India Air Conditioner Market (2025-2031) | Value, Forecast, Trends, Share, Revenue, Growth, Size, Industry, Outlook, Analysis & Companies

Market Forecast By Product Type (Room Air Conditioner (RAC), Packaged Air Conditioner (PAC)), By Region (Urban, Rural), and Competitive Landscape

| Product Code: ETC004387 | Publication Date: Sep 2020 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 96 | No. of Figures: 25 | No. of Tables: 11 | |

Topics Covered in India Air Conditioner Market Report

India Air Conditioner Market Report thoroughly covers the market by product type and by region. India Air Conditioner Market Outlook report provides an unbiased and detailed analysis of the ongoing India Air Conditioner Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

India Air Conditioner Market Synopsis

The India air conditioner market witnessed growth during 2021–2025, supported by rapid urbanization, infrastructure expansion, and rising consumer affordability. The government’s Smart Cities Mission, completed by 2025, drove large-scale adoption of centralized and residential cooling systems. Rural electrification initiatives enabled wider penetration into Tier II, Tier III cities, and villages, expanding the addressable market for affordable and energy-efficient models. The growing middle-class share, accounting for some percent of population in 2025 and rising disposable incomes 2023 to 2024, boosted sales of inverter and premium split ACs.

In addition, the real estate sector’s expansion, luxury home sales priced higher and above rising in 2024 and the hospitality sector recording some branded hotel signings in 2024, within emerging cities, fueled demand for VRF and large-capacity commercial ACs. Meanwhile, office and retail infrastructure saw robust growth, with new office supply in Q2 2025. Collectively, these developments positioned the India AC market for sustained growth through 2025, supported by both policy initiatives and evolving consumer preferences.

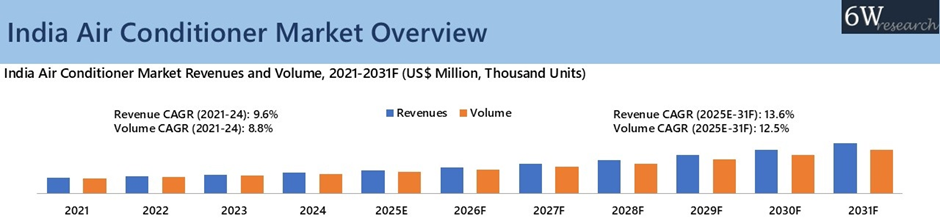

According to 6Wresearch, the India Air Conditioner Market is projected to grow at a CAGR of 13.6% in revenue and 12.5% in volume from 2025 to 2031, driven by growing demand for eco-friendly systems and supported by increasing consumer spending power. Government initiatives, including the Production-Linked Incentive (PLI) scheme, scheduled to run from FY 2021-22 to FY 2028F-29F, under which in 2025, some companies have committed investments for local manufacturing of key AC components, and policies promoting sustainable consumption are boosting domestic production and adoption of energy-efficient appliances.

The tourism sector, contributing annually from 2019-2030 to GDP through hotels, travel, and airlines, is expected to increase demand for large-scale cooling solutions. Similarly, real estate expansion, with new mall supply expected across major cities by 2027, alongside luxury housing and commercial developments, would drive residential and commercial AC installations. Increasing consumer focus on indoor comfort, smart home integration, and online availability further supports market expansion, positioning the India air conditioner market for sustained growth.

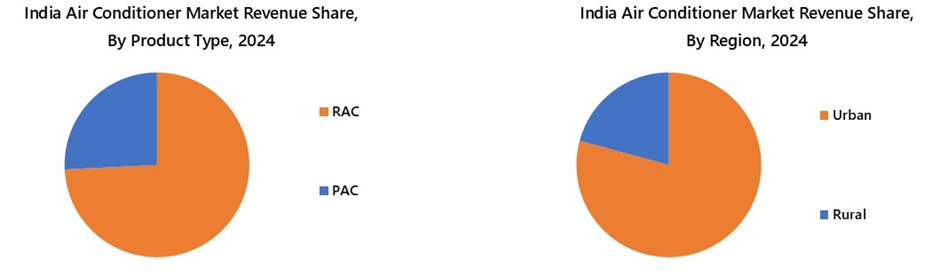

Market Segmentation By Product Type

In 2031, the room air conditioner (RAC) segment is projected to retain the larger market revenue and volume size and is expected to have fastest revenue and volume growth during 2025-2031. The expansion of residential construction, including luxury and mid-segment housing, along with the replacement of older units, would further support RAC sales.

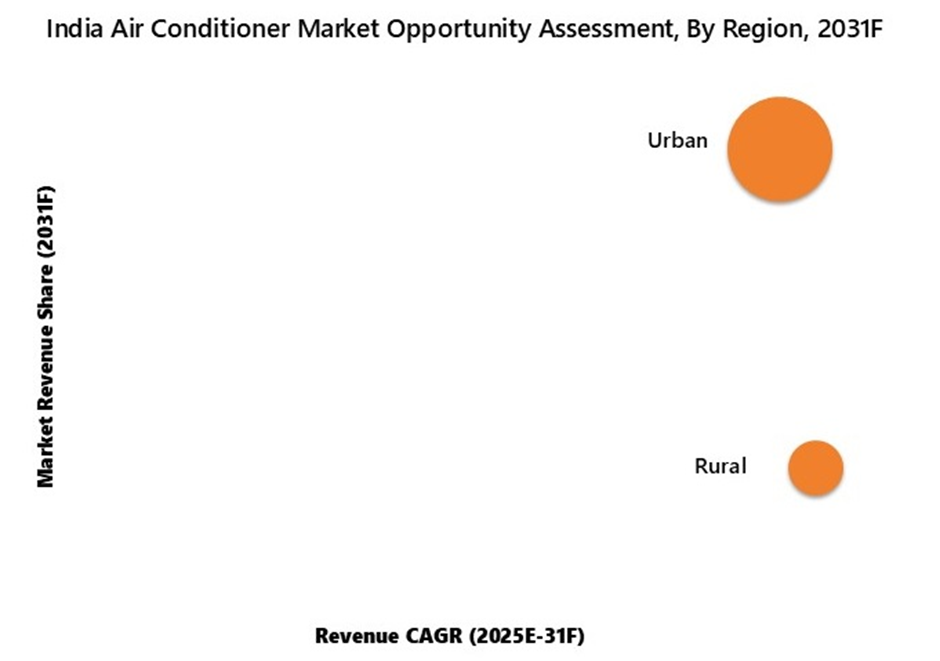

Market Segmentation By Region

In 2031, urban region is projected to retain the larger revenue size in the India air conditioner market. Expanding office spaces, retail complexes, and premium housing in metro and Tier I cities drive strong demand for both residential and commercial ACs, as urban consumers show higher adoption of energy-efficient, smart, and inverter-based units.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data: Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Air Conditioner Market Overview

- India Air Conditioner Market Outlook

- India Air Conditioner Market Forecast

- Historical Data and Forecast of India Air Conditioner Market Revenues for the Period 2021-2031F

- Historical Data and Forecast of Market Revenues, By Product Type, for the Period 2021-2031F

- Historical Data and Forecast of Market Revenues, By Region for the Period 2021-2031F

- India Air Conditioner Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- India Air Conditioner Market Evolution & Trends

- Market Opportunity Assessment

- India Air Conditioner Market Volume Share, By Top RAC Companies, 2024

- India Air Conditioner Market Volume Share, By Top PAC Companies, 2024

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Product Type

- Room Air Conditioner (RAC)

- Packaged Air Conditioner (PAC)

By Region

- Urban

- Rural

India Air Conditioner Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Key Highlights of the Report |

| 2.2. Report Description |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Air Conditioner Market Overview |

| 3.1. India Macro Economics Indicators |

| 3.2. India Air Conditioner Market Revenues and Volume (2021-2031F) |

| 3.3. India Air Conditioner Market Industry Life Cycle |

| 3.4. India Air Conditioner Market Porter’s Five Forces Model |

| 4. India Air Conditioner Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. India Air Conditioner Market Evolution & Trends |

| 6. India Air Conditioner Market Overview, By Product Type |

| 6.1. India Air Conditioner Market Revenue Share, By Product Type (2024 & 2031F) |

| 6.1.1. India Air Conditioner Market Revenues, By RAC (2021-2031F) |

| 6.1.2. India Air Conditioner Market Revenues, By PAC (2021-2031F) |

| 6.2. India Air Conditioner Market Volume Share, By Product Type (2024 & 2031F) |

| 6.2.1. India Air Conditioner Market Volume, By RAC (2021-2031F) |

| 6.2.2. India Air Conditioner Market Volume, By PAC (2021-2031F) |

| 7. India Air Conditioner Market Overview, By Region |

| 7.1. India Air Conditioner Market Revenue Share, By Region (2024 & 2031F) |

| 7.1.1. India Air Conditioner Market Revenues, By Urban (2021-2031F) |

| 7.1.2. India Air Conditioner Market Revenues, By Rural (2021-2031F) |

| 8. India Air Conditioner Market- Number of PAC Factories With Production Capacity |

| 9. India Air Conditioner Market- Major Aluminium Condensers Companies |

| 9.1. Factory Name |

| 9.2. Production Capacity |

| 9.3. Key Consumers |

| 10. India Air Conditioner Market- PAC Price and Market Positioning, By Brands |

| 11. India Air Conditioner Factories’ Demand for Aluminium Condensers |

| 12. India Air Conditioner Market Key Performance Indicators |

| 13. India Air Conditioner Market Opportunity Assessment |

| 13.1. Market Opportunity Assessment, By Product Type (2031F) |

| 13.2. Market Opportunity Assessment, By Region (2031F) |

| 14. India Air Conditioner Market Competitive Landscape |

| 14.1. India Room Air Conditioner Market Volume Share, By Top 3 Companies CY 2024 |

| 14.2. India Packaged Air Conditioner Market Volume Share, By Top 3 Companies CY 2024 |

| 14.3. India Air Conditioner Market Key Companies Competitive Benchmarking, By Operating Parameters |

| 14.4. India Air Conditioner Market Key Companies Competitive Benchmarking, By Technical Parameters |

| 15. Company Profiles |

| 15.1. Voltas Ltd. |

| 15.2. Carrier Global Corporation |

| 15.3. Daikin Airconditioning India Pvt. Ltd. |

| 15.4. Blue Star Ltd. |

| 15.5. Johnson Controls-Hitachi Air Conditioning India Limited |

| 15.6. LG Electronics India Pvt. Ltd. |

| 15.7. Samsung India Electronics Pvt. Ltd. |

| 15.8. Godrej & Boyce Mfg. Co. Ltd. |

| 15.9. Panasonic Life Solutions India Pvt. Ltd. |

| 15.10. Lloyd (Havells India Ltd.) |

| 15.11. Mitsubishi Electric India Pvt. Ltd. |

| 15.12. Haier Appliances India Pvt. Ltd. |

| 16. Company Profiles- India Heat Exchanger Suppliers |

| 17. Key Strategic Recommendations |

| 18. Disclaimer |

| List of Figures |

| 1. India Real GDP Growth , Y-O-Y Change, 2021-2025E, (%) |

| 2. India GDP Per Capita, Current Prices (U.S. Dollars Per Capita), 2021-2030F |

| 3. India Inflation Rate (Average Consumer Prices, Y-O-Y Change 2021-2025E, (in %) |

| 4. India Air Conditioner Market Revenues and Volume, 2021-2031F (US$ Million, Thousand Units) |

| 5. India Region-wise Number of Villages Electrified under DDUGJY (As of March 2025) |

| 6. India Total Disposable Personal Income, 2021-2024 (USD Billion) |

| 7. India Percentage of Population Living in Urban Areas (2025E-2050F) |

| 8. India Air Conditioner Market Revenue Share, By Product Type, 2024 & 2031F |

| 9. India Air Conditioner Market Volume Share, By Product Type, 2024 & 2031F |

| 10. India Air Conditioner Market Revenue Share, By Region, 2024 & 2031F |

| 11. India PAC Market Positioning by Brands, as of Sep 2025 |

| 12. Aluminium Condensers as a Percentage Share of Total AC Units Sold in India, 2024, (in %) |

| 13. India Hotel Transaction Volume, By Source, (%), 2024 |

| 14. India Supply Composition of Hotel Rooms By Positioning, 2029F |

| 15. India Luxury and First-Class Hotel Projects, 2022-2025E (Units) |

| 16. Total Contribution of Indian Hotel Industry to GDP (INR Lakh Crores), 2022-47F |

| 17. India New Residential Launches and Residential Sales, By Top 7 Cities, 2024-2025 (in Units) |

| 18. India’s Office Sector Gross Leasing Across the Top 8 Cities, 2023 and 2024, (Million Square Feet) |

| 19. India Shopping Mall Total Supply by Top 7 States, 2027F |

| 20. India New Office Supply Q2 2024 and Q2 2025 (Million Square Feet) |

| 21. India Air Conditioner Market Opportunity Assessment- Revenue Outlook, By Product Type, 2031F |

| 22. India Air Conditioner Market Opportunity Assessment- Volume Outlook, By Product Type, 2031F |

| 23. India Air Conditioner Market Opportunity Assessment, By Region, 2031F |

| 24. India Room Air Conditioner Market Volume Share, By Companies, CY2024 |

| 25. India Packaged Air Conditioner Market Volume Share, By Companies, CY2024 |

| List of tables |

| 1. Key Highlights of India Smart City Mission, 2025 |

| 2. India’s State-wise Number of Villages Electrified under DDUGJY (As of March 2025) |

| 3. India Air Conditioner Market Revenues, By Product Type, 2021-2031F (US$ Million) |

| 4. India Air Conditioner Market Volume, By Product Type, 2021-2031F (units) |

| 5. India Air Conditioner Market Revenues, By Region, 2021-2031F (US$ Million) |

| 6. India Number of Packaged Air Conditioners (PAC) Factories and Production Capacities, As of September 2025 |

| 7. India List of Major Aluminium Condenser Companies and their Production Capacities, As of Sep 2025 |

| 8. India Average Price PAC, By Brands, 2025 |

| 9. India Estimated Application Of Condenser Types Within PAC Players’ Portfolio, As of Sep 2025 |

| 10. India Upcoming Hotel Projects 2025F-2028F |

| 11. Major Upcoming Airport in India, 2025-2030F |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero