Singapore Animal Feed Market (2025-2031) | Share, Outlook, Trends, Value, Forecast, Industry, Size, Companies, Growth, Analysis, Revenue

Market Forecast By Form (Pellets, Crumbles, Mash, Others), By Species (Poultry, Ruminants, Aqua, Swine, Others), By Type (Acidifiers, Probiotics, Enzyme, Antioxidants, Antibiotics, Vitamins, Minerals, Others) And Competitive Landscape

| Product Code: ETC018467 | Publication Date: Nov 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

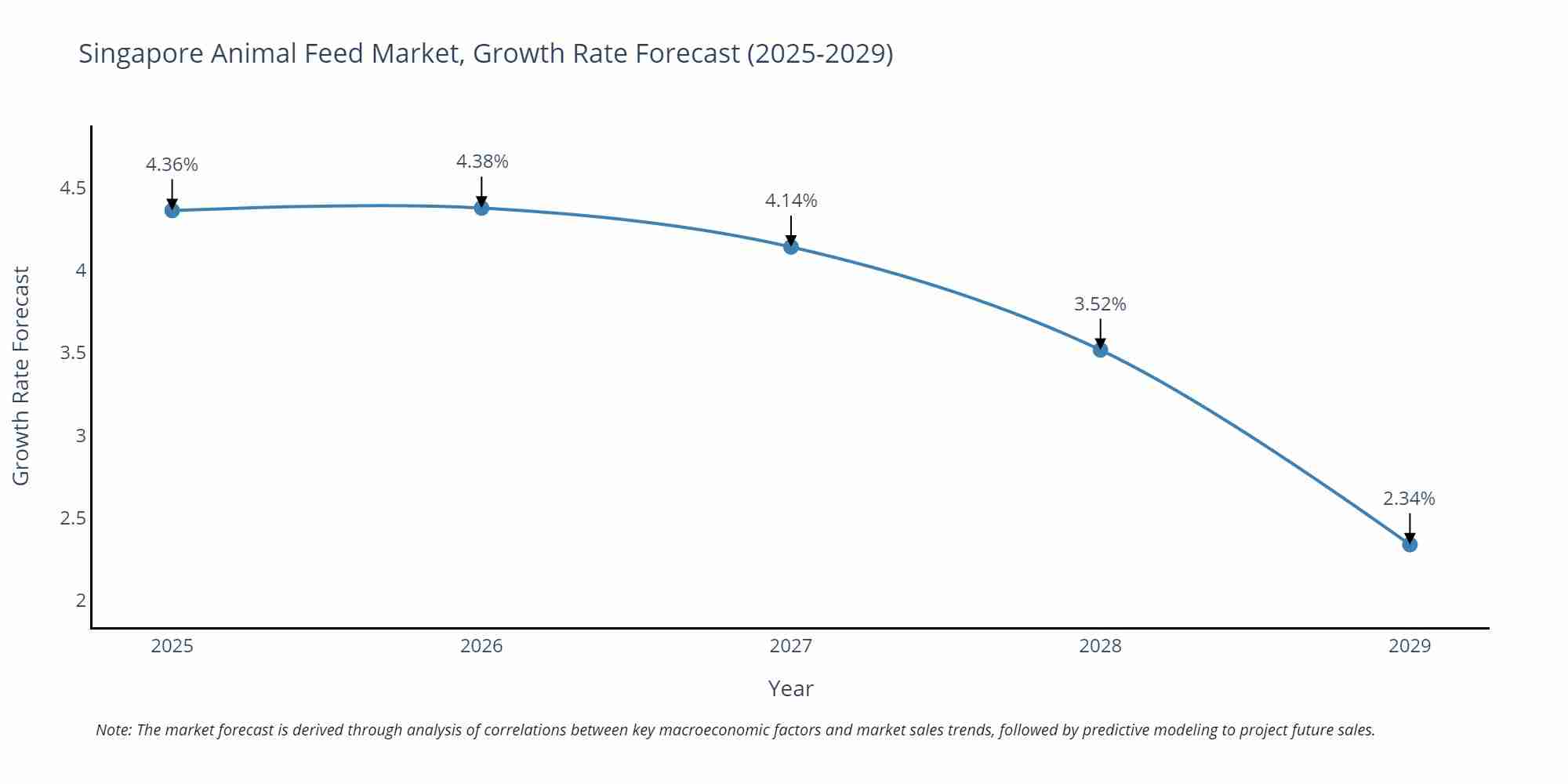

Singapore Animal Feed Market Size Growth Rate

The Singapore Animal Feed Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 4.38% in 2026, following an initial rate of 4.36%, before easing to 2.34% at the end of the period.

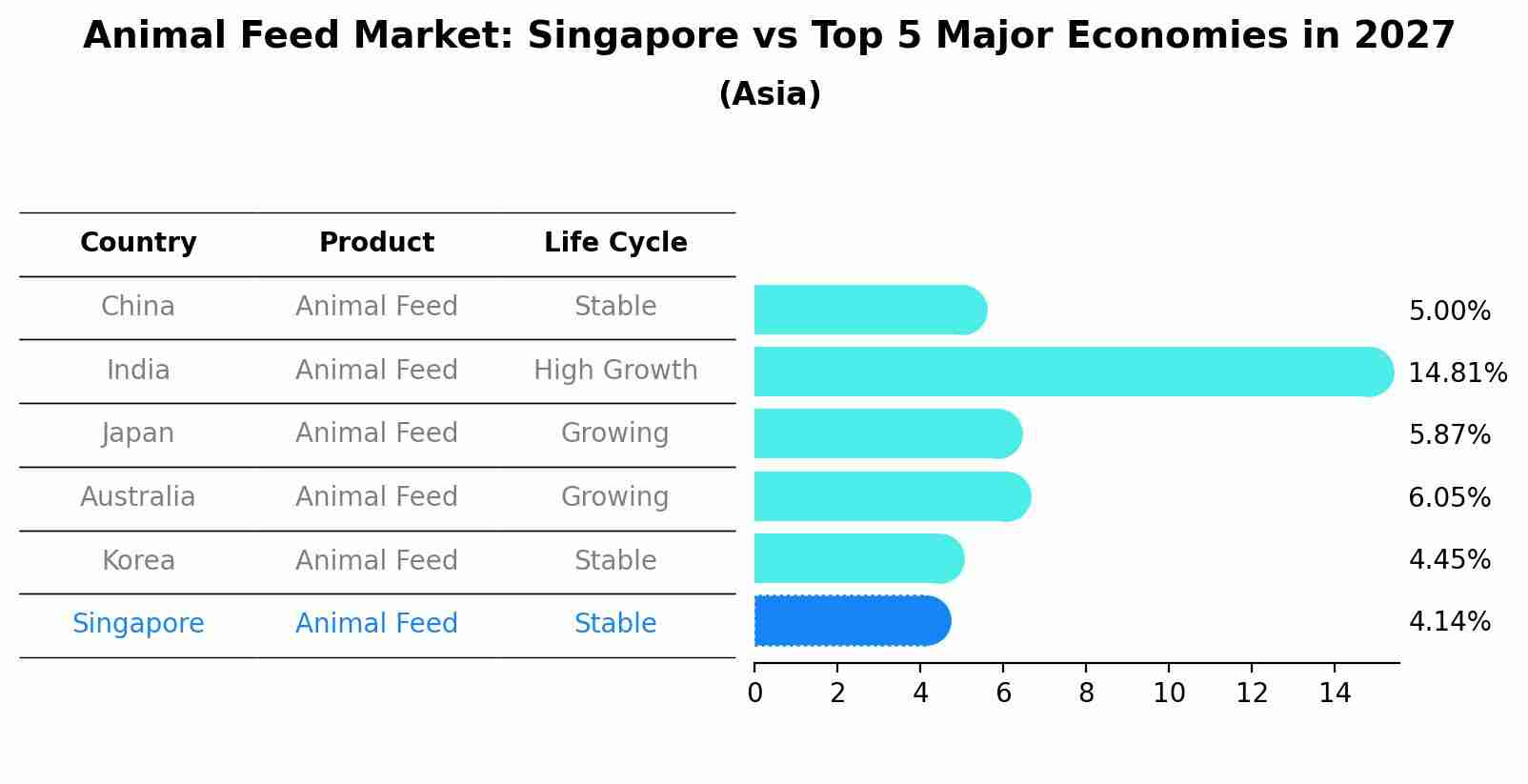

Animal Feed Market: Singapore vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Animal Feed market in Singapore is projected to expand at a stable growth rate of 4.14% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Topics Covered in the Singapore Animal Feed Market

Singapore Animal Feed Market report thoroughly covers the market by form, by species, and by type. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Singapore Animal Feed Market Synopsis

Singapore Animal Feed Market has been experiencing significant growth in the past few years. The growing demand for meat, dairy products, and health supplements has fueled the need for animal feed in the country. Additionally, the Singapore government has introduced several policies and schemes to support the development of the animal feed industry.

According to 6Wresearch, the Singapore Animal Feed Market Size is anticipated to grow at a CAGR of 4% during the forecast period of 2025-2031. The rise in demand for meat and dairy products, the growing awareness of animal health and welfare, and the need to reduce the environmental impact of animal farming have pushed feed manufacturers to develop more sustainable and functional products. At the same time, the market is confronted with challenges such as rising production costs, limited natural resources, and strict regulatory frameworks. One of the major trends that have been shaping the Singapore Animal Feed Market Share is the growing demand for high-quality protein sources. With a rising middle class in Asia, the demand for meat, fish, and dairy products has been increasing, putting pressure on feed producers to find more efficient, nutritious, and sustainable sources of protein. This has driven innovation in the industry, with companies investing in research and development to increase the use of alternative protein sources such as insect meal, algal meal, or single-cell protein. Another important trend in the Singapore animal feed market is the increasing focus on animal welfare and health. Consumers are becoming more aware of the conditions in which animals are raised and are demanding higher standards of welfare. This has led to a shift in the type of feed used, with feed producers developing more customized diets that take into account the specific needs of each animal, its developmental stage, and its living conditions. However, rising cost of production is one of the major challenges faced by the market. Due to high land prices, limited natural resources, and a highly regulated environment, it is becoming increasingly difficult for feed manufacturers to maintain profitability while keeping prices competitive. This has forced them to find ways to optimize their production processes and to increase efficiency while minimizing waste.

Government policies and schemes introduced in the Singapore Animal Feed Market

The government has been proactive in supporting the Singapore Animal Feed Market Growth. The government launched the Singapore Food Story R&D Programme to support local food production, including animal feed. Additionally, the government has introduced policies to ensure the safety and quality of animal feed products. For instance, the Agri-Food and Veterinary Authority (AVA) manages the import and sale of animal feed in the country and enforces strict regulations to ensure the safety of the products. The Singapore Animal Feed Market is expected to grow in the upcoming years due to the growing demand for animal-derived products. The increasing focus on food safety and animal welfare will drive the demand for high-quality animal feed in the country. Additionally, the government's support and initiatives to promote local food production will boost the industry's growth.

Leading players in the Singapore Animal Feed Market

The Singapore Animal Feed Industry is highly competitive, with several local and international players operating in the country. The leading players include Charoen Pokphand Group, Cargill, Archer Daniels Midland Company, and New Hope Liuhe Co. Ltd. These players are focusing on new product development, marketing activities, and partnerships to expand their reach in the market.

Market analysis by Form

By Form, one of the most significant forms of animal feed used in Singapore is Pellets, which are created using a compression process that increases their density. The pellets form is more appealing as it has a longer shelf life, reduces wastage, and is easier to transport. However, crumbles form of animal feed is also experiencing an upward trajectory, driven by the demand for convenient feed that is easily consumed by animals.

Market Analysis by Species

According to Shivam, Senior Research Analyst, 6Wresearch, poultry is the most popular due to its high demand in the market. The types of feed vary according to the type of species, with each having specific nutritional requirements. For example, poultry requires a protein-rich diet that ensures healthy body growth and efficient egg production.

Key attractiveness of the report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Singapore Animal Feed Market Outlook

- Market Size of Singapore Animal Feed Market, 2024

- Forecast of Singapore Animal Feed Market, 2031

- Historical Data and Forecast of Singapore Animal Feed Revenues & Volume for the Period 2021 - 2031

- Singapore Animal Feed Market Trend Evolution

- Singapore Animal Feed Market Drivers and Challenges

- Singapore Animal Feed Price Trends

- Singapore Animal Feed Porter's Five Forces

- Singapore Animal Feed Industry Life Cycle

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Form for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Pellets for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Crumbles for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Mash for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Species for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Poultry for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Ruminants for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Aqua for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Swine for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Acidifiers for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Probiotics for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Enzyme for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Antioxidants for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Antibiotics for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Vitamins for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Minerals for the Period 2021 - 2031

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Others for the Period 2021 - 2031

- Singapore Animal Feed Import Export Trade Statistics

- Market Opportunity Assessment By Form

- Market Opportunity Assessment By Species

- Market Opportunity Assessment By Type

- Singapore Animal Feed Top Companies Market Share

- Singapore Animal Feed Competitive Benchmarking By Technical and Operational Parameters

- Singapore Animal Feed Company Profiles

- Singapore Animal Feed Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Form

- Pellets

- Crumbles

- Mash

- Others

By Species

- Poultry

- Ruminants

- Aqua

- Swine

- Others

By Type

- Acidifiers

- Probiotics

- Enzyme

- Antioxidants

- Antibiotics

- Vitamins

- Minerals

- Others

Singapore Animal Feed Market (2025-2031)

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Singapore Animal Feed Market Overview |

| 3.1 Singapore Country Macro Economic Indicators |

| 3.2 Singapore Animal Feed Market Revenues & Volume, 2021 & 2031F |

| 3.3 Singapore Animal Feed Market - Industry Life Cycle |

| 3.4 Singapore Animal Feed Market - Porter's Five Forces |

| 3.5 Singapore Animal Feed Market Revenues & Volume Share, By Form, 2023 & 2031F |

| 3.6 Singapore Animal Feed Market Revenues & Volume Share, By Species, 2023 & 2031F |

| 3.7 Singapore Animal Feed Market Revenues & Volume Share, By Type, 2023 & 2031F |

| 4 Singapore Animal Feed Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Singapore Animal Feed Market Trends |

| 6 Singapore Animal Feed Market, By Types |

| 6.1 Singapore Animal Feed Market, By Form |

| 6.1.1 Overview and Analysis |

| 6.1.2 Singapore Animal Feed Market Revenues & Volume, By Form, 2021 & 2031F |

| 6.1.3 Singapore Animal Feed Market Revenues & Volume, By Pellets, 2021 & 2031F |

| 6.1.4 Singapore Animal Feed Market Revenues & Volume, By Crumbles, 2021 & 2031F |

| 6.1.5 Singapore Animal Feed Market Revenues & Volume, By Mash, 2021 & 2031F |

| 6.1.6 Singapore Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 6.2 Singapore Animal Feed Market, By Species |

| 6.2.1 Overview and Analysis |

| 6.2.2 Singapore Animal Feed Market Revenues & Volume, By Poultry, 2021 & 2031F |

| 6.2.3 Singapore Animal Feed Market Revenues & Volume, By Ruminants, 2021 & 2031F |

| 6.2.4 Singapore Animal Feed Market Revenues & Volume, By Aqua, 2021 & 2031F |

| 6.2.5 Singapore Animal Feed Market Revenues & Volume, By Swine, 2021 & 2031F |

| 6.2.6 Singapore Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 6.3 Singapore Animal Feed Market, By Type |

| 6.3.1 Overview and Analysis |

| 6.3.2 Singapore Animal Feed Market Revenues & Volume, By Acidifiers, 2021 & 2031F |

| 6.3.3 Singapore Animal Feed Market Revenues & Volume, By Probiotics, 2021 & 2031F |

| 6.3.4 Singapore Animal Feed Market Revenues & Volume, By Enzyme, 2021 & 2031F |

| 6.3.5 Singapore Animal Feed Market Revenues & Volume, By Antioxidants, 2021 & 2031F |

| 6.3.6 Singapore Animal Feed Market Revenues & Volume, By Antibiotics, 2021 & 2031F |

| 6.3.7 Singapore Animal Feed Market Revenues & Volume, By Vitamins, 2021 & 2031F |

| 6.3.8 Singapore Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 6.3.9 Singapore Animal Feed Market Revenues & Volume, By Others, 2021 & 2031F |

| 7 Singapore Animal Feed Market Import-Export Trade Statistics |

| 7.1 Singapore Animal Feed Market Export to Major Countries |

| 7.2 Singapore Animal Feed Market Imports from Major Countries |

| 8 Singapore Animal Feed Market Key Performance Indicators |

| 9 Singapore Animal Feed Market - Opportunity Assessment |

| 9.1 Singapore Animal Feed Market Opportunity Assessment, By Form, 2021 & 2031F |

| 9.2 Singapore Animal Feed Market Opportunity Assessment, By Species, 2021 & 2031F |

| 9.3 Singapore Animal Feed Market Opportunity Assessment, By Type, 2021 & 2031F |

| 10 Singapore Animal Feed Market - Competitive Landscape |

| 10.1 Singapore Animal Feed Market Revenue Share, By Companies, 2024 |

| 10.2 Singapore Animal Feed Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Form (Pellets, Crumbles, Mash, Others), By Species (Poultry, Ruminants, Aqua, Swine, Others), By Type (Acidifiers, Probiotics, Enzyme, Antioxidants, Antibiotics, Vitamins, Minerals, Others) And Competitive Landscape

| Product Code: ETC018467 | Publication Date: Oct 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Singapore Animal Feed Market is projected to grow over the coming year. Singapore Animal Feed Market report is a part of our periodical regional publication Asia Pacific Animal Feed Market outlook report. 6W tracks Animal Feed market for over 60 countries with individual country-wise market opportunity assessment and publishes with the report titled Global Animal Feed Market outlook report annually.

Key Highlights of the Report:

- Singapore Animal Feed Market Outlook

- Market Size of Singapore Animal Feed Market, 2019

- Forecast of Singapore Animal Feed Market, 2026

- Historical Data and Forecast of Singapore Animal Feed Revenues & Volume for the Period 2016 - 2026

- Singapore Animal Feed Market Trend Evolution

- Singapore Animal Feed Market Drivers and Challenges

- Singapore Animal Feed Price Trends

- Singapore Animal Feed Porter's Five Forces

- Singapore Animal Feed Industry Life Cycle

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Form for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Pellets for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Crumbles for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Mash for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Others for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Species for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Poultry for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Ruminants for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Aqua for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Swine for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Others for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Type for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Acidifiers for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Probiotics for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Enzyme for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Antioxidants for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Antibiotics for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Vitamins for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Minerals for the Period 2016 - 2026

- Historical Data and Forecast of Singapore Animal Feed Market Revenues & Volume By Others for the Period 2016 - 2026

- Singapore Animal Feed Import Export Trade Statistics

- Market Opportunity Assessment By Form

- Market Opportunity Assessment By Species

- Market Opportunity Assessment By Type

- Singapore Animal Feed Top Companies Market Share

- Singapore Animal Feed Competitive Benchmarking By Technical and Operational Parameters

- Singapore Animal Feed Company Profiles

- Singapore Animal Feed Key Strategic Recommendations

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero