a Herfindahl index of 952 in 2017 which signifies high competitiveness also in 2021 it registered a Herfindahl index of 1126 which signifies high competitiveness in the market.

Sri Lanka Animal Feed Market - Export Market Opportunities

Topics Covered in the Sri Lanka Animal Feed Market

Sri Lanka Animal Feed Market report thoroughly covers the market by form, by species, and by type. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Sri Lanka Animal Feed Market Synopsis

Sri Lanka Animal Feed Market is witnessing steady growth powered by a robust livestock industry. With a population of over 22 million, the market demand for milk, meat, and egg production is increasing, making it imperative for farmers to maintain the quality of their animal’s feed.

According to 6Wresearch, the Sri Lanka Animal Feed Market Size is projected to grow during the forecast period of 2025-2031. There is an increasing demand for meat, eggs, and dairy products. The government's focus on importing high-quality feed ingredients such as soybean meal, corn, and wheat bran promotes the Sri Lanka Animal Feed Market Growth. The growing trend of keeping livestock in Sri Lanka is leading to an increase in the use of formulated feed for better nutrition and health. Despite the promising growth prospects, the animal feed market in Sri Lanka faces a few challenges. One of the biggest challenges is the price of feed ingredients, which are often costly because they are imported. Secondly, the unavailability of certain feed ingredients also limits the growth of the market. Lastly, the high costs of production due to expensive energy and labor costs make it difficult for some farmers to afford quality feed for their animals. The animal feed market in Sri Lanka offers a wide range of opportunities for investors and farmers. Firstly, collaborations with international animal feed companies can help establish partnerships to supply quality products to local farmers. Secondly, developing in-house feed production facilities can help reduce the costs of importing feed ingredients. Lastly, technology can be used to optimize the efficiency of feed formulation and improve the nutrition content of the feed. There is a promising growth prospect for the Sri Lanka Animal Feed Market Share. The government's impetus to gradually reduce the country's dependence on imported feed and the burgeoning trend of keeping livestock in households will be key growth drivers. Investing in sustainable animal feed production and improving supply chains can not only improve the livestock industry's profitability but also drive food and nutrition security across the country.

Government policies and schemes introduced in the Sri Lanka Animal Feed Market

The Sri Lanka government is committed to creating an environment that supports the Sri Lanka Animal Feed Market Growth. One of the most significant initiatives taken is the Livestock Development Plan (LDP), which aims to increase domestic production to reduce the country's reliance on imported animal feed. Additionally, the Animal Feed Act was introduced, which sets standards for feed production, storage, and transportation. Moreover, the government has provided subsidies for farmers to improve their animal husbandry practices, and to train them on the importance of animal feed quality and nutrition. The growth of the animal feed market in Sri Lanka has been attracting interest from domestic and foreign investors. There are numerous opportunities in the industry, from production to logistics and transportation. With the government's focus on increasing domestic production, there is potential for large-scale animal feed production facilities. Additionally, there are opportunities in the provision of raw materials such as corn and soybeans.

Leading players in the Sri Lanka Animal Feed Market

A few key players in the Sri Lanka animal feed industry are Ceylon Grain Elevators PLC, Prima Group, Feed Lanka, and Nutri feeds. These companies are leading the market in terms of production capacity, range of products, and quality. Ceylon Grain Elevators PLC is one of the oldest animal feed producers in the country and has a reputation for quality products. Prima Group has been investing in the industry for over 50 years and has a wide range of animal feed products. Feed Lanka is a relatively new entrant but is fast becoming a key player with its innovative feed products. Nutri Feeds also offers a range of high-quality feed products for various types of animals.

Market Analysis by Type

According to Mohit, Senior Research Analyst, 6Wresearch, the most market-demanded feed types are vitamins and minerals as they are vital for optimal animal growth, development, and health.

Market Analysis by Species

By Species, there is a higher demand for poultry and aquaculture feed than the other species types. The poultry industry in Sri Lanka is the largest animal industry, followed by aquaculture and ruminants. Consequently, feed formulated for poultry and aquaculture has the highest market share in the Sri Lankan animal feed market.

Key attractiveness of the report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Sri Lanka Animal Feed Market Outlook

- Market Size of Sri Lanka Animal Feed Market, 2024

- Forecast of Sri Lanka Animal Feed Market, 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Revenues & Volume for the Period 2021 - 2031

- Sri Lanka Animal Feed Market Trend Evolution

- Sri Lanka Animal Feed Market Drivers and Challenges

- Sri Lanka Animal Feed Price Trends

- Sri Lanka Animal Feed Porter's Five Forces

- Sri Lanka Animal Feed Industry Life Cycle

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Form for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Pellets for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Crumbles for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Mash for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Species for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Poultry for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Ruminants for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Aqua for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Swine for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Acidifiers for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Probiotics for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Enzyme for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Antioxidants for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Antibiotics for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Vitamins for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Minerals for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Animal Feed Market Revenues & Volume By Others for the Period 2021 - 2031

- Sri Lanka Animal Feed Import Export Trade Statistics

- Market Opportunity Assessment By Form

- Market Opportunity Assessment By Species

- Market Opportunity Assessment By Type

- Sri Lanka Animal Feed Top Companies Market Share

- Sri Lanka Animal Feed Competitive Benchmarking By Technical and Operational Parameters

- Sri Lanka Animal Feed Company Profiles

- Sri Lanka Animal Feed Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Form

- Pellets

- Crumbles

- Mash

- Others

By Species

- Poultry

- Ruminants

- Aqua

- Swine

- Others

By Type

- Acidifiers

- Probiotics

- Enzyme

- Antioxidants

- Antibiotics

- Vitamins

- Minerals

- Others

Sri Lanka Animal Feed Market (2025-2031) : FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Sri Lanka Animal Feed Market Overview |

| 3.1 Sri Lanka Country Macro Economic Indicators |

| 3.2 Sri Lanka Animal Feed Market Revenues & Volume, 2021 & 2031F |

| 3.3 Sri Lanka Animal Feed Market - Industry Life Cycle |

| 3.4 Sri Lanka Animal Feed Market - Porter's Five Forces |

| 3.5 Sri Lanka Animal Feed Market Revenues & Volume Share, By Form, 2021 & 2031F |

| 3.6 Sri Lanka Animal Feed Market Revenues & Volume Share, By Species, 2021 & 2031F |

| 3.7 Sri Lanka Animal Feed Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 4 Sri Lanka Animal Feed Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Sri Lanka Animal Feed Market Trends |

| 6 Sri Lanka Animal Feed Market, By Types |

| 6.1 Sri Lanka Animal Feed Market, By Form |

| 6.1.1 Overview and Analysis |

| 6.1.2 Sri Lanka Animal Feed Market Revenues & Volume, By Form, 2021 & 2031F |

| 6.1.3 Sri Lanka Animal Feed Market Revenues & Volume, By Pellets, 2021 & 2031F |

| 6.1.4 Sri Lanka Animal Feed Market Revenues & Volume, By Crumbles, 2021 & 2031F |

| 6.1.5 Sri Lanka Animal Feed Market Revenues & Volume, By Mash, 2021 & 2031F |

| 6.1.6 Sri Lanka Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 6.2 Sri Lanka Animal Feed Market, By Species |

| 6.2.1 Overview and Analysis |

| 6.2.2 Sri Lanka Animal Feed Market Revenues & Volume, By Poultry, 2021 & 2031F |

| 6.2.3 Sri Lanka Animal Feed Market Revenues & Volume, By Ruminants, 2021 & 2031F |

| 6.2.4 Sri Lanka Animal Feed Market Revenues & Volume, By Aqua, 2021 & 2031F |

| 6.2.5 Sri Lanka Animal Feed Market Revenues & Volume, By Swine, 2021 & 2031F |

| 6.2.6 Sri Lanka Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 6.3 Sri Lanka Animal Feed Market, By Type |

| 6.3.1 Overview and Analysis |

| 6.3.2 Sri Lanka Animal Feed Market Revenues & Volume, By Acidifiers, 2021 & 2031F |

| 6.3.3 Sri Lanka Animal Feed Market Revenues & Volume, By Probiotics, 2021 & 2031F |

| 6.3.4 Sri Lanka Animal Feed Market Revenues & Volume, By Enzyme, 2021 & 2031F |

| 6.3.5 Sri Lanka Animal Feed Market Revenues & Volume, By Antioxidants, 2021 & 2031F |

| 6.3.6 Sri Lanka Animal Feed Market Revenues & Volume, By Antibiotics, 2021 & 2031F |

| 6.3.7 Sri Lanka Animal Feed Market Revenues & Volume, By Vitamins, 2021 & 2031F |

| 6.3.8 Sri Lanka Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 6.3.9 Sri Lanka Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 7 Sri Lanka Animal Feed Market Import-Export Trade Statistics |

| 7.1 Sri Lanka Animal Feed Market Export to Major Countries |

| 7.2 Sri Lanka Animal Feed Market Imports from Major Countries |

| 8 Sri Lanka Animal Feed Market Key Performance Indicators |

| 9 Sri Lanka Animal Feed Market - Opportunity Assessment |

| 9.1 Sri Lanka Animal Feed Market Opportunity Assessment, By Form, 2021 & 2031F |

| 9.2 Sri Lanka Animal Feed Market Opportunity Assessment, By Species, 2021 & 2031F |

| 9.3 Sri Lanka Animal Feed Market Opportunity Assessment, By Type, 2021 & 2031F |

| 10 Sri Lanka Animal Feed Market - Competitive Landscape |

| 10.1 Sri Lanka Animal Feed Market Revenue Share, By Companies, 2024 |

| 10.2 Sri Lanka Animal Feed Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero